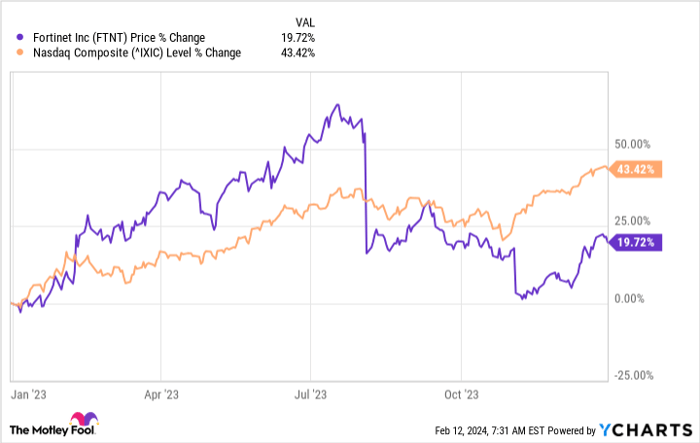

Fortinet, a leading cybersecurity pure-play listed as Fortinet (NASDAQ: FTNT), has recently allayed investor concerns by giving a green light for potential healthy returns in the cybersecurity stock market. The company’s firewall and security hardware business witnessed a downturn during the latter part of 2023. This decline caused apprehension among investors, particularly as Fortinet’s shares closed the year with returns trailing behind the Nasdaq Composite index.

Data by YCharts.

However, the company’s strong start in 2024, coupled with management’s optimistic outlook, suggests a potential resurgence in cybersecurity stock returns for the year.

Fortinet’s Revival in Sight?

Fortinet had experienced a remarkable growth period post-pandemic, driven by the widespread shift to cloud computing and the subsequent demand for increased IT infrastructure, particularly in installations of their hardware, such as firewalls. However, during the third-quarter earnings update in 2023, the rate of new hardware installations began to diminish. This announcement, coupled with a year-over-year decline in billings, adversely affected investor sentiment.

Fortinet’s CEO Ken Xie, however, surpassed expectations by reporting an 8.5% increase in billings year over year in Q4 2023, demonstrating the company’s resilience during a challenging period. With a slight decline in billings projected for Q1 2024, the future seemed uncertain. Nonetheless, the company’s full-year 2024 revenue guidance of approximately 8% to 9% growth suggests a potential revival and a promising second half of 2024.

Promising Future for the Cybersecurity Market

Fortinet stands out among major cybersecurity stocks by earning a significant portion of its revenue from hardware (specifically 35% in 2023), unlike its counterparts such as Palo Alto Networks, CrowdStrike Holdings, and Zscaler, which predominantly rely on subscription and services for their revenue. Despite the temporary decline in its hardware segment, Fortinet’s services revenue surged by 25% year over year in the final months of 2023 and is expected to sustain growth throughout 2024.

As the market witnesses the growth potential of Fortinet’s cybersecurity services, it serves as an optimistic indicator for the broader market. The industry, being part of a secular growth trend, is poised for high growth in the coming years, as evidenced by Fortinet’s resilience during testing times.

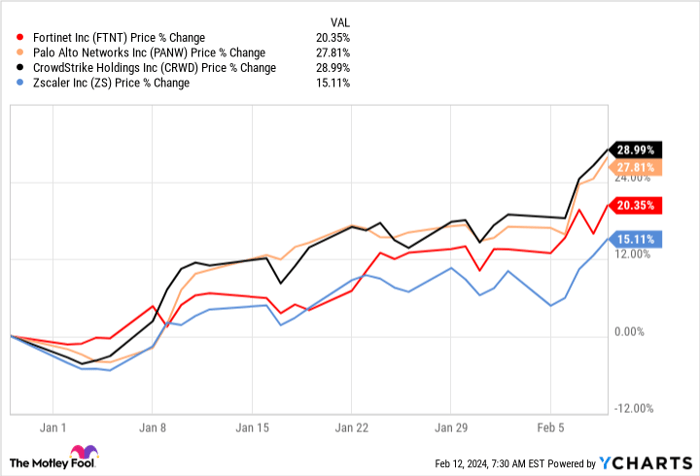

Data by YCharts.

Investors should exercise caution and adopt a dollar-cost average plan when considering investments in top cybersecurity stocks, keeping available cash to capitalize on potential share price pullbacks. Despite the recent surge in cybersecurity stocks, the industry’s enduring growth trajectory promises a prosperous future.

Concluding Thoughts on Investing in Fortinet

Before considering an investment in Fortinet, it’s essential to note that the Motley Fool Stock Advisor team did not feature Fortinet among their top 10 stock picks. However, their recommended stocks are anticipated to yield substantial returns over the coming years.

The Stock Advisor service provides investors with a comprehensive investment approach, offering portfolio building guidance, regular updates from analysts, and two new stock picks each month. Since 2002, the Stock Advisor has significantly outperformed the S&P 500 index*

Explore the 10 recommended stocks

*Stock Advisor returns as of February 12, 2024

Nicholas Rossolillo and his clients own positions in CrowdStrike, Fortinet, and Palo Alto Networks. The Motley Fool has positions in and recommends CrowdStrike, Fortinet, Palo Alto Networks, and Zscaler. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.