Tesla(NASDAQ: TSLA) relinquished its position as the world’s top electric vehicle (EV) seller in the final quarter of the previous year when China-based BYD surpassed it for the first time. Once monopolizing the EV market, Tesla now faces an onslaught of competition from emerging EV ventures and traditional automakers venturing into the realm.

Simultaneously, consumer demand appears to be waning. EVs typically bear a premium price tag, coupled with soaring interest rates nudging buyers towards more economical gas-powered automobiles. To stoke demand, Tesla resorted to a drastic measure, slashing prices by 25% in 2023, although this move put a dent in its profitability.

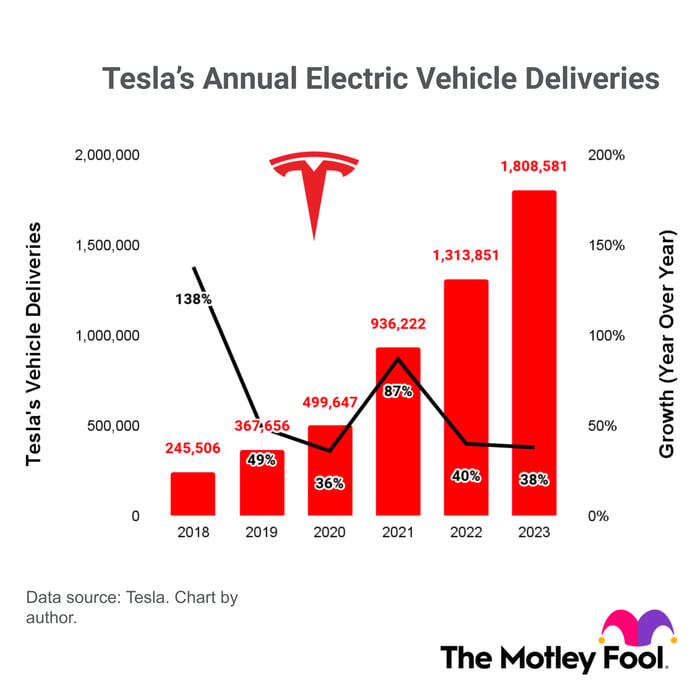

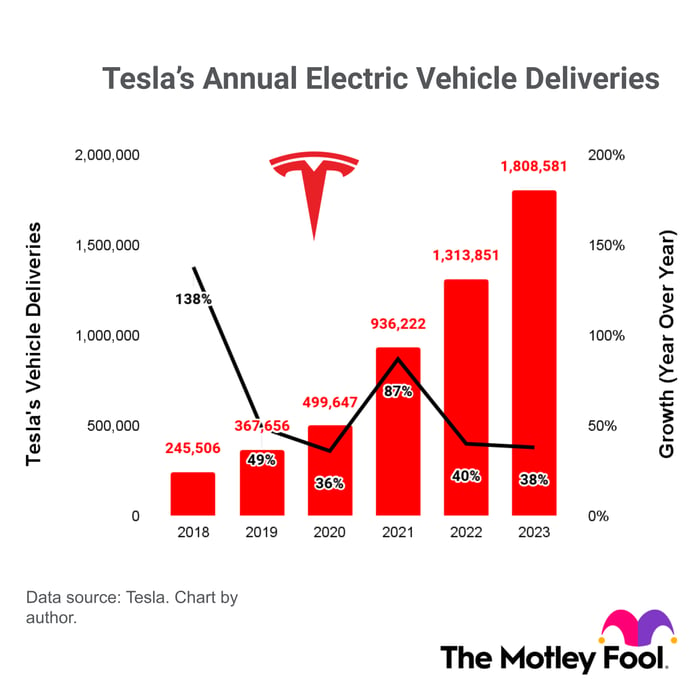

Year-to-date, Tesla stock has plummeted by 21%, with the majority of the decline following the release of its 2023 annual results. Despite achieving a milestone of 1.8 million deliveries for the year, representing a 38% annual upswing, this growth rate was the most sluggish since 2020. Omitting a delivery projection for 2024, analysts forecast 2.2 million vehicles, indicative of a further growth deceleration to a mere 22%.

Strategic Initiatives to Stoke Growth

Looking ahead, Tesla envisages commencing the production of a more affordable EV model in 2025, potentially priced at $25,000. This maneuver aims to widen Tesla’s consumer base to include individuals eyeing a Tesla but economically shackled by the brand’s existing lineup.

Nonetheless, Tesla is not solely an automobile manufacturer. Its ongoing development of cutting-edge self-driving software bears the potential to revolutionize its operational landscape. Additionally, Tesla lays the groundwork for the launch of Optimus, a humanoid robot slated for a 2027 debut. Let’s not overlook Tesla’s rapidly expanding solar energy and battery storage ventures.

While these endeavors may not trigger an immediate skyrocketing of Tesla stock, the 21% plunge this year – and a broader 52% descent from its pinnacle – could present an advantageous entry point for investors with the patience to endure the long haul.

Where to invest $1,000 right now

If there’s a stock tip from our analysts, it might be worth your time to heed it. Over two decades, the newsletter helmed by the Motley Fool Stock Advisor has outstripped the market by more than triple.*

They’ve recently unveiled what they believe constitute the 10 premier stocks for investors to consider today, with Tesla making the cut – yet there are nine other stocks possibly escaping your scrutiny.

Explore the 10 stocks

*Stock Advisor returns as of February 20, 2024

Anthony Di Pizio holds no position in any of the stocks discussed. The Motley Fool has stakes in and endorses BYD and Tesla. The Motley Fool stands by a policy of full disclosure.

The perspectives and opinions articulated herein belong to the author and do not necessarily mirror those of Nasdaq, Inc.