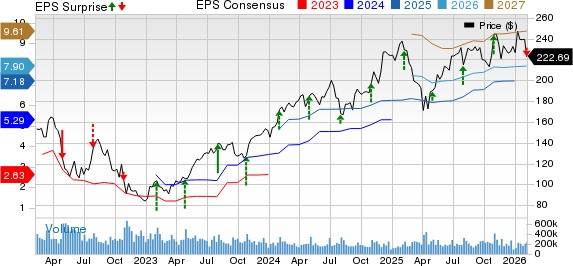

The ongoing transition in the AI market has triggered a significant selloff, particularly affecting U.S. software and data-services companies. Since late January, this sector has lost approximately $1 trillion in market value, with key players like ServiceNow Inc. (NOW), Salesforce Inc. (CRM), and Microsoft Corp. (MSFT) showing notable declines. Concerns are mounting that AI advancements are overtaking traditional software models, leading to investor skepticism regarding legacy business models.

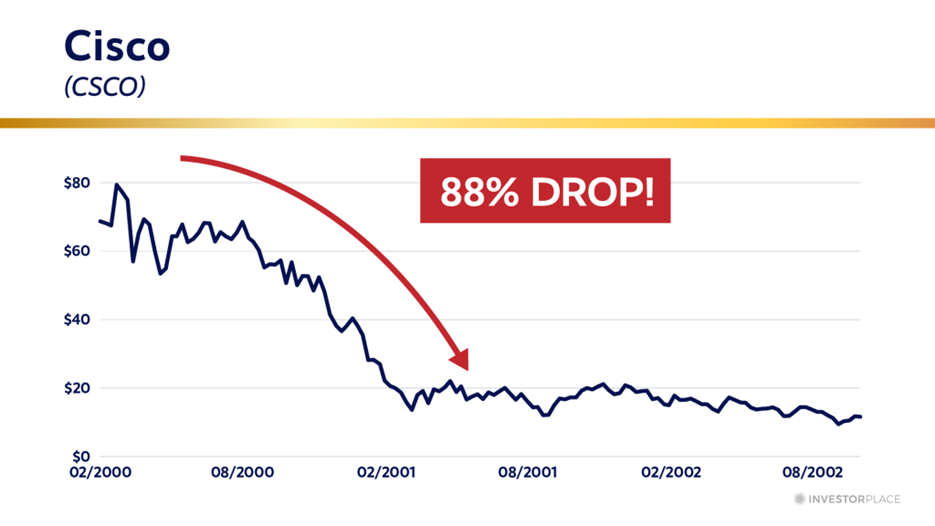

Notably, Thomson Reuters Corp. (TRI) experienced a staggering nearly 16% one-day loss, driven by fears of AI encroaching into its core operations, despite a dividend increase and stable results. The current market situation mirrors earlier technological transitions, where initial leaders may falter as innovation evolves. Billions in investments, particularly among giants like Alphabet Inc. (GOOG), Amazon.com Inc. (AMZN), Meta Platforms Inc. (META), and Microsoft have surged over 60% year-on-year, but these companies collectively lost over $950 billion in market value recently.

Experts suggest a phase shift is imminent, moving from an initial AI boom focused on feasibility to a more selective phase that prioritizes long-term profitability and returns. Smaller companies providing essential AI infrastructure may emerge as the next market leaders, reflecting historical patterns of technological progression.