A Glorious Triumph for AMR

Alpha Metallurgical Resources, a powerhouse in providing metallurgical products to the steel industry, revealed its earnings prowess earlier this week to resounding applause. Unleashing Q4 earnings of $12.88 per share, the company stunned the Zacks Consensus estimate of $8.78 by an impressive 47% margin.

Despite a slight dip in Q4 EPS compared to the previous quarter, Alpha Metallurgical Resources has consistently outshined expectations, boasting an average earnings surprise of 24.78% over the last four quarters.

Image Source: Zacks Investment Research

TREE’s Victory Lap in the Financial Arena

Following suit, LendingTree entered the earnings battleground with finesse, reporting Q4 earnings of $0.28 per share, surpassing estimates of $0.14 by a staggering 100%. Despite a slight downturn in Q4 EPS from a year earlier, LendingTree has shown unwavering strength, beating earnings projections for 13 consecutive quarters with an average surprise of 202.32% in the last four reports.

Image Source: Zacks Investment Research

Earnings Momentum in Motion

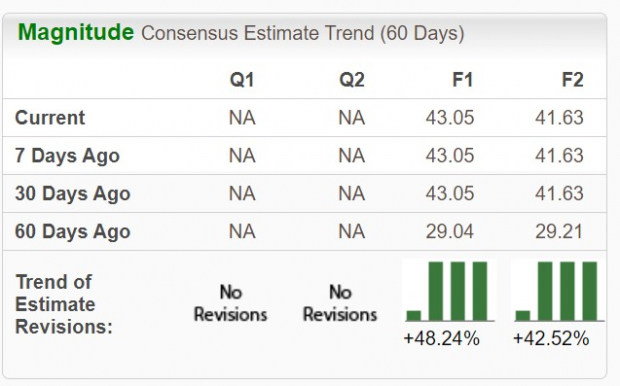

Surging earnings estimates herald a promising future for Alpha Metallurgical Resources and LendingTree, with substantial upside potential following their earnings triumphs. Noteworthy is the remarkable surge in fiscal 2024 and FY25 earnings estimates for Alpha Metallurgical Resources by 48% and 42% respectively in the last 60 days.

Image Source: Zacks Investment Research

Meanwhile, LendingTree has seen a 3% surge in FY24 earnings estimates and a robust 16% climb in FY25 EPS projections in the same period.

Image Source: Zacks Investment Research

The Grand Finale

The financial horizon for Alpha Metallurgical Resources and LendingTree gleams with promise, marking an ideal moment to acquire their stocks as prime contenders within the basic materials and finance sectors.

Zacks Names #1 Semiconductor Stock

Boasting remarkable growth potential, our top semiconductor stock, though dwarfed in size compared to NVIDIA, stands poised for a meteoric rise in the era of Artificial Intelligence, Machine Learning, and the Internet of Things. With the global semiconductor industry set to nearly double by 2028, the opportunities are boundless.

Witness This Stock’s Potential for Free >>

For more insights, visit Zacks.com here.

Please note that the opinions expressed in this article belong solely to the author and do not necessarily reflect those of Nasdaq, Inc.