Cathie Wood stands at the helm of Ark Investment Management, steering a fleet of 14 exchange-traded funds (ETFs) that delve into the realms of technological advancements, spanning artificial intelligence, electric vehicles, and the hotbed of potential that is cryptocurrency.

Ark Investment Management exudes an aura of optimism towards the grandee of all cryptocurrencies, Bitcoin (CRYPTO: BTC). While the firm’s official stance speculates on a 2,000% surge by 2030, Wood herself has reset the compass, guiding towards an otherworldly potential upside of over 5,300%.

As Bitcoin dances near all-time price highs, enthusiasts are riding the wave of optimism. But do Wood’s lofty predictions align with reality?

Image source: Getty Images.

Fathoming Bitcoin as an Uncharted Terrain

Bitcoin often flutters in conversations as a contender to traditional currency. It defies the grasp of any individual or institution, anchored on a transparent blockchain ledger. It’s a wild ride on the price rollercoaster; shedding 65% in the tumult of 2022, Bitcoin has since recovered by a substantial 325%. Yet, this volatility renders it unsuitable for the everyday financial transactions of individuals and businesses.

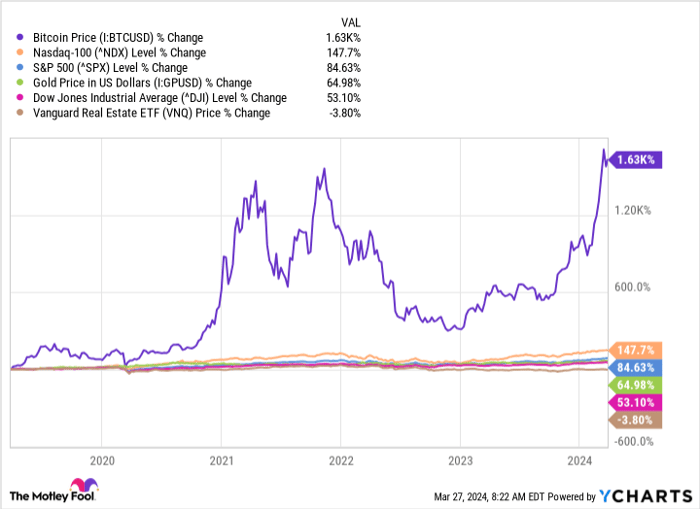

For many, Bitcoin plays the role of a haven, akin to a digital rendition of gold, outshining every other asset class in the past five years:

Bitcoin Price data by YCharts

The narrative underpinning Bitcoin hinges on a simple premise; a finite supply of 21 million coins, rewards meted out to miners who crack cryptographic puzzles. Each 210,000 blocks mark a halving event, slicing the mining rewards in half. Forecasts musing over the final Bitcoin reveal a distant horizon around the year 2140.

Driven solely by demand due to its capped supply, Bitcoin boasts about 50 million wallets holding complete or partial coins, nearing an all-time apogee. The enthusiasm witnessed during wallet creations in 2023 signifies a thriving demand ecosystem. Yet, even with demand as the wind in its sails, Bitcoin’s trajectory to reach the stratospheric gains projected by Ark and Wood remains uncharted.

Ark’s Fuel for a Price Propel

Ark unfurls a tapestry of eight potent demand sources fueling Bitcoin’s potential ascendancy by 2030:

- Corporate reservoir: Corporates may stash 0% to 5% of their reserves in Bitcoin.

- Remittance fuel: Bitcoin could crown 5% to 25% of all non-commercial money transfers.

- Nation-state goldmine: Government treasuries worldwide might secure 0% to 5% of their funds in Bitcoin.

- Emerging cash: Bitcoin could reign as the prime currency in emerging nations, a realm pioneered by El Salvador’s embracement.

- Economic expressway: Bitcoin’s domain could obliterate sundry fees hinged by conventional financial entities, gusting 1% to 10% of U.S. bank settlements.

