1. IBM: A Steady Dividend Performer

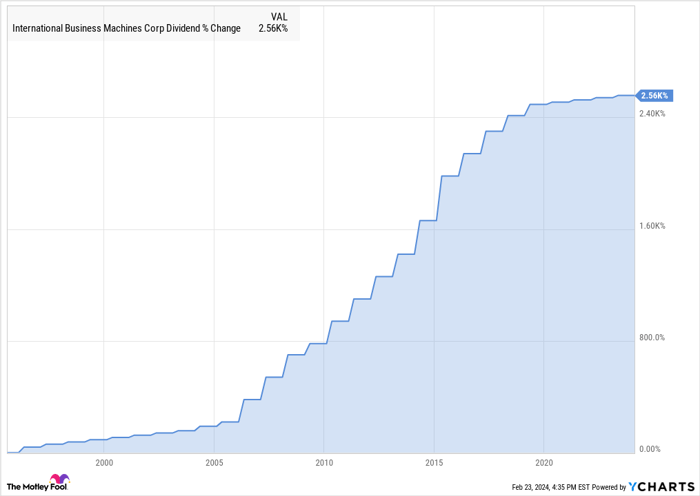

International Business Machines, commonly known as IBM, stands as a beacon of stability in an ever-evolving tech landscape. With a commendable dividend yield of 3.6%, IBM’s commitment to rewarding shareholders is as steadfast as the North Star. Since the glorious days of a 40% dividend boost in 1996, IBM has consistently increased its quarterly payouts, resulting in a spectacular 2,560% gain over 28 years. Even in the face of modest increases post-pandemic, IBM’s dividend growth has continued unabated. The company’s strategic shift towards high-growth markets like data security, cloud computing, and artificial intelligence is clearly paying off, with its Watson AI platform gaining traction and redefining its future prospects.

2. Intel: Embracing Change and Building a Future

Intel, the semiconductor giant synonymous with innovation, has weathered storms of change by steering towards a promising horizon. Despite a recent dip in its dividend yield to 1.2%, Intel’s strategic overhaul is poised to yield lucrative returns. The company’s aggressive push to expand chip-making capacity and delve into semiconductor manufacturing services are bold moves that align with the demands of the AI-driven era. Intel’s timely adaptation to the global chip shortage, boosted by the CHIPS Act support, underscores a management vision that is both astute and far-sighted.

These tech titans, IBM and Intel, are not just dividend payers but solid contenders for long-term investors looking for stable growth and innovative prowess. In a market filled with noise and uncertainty, these companies represent hidden gems waiting to shine brighter in the tech firmament.