September has a reputation for stirring up turbulence in the stock market, but amidst the chaos, Dole and Pilgrim’s Pride emerge as beacons of stability for investors seeking a safe haven in the stormy seas of volatility.

Two Food Giants Weathering the Storm

As market volatility heightens, Dole and Pilgrim’s Pride offer a glimmer of hope for investors seeking refuge. These two stalwarts in the consumer food industry, holding coveted spots on the Zacks Rank #1 (Strong Buy) list, are proving their mettle amidst the market mayhem.

Dole: Nurturing Health, Growing Prosperity

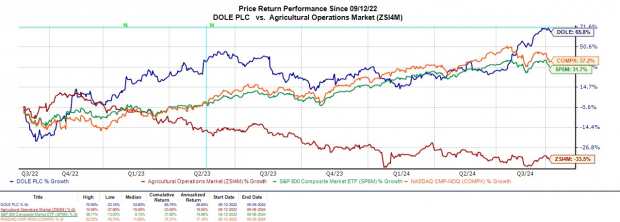

As a leading purveyor of fresh fruits including bananas, pineapples, berries, avocados, and organic produce, Dole has cultivated a reputation for quality and reliability. Despite a notable +20% surge in its stock this year, Dole maintains a low-risk profile with a beta ratio of 0.84.

Trading at $15 with a forward earnings multiple of 13.2X, Dole offers an enticing value proposition. Surpassing the broader market’s forward earnings multiple of 22.8X, Dole stands as a beacon of affordability in a sea of inflated valuations.

Pilgrim’s Pride: Soaring to New Heights

Specializing in value-added poultry products, Pilgrim’s Pride has set its sights on growth and innovation, particularly in the realm of organic, non-antibiotic offerings. Despite witnessing a remarkable +60% surge in its stock this year, Pilgrim’s Pride remains undervalued with a forward earnings multiple of just 9.4X, presenting investors with a tantalizing opportunity.

Trading at around $45, Pilgrim’s Pride continues to trade at a significant discount compared to its peers within the food-meat products industry, further enhancing its appeal to investors hunting for bargains.

The Path to Profitability

Surging ahead on the profitability front, both Dole and Pilgrim’s Pride are poised for growth. Dole’s earnings are projected to rebound with a 19% increase in fiscal year 2025, while Pilgrim’s Pride is set to witness a mammoth 183% increase in EPS this year, painting a promising picture for investors seeking high returns.

Embracing Stability Amid Chaos

In times of market turmoil, consumer food stocks like Dole and Pilgrim’s Pride offer investors a respite from the storm. With low beta ratios and attractive P/E valuations, these companies stand as steadfast sentinels of stability amidst the unpredictable market dynamics. Additionally, the upward trajectory of earnings estimate revisions further bolsters the case for investing in these resilient players.

Unlocking Potential with 7 Elite Stocks

Unveiling a curated selection of 7 elite stocks, Zacks Research offers investors a pathway to potential profits. With a track record of outperforming the market by over 2X since 1988, these premium stock picks hold the promise of early price surges, making them an irresistible proposition for savvy investors.

Discover the 7 elite stocks now >>

Read the full article on Zacks.com here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.