Co-authored with ‘Hidden Opportunities’

The tale of preferred shares weaves its way back to the 19th century when investors in railway companies clamored for “preference” in dividend payouts over the holders of common shares. Over time, this financial instrument morphed into a favored method of raising capital non-dilutively by industries with steady operations and consistent profitability. The 70s and 80s saw utility companies dominating the preferred market. As the banking sector grappled with the aftermath of the savings and loan crisis in the early 90s, they, too, turned to issuing preferreds to facilitate their recovery.

Nowadays, preferred securities are typically issued by large, highly regulated institutions or companies with stable cash flows, including banks, utilities, and REITs (Real Estate Investment Trusts). The average credit rating of preferred securities in the industry stands at BBB-. With an average investment-grade rating, preferred securities are currently trading at historically inexpensive valuations, providing an average yield of +7.5% amidst elevated interest rates.

Despite the decline in price during this hawkish monetary policy cycle, historical data indicates that the default rate of preferred securities has been significantly lower than that of global high-yield bonds.

Interest rates are at an inflection point, signaling an imminent change in direction. The final quarter of 2023 has given us a glimpse of the likely sentiment for preferreds in the coming year. A spectacular year is anticipated for this undervalued asset class, and we are thrilled to present two outstanding preferreds to optimize your exposure to this overlooked sector, offering safer income prospects.

Top Pick #1: GDV Preferreds – Yielding Up To 5.6%

Gabelli Dividend & Income Trust (GDV) is a CEF (Closed-End Fund) with a focused allocation into dividend-paying and income-producing securities.

Under normal market conditions, the Fund invests at least 80% of its assets in dividend-paying or other income-producing securities. In addition, under normal market conditions, at least 50% of the Fund’s assets will consist of dividend-paying equity securities. – Gabelli.com

The CEF boasts a highly diversified portfolio encompassing 552 holdings, with the top ten positions housing leading global dividend payers with low payout ratios. Source

The CEF carries a conservative leverage of 13%, primarily stemming from its issuance of fixed-rate preferreds. This effectively shelters the fund from increasing financing costs during times of higher interest rates. GDV’s public preferreds carry an Aa3 rating from Moody’s and offer relatively low coupons, indicating the potential for continued trading post their call dates.

Reviewing the fund’s financial data since FY 2021, GDV’s NII alone provided an average 1.8x coverage for the preferred distributions. Additionally, GDV leverages realized investment gains and ROC to fuel common shareholder dividends. The realized gains in FY 2021 and FY 2022 supplied over 11x coverage for the preferred dividends. Significantly, in the semi-annual report as of June 2023, GDV reported $140 million in unrealized gains.

-

5.375% Series H Cumulative Redeemable Perpetual Preferred Shares (GDV.PR.H) – Yield 5.6%

-

4.25% Series K Cumulative Redeemable Perpetual Preferred Shares (GDV.PR.K) – Yield 5.5%

GDV’s preferreds hold an investment-grade rating and benefit from ample coverage due to the CEF’s operations. At this juncture, we view the 5.4% yielding GDV-K as a solid buy, offering a steady yield and positioning investors for approximately 28% capital upside.

Top Pick #2: DBRG Preferreds – Yielding Up To 7.8%

DigitalBridge Group, Inc. (DBRG) is an alternative asset manager focusing on digital infrastructure, deploying and managing capital across five key digital infrastructure verticals: data centers, macro cell towers, fiber networks, small cells, and edge infrastructure. The company manages $75 billion in assets, with a portfolio of over 30 digital companies and operates through two reportable segments: Investment Management and Operating, although the latter is a legacy segment that is rapidly being phased out (including a minority position in Vantage Data Centers). Source

In its present operating structure, DBRG manages assets and collects fees, establishing itself as a highly profitable business with predictable cash flows from long-dated funds, and uses FEEUM (Fee Earning Equity Under Management) as a core performance metric. DBRG has achieved astonishing 48% CAGR FEEUM growth since 2019, reporting $29.9 billion FEEUM as of Q3 2023.

