With all due respect, Tesla (NASDAQ: TSLA)has undeniably revolutionized the electric vehicle (EV) industry. Since Elon Musk assumed the helm, the company has successfully shifted the perception of EVs from mundane to trendy. Embraced by eco-conscious consumers, Tesla’s voyage from its 2010 IPO has been buoyant.

However, the road has hit a rough patch, with Tesla’s stock plummeting by 47% from its pinnacle in late 2021, appearing to stall.

What’s the cause? In a nutshell, the harsh realities of battery-powered vehicles are settling in. The practicality of these cars falls short of initial aspirations, catching Tesla shares off-guard.

Diminishing Interest in EVs

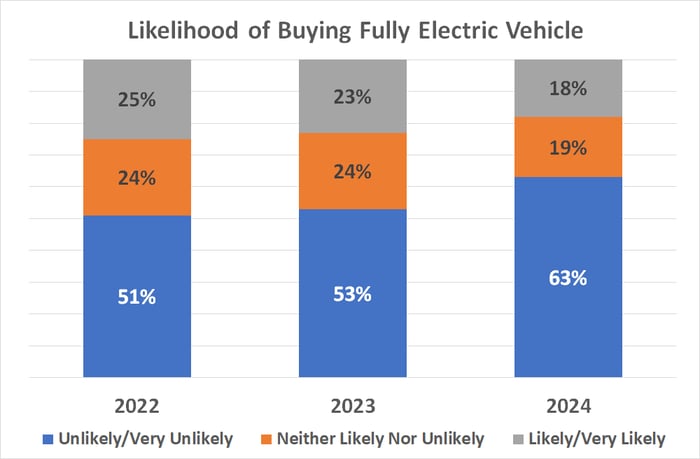

According to the American Automobile Association (AAA), surveyed U.S. drivers are gradually losing interest in fully electric vehicles. In a recent study, AAA revealed that 63% of drivers are unlikely to purchase an EV in the near future, a stark rise from 53% in 2023. Conversely, the percentage of drivers inclined to buy an EV has dwindled from 23% to a mere 18% for 2024. These shifting attitudes are part of a continuing trend that commenced a year earlier.

Data source: AAA. Chart by author.

The declining interest in EVs isn’t astonishing; consumers are fretful about limitations in driving range, sparse recharging infrastructure, and the relatively high cost associated with EV ownership.

Challenges to Tesla Stock’s Historical Premium

It would be premature to view this as the demise of the EV sector. In the United States, EV unit sales surged by 52% last year. The International Energy Administration forecasts a further 20% rise in EV sales within the U.S. this year. The EV market’s trajectory points to future expansion, with Tesla retaining its premier position in the industry.

Nonetheless, Tesla shares have historically commanded a premium due to the company’s market dominance and brand cachet. The erosion of this dominance in tandem with growing awareness of EV limitations has spurred uncertainty among investors seeking to recalibrate their expectations for Tesla’s performance.

Is Now the Time to Invest $1,000 in Tesla?

Before diving into Tesla stock, ponder this:

The Motley Fool Stock Advisor analyst team recently unveiled their list of the 10 top stocks expected to yield substantial returns, with Tesla conspicuously absent. The identified stocks harbor the potential for significant growth in the years to come.

Consider the case of Nvidia, listed on April 15, 2005… an investment of $1,000 at recommendation would have multiplied to $630,099!

Stock Advisor furnishes investors with a comprehensive investment strategy, featuring insights on portfolio construction, regular analyst updates, and bi-monthly stock recommendations. The service has outperformed the S&P 500 index fourfold since 2002*.

Discover the 10 stocks »

*As of September 3, 2024, Stock Advisor returns

James Brumley holds no positions in the mentioned stocks. The Motley Fool has vested interests in and endorses Tesla. The Motley Fool operates under a transparent disclosure policy.

The opinions expressed in this article are solely those of the author and do not necessarily reflect the views of Nasdaq, Inc.