- Seizure-resisting fortress: HNIs might shield 1% to 5% of global wealth in Bitcoin to evade governmental clutches.

- Institutional voyage: Financial titans could invest 1% to 6.5% of their assets in Bitcoin, viewing it as a valuable appreciating asset.

- Digital aurum: Investors swaying away from gold might redirect 20% to 50% of their gold-bound funds towards Bitcoin, enticed by its performance and portability.

Ark’s prophecy envisions the following celestial heights for Bitcoin by 2030, intertwined with the demand melodies from the aforementioned catalysts:

- Bear case: $258,500, marking a 270% surge from today’s $69,000.

- Base case: $682,800, resonating an 880% upswing.

- Bull case: $1,480,000, heralding a 2,400% uptick.

Security token on the public visible web?

In fact, security tokens on the public visible web are not inherently a security risk. These tokens provide an added layer of security, such as secure access to internal resources, without being a threat themselves. They act as a key to secure resources and don’t pose a vulnerability by being on the public web. The security of these tokens lies in their configuration and usage within a secure infrastructure.

Wood’s Double-Down on Bitcoin

During the Bitcoin Investor Day congregation in New York, Wood amplified the Bitcoin symphony, transcending Ark’s initial 2030 peg of $1.48 million to envision a stratospheric leap to $3.8 million. The 5,300% elevation envisions the fuel of Bitcoin exchange historians. clicking the

. Sm, security

: re shiftingun of of of e.

this this

tweaking.

adding release as ( This a of uz.

of of of at The The The The The The The The The The P The The The The The The The The The The The K Camera from . Virt of K. e . Pay !

Rap 553 X342.jpg

” Zoom Camera lense on the blue background

© manfalling

In 2019

Close

A hand holding An Infinix Zero 5 Plus’s Camera

© manfalling

In 2019

Close

Camera lens up close

© manfalling

In 2019

Close

hand holding Phone Camera lens

© manfalling

In 2019

Close

hand holding front Camera lens of a Phone

© manfalling

In 2019

Close

hand holding Camera lens of a Phone

© manfalling

In 2019

Close

hand holding Phone Camera lens

© manfalling

In 2019

Close

hand holding Camera lens of Phone

© manfalling

In 2019

Close

hand holding Camera len of a Phone

© manfalling

In 2019

Close

hand showing Phone Camera lens

© manfalling

In 2019

Close

Cellphone camera lens

© manfalling

In 2019

Close

Cellphone Camera lens

© manfalling

In 2019

Close

hand showing Phone Camera lens

© manfalling

In 2019

Close

A Phot by Manfalling in Dubai, The Asmaazia

Taken in 2019

Close

A Trout’s eye!

© Michael Howlett CC-BY-NA2.0

In 2019

Close

hand holding Camera

© Michael Gaida CC-BY

In 2019

Close

Camera lens

© Jhonatan Monassa CC-BY

In 2019

Close

Camera lens

© Skitterphoto CC-BY

In 2019

Close

Camera lens

© Christian Wiediger CC-BY

In 2019

Close

Camera lens

© Yoss Cinematic Polish CC-BY

In 2019

Close

Camera lens

© Skitterphoto CC-BY

In 2019

Close

h.

