The “Magnificent Seven” stocks have risen above the growth-focused Nasdaq Composite index over the past year and are continuing their dominance in 2024, outstripping the Nasdaq’s returns by almost double. The Roundhill Magnificent Seven ETF’s performance showcases a remarkable 12.4% year-to-date gain for this exclusive group. Amidst these top-tier tech stocks, Nvidia and Amazon stand out, displaying robust growth potential and promising prospects beyond their recent peaks. Let’s delve into why these two companies are solid selections for investors in the present market landscape.

Nvidia: Riding the AI Wave

Nvidia has been a leading beneficiary of the surge in artificial intelligence (AI), witnessing its stock price surge by a staggering 239% in the last 12 months. The bright side for investors joining the fray now is that the company’s meteoric growth trajectory may still have substantial runway left. Furthermore, the stock remains attractively valued vis-à-vis its underlying business expansion and for several compelling reasons.

One method to gauge end-market demand for a company’s products is by examining the reports of businesses with related operations. Super Micro Computer, a manufacturer of plug-and-play rack systems for data centers housing Nvidia’s GPUs, reported a 103% year-over-year revenue increase in the most recent quarter. The surge in demand for AI rack solutions, centered on Nvidia’s H100 chip, indicates that the appetite for Nvidia’s chips is far from waning.

Despite already lofty growth expectations for the GPU leader, analysts are revising their annual revenue forecasts upwards for Nvidia over the next few years, underscoring the company’s bullish outlook. Trading at a modest 35 times next year’s consensus earnings estimate, the stock’s valuation appears reasonable, given the company’s robust growth trajectory.

The dawn of AI is compelling more companies to adopt accelerated computing and invest in GPUs, crucial catalysts driving Nvidia’s phenomenal growth. With $32 billion in trailing revenue from its data center segment and an estimated 80% market share in the AI chip sector, Nvidia is primed to continue delivering substantial growth and returns for its stakeholders, leveraging both historical context and future potential.

Amazon: Reinforcing Its Dominance

Amazon stands as a formidable enterprise with multiple revenue streams buttressing returns for its shareholders, spanning cloud services, advertising, and online retail sales. While its cloud unit, Amazon Web Services, garners the limelight on Wall Street, it’s the company’s burgeoning e-commerce growth that underpins the stock’s ascent.

Although some may posit that AI technology could potentially facilitate easier product discovery at other retailers, undermining Amazon in the long run, this overlooks the human tendency to adhere to trusted brands. Furthermore, it disregards the investments Amazon is making in AI and infrastructure to enhance its retail offerings.

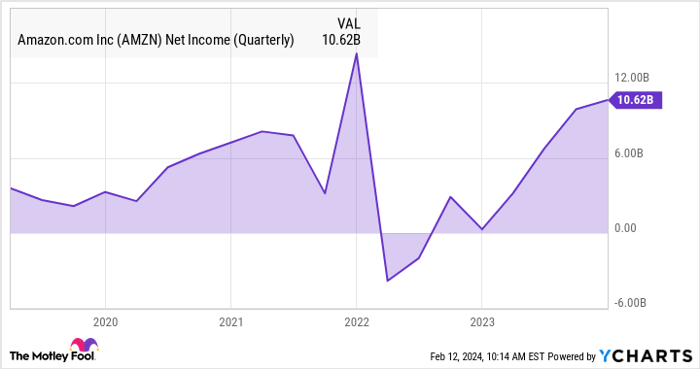

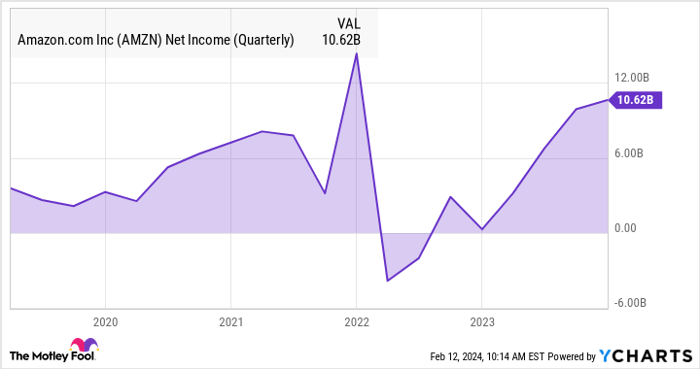

Amazon is actively enhancing its delivery speed, solidifying its competitive edge and making it arduous for rivals to match. The company revealed that it achieved its swiftest delivery speeds in 2023, with over 7 billion units arriving the same or next day, fostering more frequent shopping patterns. Notably, Amazon’s online sales growth accelerated each quarter last year, while augmented profits stemmed from cost efficiencies and inventory optimization.

AMZN Net Income (Quarterly) data by YCharts.

The advent of AI is set to fortify Amazon’s brand, with many consumers gravitating to Amazon.com almost reflexively rather than scouring for products on Google. Furthermore, Amazon is on the cusp of bolstering its value proposition with the launch of Rufus, a new shopping assistant driven by generative AI.

Amazon’s stride in speeding up deliveries and the potential to elevate the shopping experience through AI tools are pivotal in safeguarding its competitive moat. Meanwhile, the stock is trading at a reasonable valuation of approximately 3.1 times trailing revenue, emblematic of the prospects for market-outperforming gains as the company’s e-commerce arm recuperates.

Investing Consideration

Motley Fool Stock Advisor analysts have singled out what they believe are the 10 best stocks for investors to buy now, and Nvidia did not make the cut. Delve into the Stock Advisor service for insights and guidance on maximizing returns – a service that has significantly outperformed the S&P 500 since 2002*

*Stock Advisor returns as of February 12, 2024

John Mackey, a former CEO of Whole Foods Market, an Amazon subsidiary, sits on The Motley Fool’s board of directors. John Ballard has positions in Nvidia. The Motley Fool holds positions in and recommends Amazon and Nvidia, additionally recommending Super Micro Computer. The Motley Fool adheres to a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.