Growth stocks are like rare gems, seldom seen at a discount. When one does glitter at a reduced price, wise investors must pay heed, much like seizing a bargain on Black Friday.

The journey to acquire a growth stock without breaking the bank usually involves two paths. Firstly, investing in it before it blossoms into a growth stock. Secondly, diving in when skepticism clouds its growth trajectory, like a shadow cast in the setting sun.

A scenario of the latter type is currently unfolding with the PayPal (NASDAQ:PYPL) stock. For years, these shares commanded a premium due to soaring revenue growth rates. However, in the last three years, the stock has experienced a freefall, shedding nearly 79% from its peak.

If you’ve ever dreamed of a second chance to snag a blue-chip growth stock, well, this is your moment.

The Undervalued PayPal Stock

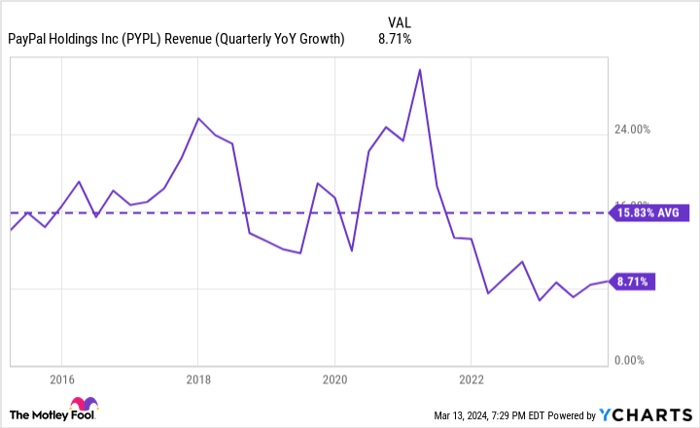

Many factors fuel disdain towards PayPal stock, and the major one is a sharp decline in growth.

Since parting ways with eBay in 2015, PayPal’s revenue had been growing at an average of 15% annually. Yet, from 2022 onwards, this growth dipped to 8%-10% per year. This significant slowdown in growth strapped the stock’s valuation. Back in 2020, when growth rates surged above 20% annually, PayPal shares traded at a price-to-sales ratio of 15. Now, they exchange hands at a mere 2.3 times sales.

Despite the decline in revenue growth, PayPal’s valuations have plummeted far more. This indicates harsh treatment by the market. While revenue growth rates seem positive, some skeptics fear a potential nosedive, possibly as soon as this year.

The crux of PayPal’s revenue lies in its user base. Revenue upticks at PayPal majorly stem from two avenues: acquiring new users or enhancing activity among existing users.

Progress on the former task appears challenging. After decades of user base expansion, the total user count at PayPal took a U-turn in the first quarter of 2023, a decline with inevitable repercussions on payment volumes, revenue growth, and profits.

On the latter front—boosting usage among existing users—PayPal has actually excelled. In 2023, the number of payment transactions through PayPal ascended by 12%, driven by a 14% surge in transactions per active account. Despite losing users, PayPal’s existing user base demonstrates increased engagement. This obscured reality positions PayPal stock as a lucrative buy today.

Embrace the Hidden Potential

While the market fixates on PayPal’s dwindling user base, redirect your gaze towards other facets, notably the rising activity levels among existing users. Behind the scenes, PayPal is fostering new technologies and services to sustain or elevate revenue growth rates.

For instance, the company recently launched six innovative technologies aimed at revitalizing growth. While some of these innovations received exaggerated hype from management, like mobile app revamps and novel business profile displays, one feature stands out—Fastlane.

Presently, PayPal handles approximately 25% of global e-commerce transactions annually, granting it access to a wealth of data surpassing most competitors. Fastlane leverages this data, enabling users to checkout sans additional payment details, potentially reducing checkout durations by 40%.

Innovations such as Fastlane have anchored PayPal’s revenue growth. Amid fierce competition in the payments sector, the company may not reverse its user decline. However, if PayPal continues to drive up utilization among existing users, the negative pressures might be offset. Despite a year-long contraction in the user base, revenue continues to climb, thanks to escalated user activity.

Remember, PayPal stands as a remarkably profitable entity. Shares hover at a modest 16 times earnings, surpassing broader market valuations. Moreover, a free cash flow yield exceeding 6% underscores PayPal’s growth potential, a beacon even in today’s skeptical market. Investors can now embrace a buying window at an unparalleled valuation.

Which places would serve as sound havens for a $1,000 investment now?

When our analysts whisper a stock tip, keen ears heed the call. The newsletter they’ve steered for two decades, Motley Fool Stock Advisor, has outstripped the market threefold.*

Their recent unveiling highlights what they deem as the 10 premier stocks for investors to clutch today, with PayPal holding its ground among these selections—though nine other sneaky gems may be lurking in the shadows.

*Stock Advisor returns as of March 11, 2024

Ryan Vanzo remains neutral across the stocks mentioned. The Motley Fool holds positions in and vouches for PayPal. The Motley Fool applauds eBay and advocates indulging in the subsequent options: short July 2024 $52.50 calls on eBay and short March 2024 $67.50 calls on PayPal. The Motley Fool pledges a transparency oath.

The thoughts and views articulated herein emanate from the author and perspire the views and opinions of Nasdaq, Inc.