Every investor dreams of discovering the next explosive growth opportunity hidden within the realm of small-cap stocks. These underdogs often hold the potential to outshine their larger counterparts, promising substantial returns to those willing to take the risk.

However, it’s crucial to acknowledge the inherent volatility of small-caps. They tend to operate in the shadows, where swift movements can either catapult them to great heights or leave them wallowing in the depths of financial despair.

EZCORP: Pawning Success

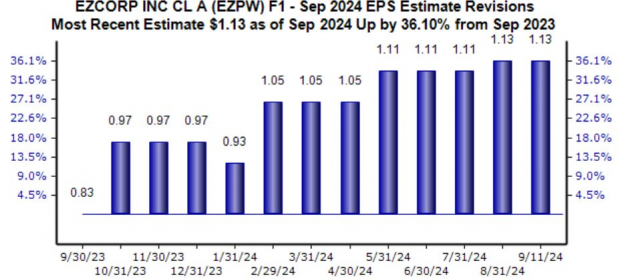

EZCORP, a pawnshop operator with a Zacks Rank #1 (Strong Buy), has recently set the stage on fire with its record-breaking sales performance. By offering consumer credit services and dealing in second-hand merchandise, the company has carved out a niche for itself in the financial landscape.

The firm’s EPS estimates have surged by 40% over a year, indicating a robust 22% year-over-year growth rate. To top it off, EZCORP’s quarterly revenue hit an all-time high of $280 million, with a 3% increase in same-store sales displaying sustained demand.

HRTG: Insuring Big Profits

Heritage Insurance, another Zacks Rank #1 gem, serves as a beacon in the property and casualty insurance sector. Its offerings cater to single-family homeowners and condominium owners, providing them with a safety net.

The company’s recent financials have been nothing short of stellar, with a jaw-dropping 90% increase in EPS year-over-year and a commendable 10% surge in sales. Notably, gross premiums earned climbed by 6% annually, accompanied by a significant drop in the net loss ratio from 60.3% to 55.7%. This signifies a dual triumph of revenue growth and prudent risk management.

The Path Forward

Small-cap stocks, although notorious for their unpredictability, continue to beckon daring investors with the promise of extraordinary growth potential. While the road may be fraught with risks, the rewards can be equally enticing, provided one treads carefully.

Both Heritage Insurance (HRTG) and EZCORP (EZPW) emerge as prime candidates, boasting promising growth prospects and favorable Zacks Ranks. These unpolished gems have the potential to shine bright in the investment arena, offering a glimmer of hope to those seeking to strike gold.

Unleashing an Infrastructure Stock Surge Across America

The imminent wave of infrastructure rejuvenation in the U.S. promises not just a revitalization of crumbling structures but also an opportunity for astute investors to reap substantial rewards. As trillions are set to be injected into infrastructure projects, the stage is set for a wealth-building extravaganza.

Are you ready to seize the moment and invest in the stocks poised to benefit most from this monumental undertaking? Zacks has your back with a comprehensive Special Report, enabling you to identify the top 5 companies poised to capitalize on this transformative phase.

Download FREE: How To Profit From Trillions On Spending For Infrastructure >>

Click here to access this article on Zacks.com.

Explore more with Zacks Investment Research.

Remember, the opinions voiced here are solely those of the author and do not necessarily align with Nasdaq, Inc.’s perspectives.