© Yoss Cinematic Polish CC-BY

In 2019

Close

Detective lens

© Edward Eyer CC-BY

In 2019

Close

Detective lens

© Jou Paper CC-BY

In 2019

Close

Eye glass lens

© Timtrad CC-BY

In 2019

Close

Eye glass lens

© getinhere CC-BY

In 2019

Close

Eye glass lens

© manya petrova CC-BY

In 2019

Close

Camera lens

© Edison Vashlesi CC-BY

In 2019

Close

Camera lens spotted

© Andrew Buker CC-BY

In 2019

Close

Camera lens spotted

© Martin Dufek CC-BY

In 2019

Close

Spy lens

© Kevin Lewis CC-BY

In 2019

Close

Spy lens

© Martin Lopez CC-BY

In 2019

Close

Spy lens

© Ethereum Vienna CC-BY

In 2019

Close

Detective’s lens

© Kevin Dublow CC-BY

In 2019

Close

Detective’s lens

© MOHAMED KARIM CC-BY

In 2019

Close

Detective’s lens…

© Jhonatan Monassa CC-BY

In 2019

Close

Detective’s lens…

© Armadale Eye CC-BY

In 2019

Close

Detective’s lens

© Riccardo Lecca CC-BY

In 2019

Close

Detective’s lens

© Armadale Eye CC-BY

In 2019

Close

Monitor lens

© Marvin Smack CC-BY

In 2019

Close

Monitor lens

© manfalling CC-BY

In 2019

Close

Monitor lens

© Marvin Smith CC-BY

In 2019

Close

Monitor lens

© Marvin Markell CC-BY

In 2019

Close

Monitor lens

© Garrison Shields CC-BY

In 2019

Close

Monitor lens

© Arizona Ghostbusters CC-BY

In 2019

Close

Mobile device lens

© Shawn Lee CC-BY

In 2019

Close

Phone camera lens

© manya petrova CC-BY

In 2019

Close

Phone Camera lens

© manya petrova CC-BY

In 2019

Close

Smart Device lens

© Shawn Lee CC-BY

In 2019

Close

Camera

© MOHAMED KARIM CC-BY

In 2019

Close

Smart Device lens

©…

New Paragraph

So far, the 10 approved ETF operators – including Ark – manage a combined total exceeding $58 billion in Bitcoin assets, with the figure poised for a northward trajectory. Wood posits that should institutional investors allot a tad over 5% of their portfolios to Bitcoin, the outcome would justify a value of $3.8 million.

Wood envisions boundless potential for Bitcoin’s soar into new heights. She perceives the cryptocurrency as a linchpin in facilitating an internet-based financial ecosystem that sidesteps the toll collectors such as banks and financial intermediaries, who pinch a fraction each time money shuffles between hands.

The Balancing Act of Wood’s Projection

History has shown that past performance is no oracle for future events; hence, the astronomic gains projected by Wood might trudge a path far removed from reality.

Should Bitcoin ascend to a lofty $3.8 million, it would sport a market capitalization of $74.7 trillion, looming nearly threefold more esteemed than the entire US economy measured by GDP with a staggering 23-fold lead over the reigning giant, Microsoft.

Such a celestial leap seems an arduous expectancy. Deeming Bitcoin as a value repository aligns with reason; perchance one day, its market valuation might echo that of gold, presently at $14.6 trillion. Such a narrative would translate to a tenfold leap for Bitcoin from the current juncture, ferrying it to $743,500 – a hairbreadth above Ark’s base vision.

Should you invest $1,000 in Bitcoin right now?

Before setting sail on the Bitcoin voyage, ponder on this:

The Motley Fool Stock Advisor troupe has unveiled their cherry-picked catalog of the 10 best stocks they expect investors to bet on. Surprisingly, Bitcoin finds no haven among the chosen ten. Could these be the golden nuggets destined to yield substantial returns in the forthcoming epochs?

The Stock Advisor roadmap equips investors with a user-friendly blueprint for prosperity, offering counsel on sculpting a diversified portfolio, crisp updates from analysts, and dual stock picks blossoming each month. The Stock Advisor caravan has more than tripled the returns garnered from the S&P 500 bulletin since 2002*.

Discover the 10 stocks

*Stock Advisor returns as of March 25, 2024

Anthony Di Pizio has no stake in any cited stocks. The Motley Fool nods at and supports Bitcoin and Microsoft. The troupe from Motley Fool considers options: they coo over long January 2026 $395 Microsoft calls and murmur about short January 2026 $405 Microsoft calls. Motley Fool unveils a disclosure policy.

The thoughts and viewpoints shared herein are bursts of the author’s brainchild and may or may not mirror those residing in the cradle of Nasdaq, Inc.