For investors navigating the tumultuous seas of the stock market, dividend-paying stocks act as trusty life rafts, providing a steady stream of income regardless of the market’s roller-coaster movements. While tech stocks are often associated with high growth potential, some also offer the comforting allure of dividends. Let’s delve into two tech companies that not only showcase promising growth prospects but also serve as reliable income sources.

AT&T: Weathering Storms and Sailing Towards Stability

AT&T (NYSE: T) has been a rough patch for many investors over the past decade, witnessing a significant decline in stock price. However, recent months have brought about a glimmer of hope, with the stock registering a 20% uptick. This turnaround hints at a possible brighter future for the telecom giant.

AT&T’s woes, stemming from a foray into the media and entertainment realm, prompted the company to realign its focus on core telecom operations. Despite slashing its dividend in half after spinning off WarnerMedia in the first quarter of 2022, AT&T still boasts one of the most generous dividend yields in the S&P 500, surpassing the index’s average by nearly fivefold.

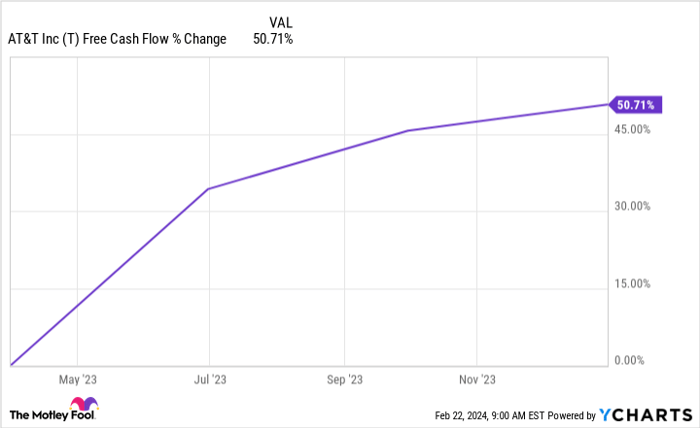

The company’s recent financial performance paints a rosier picture, with $16.8 billion in free cash flow generated in 2023, comfortably covering dividend payments and debt obligations. Notably, this figure marks a $2.6 billion increase from the preceding year.

AT&T’s strategic realignment is yielding results, with substantial customer additions in the 5G wireless and fiber segments in 2023. Moreover, a reduction of over $3 billion in net debt bolsters the company’s financial resilience.

With AT&T’s trajectory pointing northwards, investors can find solace in the notion of a stable income stream from this telecom titan. While an immediate dividend raise may not be on the horizon, fears of a reduction seem unwarranted given recent performance.

Taiwan Semiconductor Manufacturing Company: The Chip-Making Maestro

Taiwan Semiconductor Manufacturing (NYSE: TSM) (TSMC) operates in a niche space within the tech industry, producing semiconductor chips tailored to clients’ specifications. Favored by tech giants like Apple and Nvidia, TSMC’s chips are indispensable components in the digital ecosystem.

Employing a foundry model that has set it apart, TSMC’s peers have tried to emulate its success without matching the quality of its offerings. Despite facing a temporary slowdown in the smartphone sector, recent indicators suggest that the worst of this cyclical downturn is in the rearview mirror.

TSMC’s dividends may not dazzle like AT&T’s, hovering just above 1.5%. However, when paired with the company’s stock price growth potential, this dual benefit makes it an attractive proposition for investors seeking both stability and growth.

Investing in dividend-paying tech stocks like AT&T and Taiwan Semiconductor Manufacturing provides investors with not just monetary rewards but also the security of knowing that income flows steadily, akin to a reliable ship sailing through the market’s stormy waters.

Stefon Walters holds positions in Apple. The Motley Fool has positions in and recommends Apple, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool maintains a transparent disclosure policy.

The opinions expressed are solely those of the author and do not reflect the views of Nasdaq, Inc.