Advance Auto Parts and Ford: Captivating Investment Opportunities Ahead

The automotive sector is a crucial part of the global economy, attracting investors seeking long-term opportunities. Two notable stocks that may be primed for a rebound are Advance Auto Parts AAP and Ford F.

Despite facing challenges in recent years, both companies present a chance for investors to acquire shares at more attractive valuations.

Advance Auto Parts Enters Growth Phase

Advance Auto Parts, a leading provider of automotive aftermarket parts in North America, announced in March that it had completed the store closure phase of its transformation. The company is now entering a growth phase.

By optimizing its retail footprint, Advance Auto Parts aims to achieve long-term success. More than 75% of its stores will now be located in markets where it holds the No. 1 or No. 2 position based on store density, thereby strengthening its strategic presence.

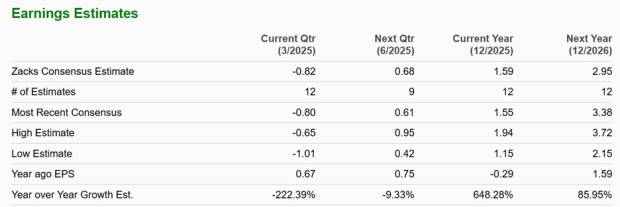

This strategy positions Advance Auto Parts to better compete against major rivals like AutoZone AZO and O’Reilly Automotive ORLY. Significantly, with shares trading at $32, AAP is valued at a fraction of what competitors like AutoZone and O’Reilly currently trade at. Furthermore, Advance Auto Parts is projected to see a notable rebound in its bottom line in the upcoming years.

Image Source: Zacks Investment Research

Ford’s Promising Outlook

As the U.S. negotiates trade agreements with various global partners, including China, anticipated import tariffs on automakers are projected to be lower than previously feared. Ford is at the center of these discussions and had earlier estimated a $1.5 billion impact from tariffs this year, while many analysts suggested it could exceed $2 billion.

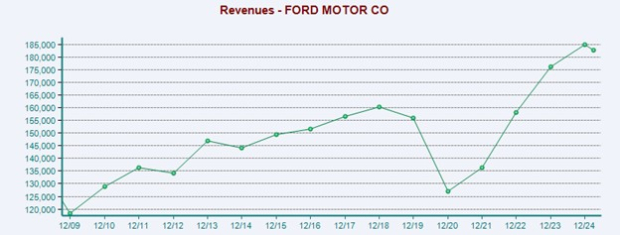

This evaluation preceded the announcement that both the U.S. and China plan to reduce their reciprocal tariffs. Additionally, Ford has proactively mitigated 35% of the anticipated impact by adjusting supply chains and halting exports to China, which may no longer be necessary. Notably, Ford is expected to achieve over $150 billion in annual sales moving forward, making its stock at $10 per share a compelling investment as the company demonstrates its dedication to reducing operating costs amid a challenging macroeconomic landscape.

Image Source: Zacks Investment Research

AAP and Ford as Value Stocks

Historically, Ford has been viewed as a value stock, and Advance Auto Parts is beginning to gain similar recognition. AAP currently trades at a forward earnings multiple of 20.9X, slightly below the benchmark S&P 500 average. In comparison, competitors AutoZone and O’Reilly trade at 24.2X and 30.2X, respectively. Meanwhile, Ford’s valuation stands at 9X forward earnings, marginally below its Zacks Automotive-Domestic Industry average of 10.8X.

Additionally, both Advance Auto Parts and Ford stocks are trading at significant discounts in terms of their Price to Book (P/B) value and below the optimal level of less than 2X sales.

Image Source: Zacks Investment Research

Attractive Dividend Yields

Investing in Advance Auto Parts and Ford also offers the benefit of generous dividends. Advance Auto Parts currently has a 3.01% annual dividend, which is notable since competitors like AutoZone and O’Reilly do not provide any dividends.

Image Source: Zacks Investment Research

Ford offers a more impressive annual dividend yield of 5.66%. This substantial yield is likely sustainable, especially with the potential for improved trade relations. Furthermore, Ford has achieved an annualized dividend growth rate of 12.48% over the last five years, maintaining a 40% payout ratio, indicating the prospect for maintaining or even increasing dividends in the future.

Image Source: Zacks Investment Research

Conclusion

Both Advance Auto Parts and Ford showcase compelling investment possibilities, offering favorable valuations and attractive dividends amid a transformative economic landscape.

Rebounding Opportunities: Advance Auto Parts and Ford Rise Below 52-Week Highs

Both Advance Auto Parts and Ford have seen their stock prices fall over 50% and 25%, respectively, from their 52-week peaks. Analysts believe that these companies may soon experience a significant rebound, supported by attractive dividends and valuations that are becoming increasingly appealing.

Potential for High Returns: Zacks’ Top Stock Selection

Zacks’ research team has identified five stocks that have a strong chance of doubling in value in the next few months. Notably, Director of Research Sheraz Mian has singled out one stock set to outperform the rest.

This standout stock hails from an innovative financial firm with a rapidly growing customer base, now exceeding 50 million, alongside a diverse portfolio of advanced solutions. While not all of Zacks’ recommendations hit the mark, this particular stock has the potential for substantial growth, similar to earlier successful picks like Nano-X Imaging, which skyrocketed by 129.6% in just over nine months.

For further insights, you can access free stock analysis reports for:

- Ford Motor Company (F)

- Advance Auto Parts, Inc. (AAP)

- O’Reilly Automotive, Inc. (ORLY)

- AutoZone, Inc. (AZO)

This article was originally published on Zacks Investment Research.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.