Rollins, the pest control powerhouse trading on the NYSE under the ticker symbol ROL, has been nothing short of awe-inspiring since the turn of the millennium. With total returns approaching 10,000%, just shy of reaching the coveted 100-bagger status in under 25 years, Rollins has defied market norms with a beta never exceeding 0.9 during these years.

What sets Rollins apart is its ability to deliver exceptional returns with remarkably low volatility, attributed to its services being viewed as non-discretionary. The company’s 5-year beta of 0.64 underscores its less reactive nature to market fluctuations, making it an enticing option for investors seeking higher returns with less risk.

A Leader in a Fragmented Industry: Acquiring Success One Company at a Time

As the parent company of the renowned Orkin brand, Rollins caters to over 2 million residential and commercial customers, offering pest and wildlife control services. The company’s revenue streams are diversified across three main service segments:

- Residential (46% of 2023 sales): Protection from pests, insects, rodents, and wildlife with a 17% sales growth in 2023.

- Commercial (33%): Pest control solutions for healthcare, food service, logistics, and hotels, witnessing an 11% sales increase last year.

- Termite (20%): Termite protection services for both residential and commercial clients, with a revenue growth of 14% in 2023.

Rollins holds an approximate 11% share in the U.S. pest control market, competing with industry peers like Rentokil Initial and its Terminix brand. While Rentokil made a significant splash with a $6.7 billion acquisition to enter the U.S. market, Rollins has excelled through strategic serial acquisitions to capitalize on the highly fragmented U.S. pest control landscape.

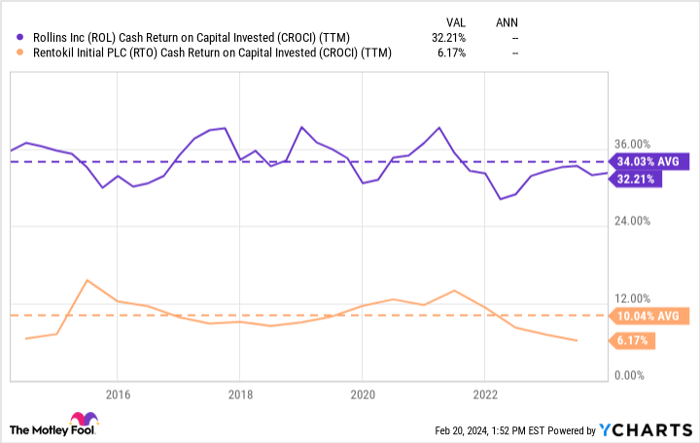

Operating in an industry cluttered with over 20,000 competitors, Rollins stands out by consistently pursuing tuck-in acquisitions to expand its operations. With a stellar track record of integrating acquired entities, Rollins’s cash return on invested capital (ROIC) exemplifies its commitment to efficient capital deployment.

Shining Bright with Superior Free Cash Flow Generation

Over the past decade, Rollins has maintained an average cash ROIC of 34%, setting it apart from its closest competitors in terms of profitability metrics. This remarkable cash return underscores Rollins’s adeptness at generating free cash flow (FCF) from its investments in mergers and acquisitions, a feat where Rentokil lags behind.

Moreover, Rollins boasts superior cash from operations (CFO) margins compared to Rentokil, alongside higher CFO-per-employee figures, showcasing its unparalleled profitability within the industry.

What sweetens the deal for investors is that over 80% of Rollins’s revenue comes from recurring contracts, ensuring a steady and predictable cash flow stream to fuel further tuck-in acquisitions, making it an appealing prospect for long-term growth.

Embracing A Dollar-Cost Averaging Strategy for Long-Term Gains

While trading at 40 times FCF, Rollins may not be a bargain pick, but its valuation aligns with a historical average of 41, a period where the company delivered returns exceeding 400%. For income-seeking investors, Rollins’s dividend yield sits 25% higher than its 10-year average, with dividend payments increasing by an average of 13% annually since 2013.

Considering Rollins’s combination of low beta, robust profitability, growing dividends, and strategic acquisition approach, a dollar-cost averaging strategy presents itself as a prudent choice for investors. Gradually building a position in Rollins allows investors to benefit from long-term growth potential without the gamble of timing the market’s ups and downs.

In conclusion, Rollins emerges as a non-discretionary giant offering stability, profitability, and growth in equal measure. With a solid foothold in the market and a proven track record of success, investors would be wise to make Rollins a cornerstone of their investment portfolios and hold on for the ride.

Is a $1,000 investment in Rollins the right move for you?

Before diving into Rollins stock, it’s crucial to note that the analysts at Motley Fool Stock Advisor have identified their top 10 stock picks for potential monster returns in the near future, with Rollins not making the cut. Their insights provide a roadmap for success, with a history of outperforming the S&P 500 returns since 2002.

Disclaimer: Josh Kohn-Lindquist holds positions in Rollins. The Motley Fool also owns and recommends Rollins. The Motley Fool maintains a disclosure policy.

The perspectives shared in this article are solely those of the author and may not align with the views of Nasdaq, Inc.