Investing in AI Stocks Amid Market Volatility: Meta and Amazon

Global equity markets have faced significant volatility in 2025, driven by escalating trade tensions between the U.S. and China, increasing global conflicts, and rising concerns about potential recessions in key economies.

This market instability, however, offers a unique opportunity to invest in high-quality, fundamental stocks driven by artificial intelligence (AI) that are currently trading at attractive valuations. Notably, Meta Platforms (NASDAQ: META) and Amazon (NASDAQ: AMZN) are poised to gain from the growing AI adoption.

Meta Platforms: Leading the AI Revolution

Meta Platforms has positioned itself as a frontrunner in the AI landscape, benefiting from its unparalleled scale and extensive geographic reach. In its fiscal 2025 first quarter, the company showcased robust performance, with revenue and earnings significantly exceeding consensus estimates.

Despite substantial investments in AI, Meta generated free cash flow of $10.3 billion and returned $14.7 billion to shareholders during the first quarter.

With over 3.4 billion daily active users—nearly half of the global population—Meta leverages vast amounts of first-party data. This information trains its machine learning and AI models, enabling more relevant content recommendations and resulting in increased user engagement. Notably, AI-driven recommendations enhanced time spent on Facebook by 7%, Instagram by 6%, and Threads by 35%.

In Q1, the introduction of the Generative Ads Recommendation Model (GEM) led to a doubling of ad performance using the same data and computational power. The efficiency allowed the corporation to allocate more resources toward model training.

This new ad model was deployed on Facebook Reels, improving ad conversion rates by 5% and attracting a 30% increase in advertisers utilizing its AI-powered creative tools during the same period.

The AI initiatives have fostered a positive cycle: improved recommendations enhance user engagement, which in turn attracts more advertisers and leads to increased revenue and further AI investments. Management is also prioritizing business messaging as a significant revenue source, with many companies in developing nations like Thailand and Vietnam already utilizing this technology. Meta is developing AI business agents to facilitate commerce in regions with higher labor costs.

Currently, the stock trades at 21.5 times forward earnings, a notable discount compared to its five-year average of 25. With sales projected to grow 13.6% and earnings per share expected to rise by 25.2% year over year, this valuation appears reasonable for a leading AI-powered digital advertising firm.

Amazon: Dominating AI Infrastructure

Amazon remains a significant player in AI infrastructure. Its fiscal 2025 first-quarter results were notable, as revenue and earnings surpassed consensus estimates despite ongoing economic uncertainty.

The stock faced a decline post-earnings release due to softer-than-expected guidance for Q2, yet many aspects of the company remain attractive.

Although still emerging, Amazon’s AI business generates multibillion-dollar annual revenue and is expanding at triple-digit rates year over year. The company’s aggressive investments enable it to provide a broad array of AI technologies, positioning it well for future growth.

Amazon Web Services (AWS) continues to lead in offering GPUs from multiple providers while also facilitating custom Trainium 2 chips, which provide 30% to 40% better price performance for AI inference workloads compared to competing solutions.

Its Bedrock service offers clients diverse foundational models for generative AI applications. The recent launch of the Nova suite, including models for speech and multistep agentic tasks, adds to its competitive edge.

Despite rising competition from Microsoft’s Azure and Alphabet’s Google Cloud, AWS boasts an annualized revenue run rate exceeding $117 billion and impressive 39.2% operating margins. This performance remains a key growth driver and profit center.

With 85% of global IT spending still on-premises, AWS stands to benefit from the shift towards cloud solutions. The robust infrastructure helps attract clients looking to run AI workloads.

Additionally, Amazon’s advertising branch has become a major revenue source, now reaching an average audience of over 275 million in the U.S. The integration of Amazon Ads across various sectors—including entertainment and retail—enhances brand targeting.

To navigate tariff challenges in its e-commerce business, Amazon is strategically managing inventory purchases. With over 2 million sellers, the company states it can source goods from suppliers less affected by tariff impacts.

Currently, the stock trades at 28.6 times forward earnings, significantly below its five-year average of 53.9. Given its strong fundamentals and favorable valuation, Amazon presents a compelling option for long-term investors.

# Navigating Investment Decisions: Is Meta Platforms Right for You?

## Investment Considerations for Meta Platforms

Before investing in Meta Platforms, it’s essential to weigh your options carefully. The *Motley Fool Stock Advisor* analyst team has recently highlighted what they consider to be the **10 best stocks** for investors at this moment, excluding Meta Platforms from this list. The selected stocks have the potential to deliver significant returns in the years ahead.

### Historical Context

Consider that when *Netflix* was included in the list on December 17, 2004, an investment of $1,000 would now be valued at approximately **$623,103**. Similarly, *Nvidia* made the list on April 15, 2005, and that $1,000 investment would have grown to around **$717,471**.

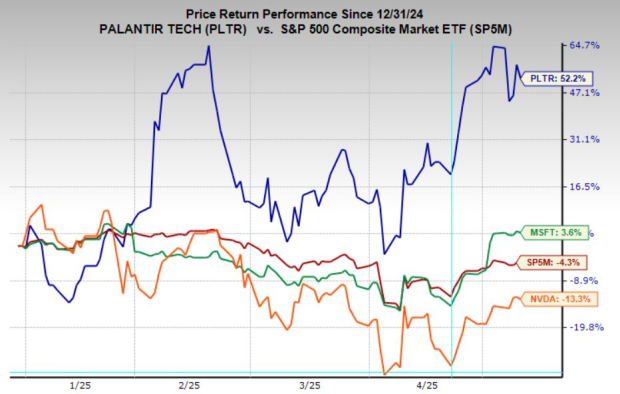

### Market Performance Insights

It’s important to note that the *Stock Advisor* boasts an impressive average return of **909%**, outpacing the S&P 500, which has delivered a return of **162%**. For those interested in discovering the latest top-performing stocks, joining *Stock Advisor* may offer valuable insights.

### Additional Information

*Suzanne Frey*, an executive at Alphabet, serves on The Motley Fool’s board of directors. Notably, *Randi Zuckerberg*, a former Facebook executive and sister to Meta Platforms CEO Mark Zuckerberg, is also part of the board. *John Mackey*, the former CEO of Whole Foods Market, is another member. *Manali Pradhan* has no positions in the mentioned stocks. The Motley Fool holds shares and recommends stocks in Alphabet, Amazon, Meta Platforms, and Microsoft. They also advise on specific options strategies related to Microsoft.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.