Realty Income: A Real Estate Powerhouse

Realty Income (NYSE: O), a real estate investment trust (REIT), holds a portfolio of over 15,540 properties in the U.S. and the United Kingdom. Often underestimated, it boasts 90% of rent providers immune to economic downturns and e-commerce shifts, ensuring customer loyalty.

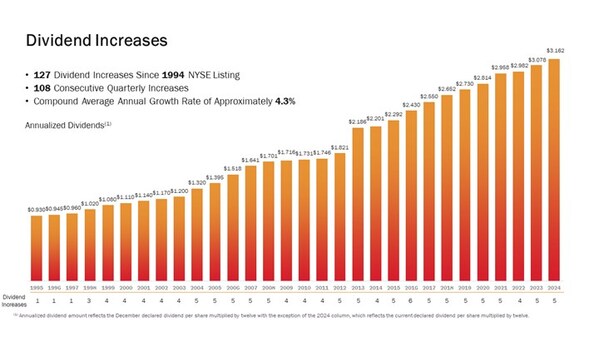

With a remarkable track record of 108 consecutive quarters with dividend increases and a 4.3% average annual growth rate since 1994, Realty Income offers a generous 5% yield. Beyond dividends, the company’s growth prospects are promising, exploring ventures in data center development in the U.S. and expansion opportunities in Europe.

Ford’s Diverging Paths: Ford Pro vs. EV Struggles

Ford Motor Company (NYSE: F) presents an intriguing case as a dividend stock. Trading at a modest 10.8 P/E ratio, with a solid 5.5% yield, Ford shines in two areas: its flourishing Ford Pro commercial segment and its challenging model e electric vehicle division.

While Ford Pro thrives, generating significant earnings and revenue growth, the EV division faces losses that could hit $5.5 billion by 2024. Ford has had to cut $12 billion in EV investments to mitigate these losses. However, a focus on scaling EVs and enhancing efficiency can bolster Ford’s profitability in the long run.

The Appeal of Long-Term Investment in Realty Income and Ford

Both Realty Income and Ford Motor Company offer investors a compelling 5%-plus dividend yield and growth potential if held for the long term. Realty Income exudes stability with opportunities to expand its reach in the U.S. and Europe, while Ford stands to enhance its financials by optimizing its EV division and leveraging its successful Ford Pro business.

Unlocking the Potential: Consider Investing in Ford Motor Company

Before diving into Ford Motor Company stock, ponder this:

The Motley Fool Stock Advisor experts have pinpointed the top 10 stocks for substantial returns, and Ford Motor Company didn’t make the cut. These selected stocks have the potential to yield significant profits over the long haul.

Imagine the outcome when Nvidia made the list in April 2005 – a $1,000 investment then would have bloomed into an astounding $743,952!

Stock Advisor provides investors with a roadmap to success, offering insights on portfolio construction, analyst updates, and two new stock picks monthly. Since 2002, the service has outperformed the S&P 500 by more than fourfold.

Explore the 10 recommended stocks

*Stock Advisor returns as of September 23, 2024

Daniel Miller holds positions in Ford Motor Company, while The Motley Fool has positions in and recommends Realty Income, abiding by a strict disclosure policy.

The views expressed in this article are those of the author and do not necessarily reflect the views of Nasdaq, Inc.