Seeing what stocks politicians have been buying is an interesting investing strategy, as they sometimes have access to information that the general public doesn’t. Other times, their financial advisors are making moves just like average investors, so blindly following these trades isn’t the best idea, either.

However, with emerging technology like artificial intelligence (AI), understanding what lawmakers are doing seems like a wise idea, as some guardrails may be emerging around the technology. Furthermore, it makes you wonder when you see a member of Congress making transactions nearing $1 million in Meta Platforms (NASDAQ: META).

U.S. Rep. Michael McCaul, a Texas Republican, has been heavily trading Meta’s stock, which is notable because he supported a new law that could lead to the Chinese social media platform TikTok being banned in the U.S. Many lot of his actions have been short-term in-and-out trades, but he’s increased his position by $73,000 in March (the last month we have data for).

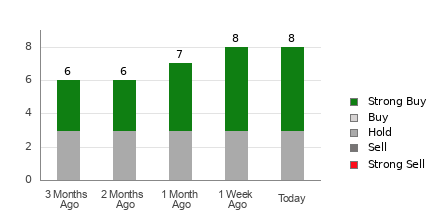

Regardless, Meta looks like an excellent buy right now, no matter what politicians are buying or the particular reasons behind their transactions.

Meta Platforms is integrating AI into its bread-and-butter business segment

Meta Platforms is better known for its social media platforms: Facebook, Instagram, Threads, WhatsApp, and Messenger. These properties keep Meta’s lights on, allowing it to pursue other AI technologies.

However, AI still plays a massive role in these apps. These platforms generate their revenue from advertising. But this isn’t the same advertising as a newspaper or TV ad where everyone sees it. Instead, it’s targeted to a specific viewer. While this technology is pretty advanced, AI takes it to the next level.

Using generative AI, advertisers can alter backgrounds, adjust images to fit the platform they’re being viewed on, and alter text to cater to a specific audience. Allowing the ad to adapt to viewers instead of targeting viewers with one specific ad is the next step in a truly catered ad experience and helps keep Meta as a partner that all companies must advertise with.

But Meta is also working on other innovative AI technologies.

Meta has other plans for AI expansion as well

In Meta’s first-quarter conference call, CEO Mark Zuckerberg raved about Meta’s glasses, which it partnered with Ray-Ban to make. These glasses integrate a camera and allow users to ask questions about objects they see around them. While this is just one use, Meta is continuing to expand the variety of tasks they can do.

If Meta creates a product that the masses demand, it will open up a new revenue stream. With many styles selling out, Meta has clearly found a niche in which it could expand.

However, we’re still a long way from technology like this becoming mainstream and widely used. In the meantime, investors should focus on what Meta does best: advertising.

In Q1, advertising revenue rose 27% year over year to $35.6 billion. From its Family of Apps business segment, it turned $17.7 billion of that revenue into operating income — just shy of 50%.

Even though expenses may rise due to the AI demand, Meta is still a formidable business. Meta investors are best suited to come in with the mindset that it’s an advertising business with an AI-based upside. If you can do that, you won’t worry about the headlines that can swing the stock a few percentage points up or down each month.

Furthermore, if you look at how the market values the stock, it’s clear that everyone else has the same mindset.

META PE Ratio (Forward) data by YCharts

At 22.6 times forward earnings, Meta doesn’t command that much of a premium over the broader market, which trades at 20.7 times forward earnings.

With Meta growing as quickly as it is, plus the upside of AI, it’s about as much of a no-brainer stock pick as you get. Regardless of whether politicians are buying the stock or not, I’ll be buying more Meta shares.

Should you invest $1,000 in Meta Platforms right now?

Before you buy stock in Meta Platforms, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Meta Platforms wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $553,959!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of May 6, 2024

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Keithen Drury has positions in Meta Platforms. The Motley Fool has positions in and recommends Meta Platforms. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.