DBRG anticipates concluding FY 2023 with $35 billion FEEUM, projecting growth to $49 billion by the end of FY 2025. FEEUM growth immediately translates to bottom-line profitability, and DBRG’s established position in the space places it favorably to meet these forecasts.

The company utilizes a straightforward calculation for FRE (Fee Related Earnings) derived from FEEUM.

-

Revenue = 0.9% of FEEUM

-

FRE = 70% of Revenue

By this calculation, the additional $19 billion FEEUM translates to $120 million FRE.

DigitalBridge’s Preferred Stock Opportunities Amid Strong Liquidity

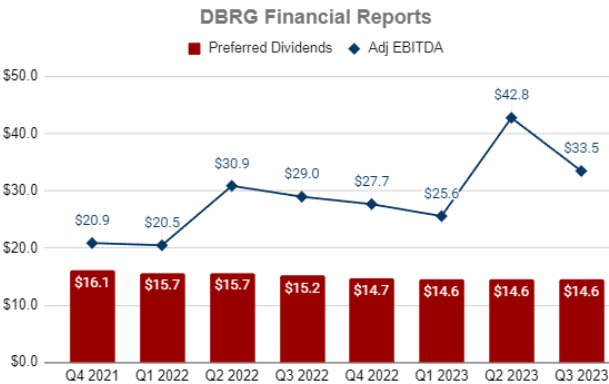

DigitalBridge is in a solid financial position, boasting a robust liquidity of $530 million as of September 2023, comprised of $230 million in cash and a $300 million revolver, with no immediate maturities on the horizon. Subsequently, the company’s preferred dividend expense has noticeably declined in recent quarters, attributable to its active pursuit of buybacks. Additionally, the reinstatement of a $0.01/share common stock dividend in Q3 2022, and its continuous maintenance, signify the company’s efforts to fortify its position. With DBRG’s fee-earning asset base poised for sustained growth in the forthcoming quarters, an escalation in Adj. EBITDA and improved coverage for the preferred dividends is anticipated.

We’re always looking to buy back our preferreds. I think we’ve made that no secret. We have a formula for how we use our cash. As you know, we’ve got close to $590 million of cash and cash equivalents coming out of this quarter. We’re well-capitalized. On the stock buybacks, we’ve been in a blackout period. We’re hopeful to end that blackout period soon, so that we can go back to buying some of our stock back when it makes sense. – Marc Ganzi, CEO

-

7.125% Series H Cumulative Redeemable Perpetual Preferred Stock (DBRG.PR.H) – Yield 7.7%

-

7.15% Series I Cumulative Redeemable Perpetual Preferred Stock (DBRG.PR.I) – Yield 7.8%

-

7.125% Series J Cumulative Redeemable Perpetual Preferred Stock (DBRG.PR.J) – Yield 7.8%

Over the course of the first nine months of FY 2023, DBRG allocated $43.9 million towards preferred stock dividends, which were adequately covered by the company’s $101 million Adj EBITDA. All three preferred options offer similar yields, presenting substantial income opportunities. We recommend utilizing limit orders for the purchase of the preferred shares.

DBRG is pioneering double-digit growth in a highly coveted industry and is poised to be a profit powerhouse for the foreseeable future. Consequently, as the company appears inclined to repurchase its preferred stocks on the open market, they currently offer lucrative investment opportunities, providing the chance to lock in yields of up to 7.8% until that time.

Favoring Income Stability and Capital Upside

Despite a substantial rally in Q4 2023, considerable discounts in the fixed-income sector persist, thus prompting the maintenance of an elevated 40% allocation to this income-oriented asset class. A meticulously constructed model portfolio encompassing over 65 preferred stocks and baby bonds yields an overall return in excess of 8%.

The focus lies not on speculating regarding the Fed’s next move, but on building a portfolio impervious to interest rate fluctuations, designed to yield consistent inflation-beating income across all rate cycles. As we navigate through an economic deceleration, preferred stocks emerge as a safer income option compared to equities. Moreover, at their historically low valuations, they position investors for substantial capital gains upon a shift in the rate cycle.

Incorporating preferred stocks into one’s portfolio enhances its defensive nature, amplifying overall income stability – two fundamental qualities essential for securing a contented and secure retirement.