Understanding 13F Filings

A 13F filing is the window through which we, the public, get a peek into the financial activities of major institutional investment managers. Required by the U.S. Securities and Exchange Commission (SEC), these disclosures pull back the curtain on the equity holdings of those with assets exceeding $100 million. It’s like a quarterly report card of their investment portfolios, revealing which stocks they own and in what quantities.

Investors and analysts devour these filings like parched wanderers stumbling upon an oasis in the desert. Why? Because uncovering the strategies of these titans of finance is invaluable. It’s like peeking into the playbook of the big leagues.

Top 3 Giants to Keep an Eye On

Nvidia’s Debut

Nvidia (NVDA) made its grand 13F filing entrance this week. As the leading chipmaker and now the third largest U.S. company, it’s a heavyweight worth shadowing. With heaps of cash at its disposal, Nvidia could be gearing up to boost its investments. And when it comes to the realm of artificial intelligence, Nvidia is the wizard behind the curtain.

Image Source: Nvidia

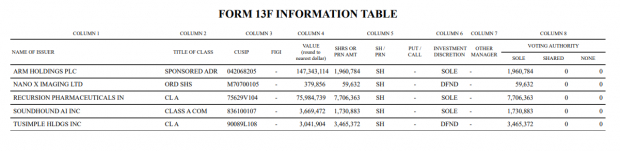

Unsurprisingly, Nvidia’s prime holding is the scorching hot IPO ARM Holdings (ARM), valued at nearly $150 million. However, a watchful eye should be kept on its IPO lockup date, expiring on March 12th. After the lockup period ends, insiders sitting on substantial profits can start selling.

Beyond merely profiting from AI’s gold rush, NVDA is on the prowl for AI-centric investments. While the crowd may be fixated on Chatbots, NVDA has spotted potential in Recursion Pharmaceuticals (RXRX), its second-largest investment, which employs AI for groundbreaking drug discoveries.

Finally, the stocks of SoundHound AI (SOUN), a voice assistant AI platform, and Nano-X Imaging (NNOX), an Israeli-based X-ray company, soared more than 50% post the revelation of NVDA’s 13F. Despite their modest size relative to NVDA’s war chest, investors are heartened by the blessing of the leading chipmaker.

Warren Buffett’s Moves

When it comes to 13F filings, few can hold a candle to Warren Buffett. The “Oracle of Omaha” boasts infallible investments, a penchant for long-term holdings, and an unwavering track record. His 13F is akin to a treasure map leading to rich bounty.

Image Source: HedgeVision

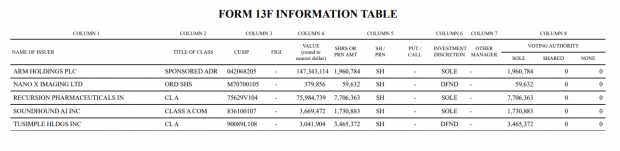

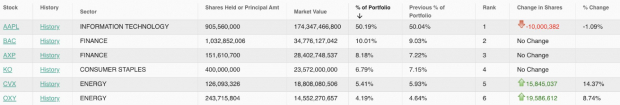

The headlines may have fixated on Buffett paring back 10 million shares of Apple (AAPL). The reduction, however, barely dented Buffett’s AAPL holdings, leaving Berkshire Hathaway with a massive 50% stake in the tech giant.

What truly caught attention were Buffett’s forays into the energy sector, with significant additions to names like Chevron (CVX) and Occidental Petroleum (OXY). Despite the waning interest in energy stocks, Buffett’s unshakeable faith and steady accumulation of shares in companies like OXY, which are trading at multi-year low price-to-book values, make perfect sense.

Image Source: Zacks Investment Research

The Wisdom of David Tepper

When you’re picking someone to follow, the safe bet is to side with the one who keeps batting a thousand. Over successive quarters, Appaloosa’s David Tepper has been on the money with his tech investments. And the latest 13F reaffirms his bullish stance, with a fresh position in Amazon (AMZN) and more than doubling down on the high-growth database software company, Elastic (ESTC).

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s credited with a “watershed medical breakthrough” and is developing a bustling pipeline of other projects

Investment Opportunity Emerges for Healthcare Innovations

The biotech industry is abuzz with excitement as a potential game-changing Recursion Pharmaceuticals, Inc. unveils its latest innovation aimed at revolutionizing treatment for liver, lung, and blood diseases. This development comes at a pivotal moment, offering investors a chance to ride the wave of a burgeoning market that has seen recent meteoric gains from companies like Boston Beer Company and NVIDIA.

Free: See Our Top Stock And 4 Runners Up

Leading the Charge in Biotech Innovation

The field of biotechnology has a storied history of heralding breakthrough advancements that have reshaped the healthcare landscape. From the development of life-changing medications to pioneering treatments, biotech companies have consistently pushed the boundaries of what is possible. Now, Recursion Pharmaceuticals, Inc. emerges as a frontrunner, capturing the attention of investors and healthcare professionals alike with its potentially transformative approach to addressing liver, lung, and blood diseases.

Riding the Wave of Market Momentum

As savvy investors keep a pulse on the market, it’s hard to ignore the recent success stories of Boston Beer Company and NVIDIA, which have experienced substantial growth. Now, the emergence of Recursion Pharmaceuticals, Inc. offers a fresh opportunity, promising to rival or even surpass these recent stock surges. This enticing prospect presents investors with the chance to capitalize on the momentum of a burgeoning market while it emerges from its bear market lows.

Diversify Your Portfolio with Promising Stocks

While established giants like Amazon, Apple, Chevron, and Occidental Petroleum continue to command attention in the stock market, it’s essential for investors to keep a watchful eye on up-and-coming players. Recursion Pharmaceuticals, Inc. and other promising companies like ARM Holdings PLC, Elastic N.V., Nano-X Imaging Ltd., and SoundHound AI, Inc. offer a compelling opportunity to diversify portfolios and potentially reap significant rewards in the ever-evolving landscape of healthcare innovation.

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.