Diving into the stock market can feel like riding a roller coaster, especially given the recent tumultuous years. The 2021 COVID-19 pandemic spurred a surge in stocks as homebound consumers sought out office and entertainment products. However, 2022 brought an economic slump, wiping out the gains of the previous year for many companies.

Thankfully, in 2023, the market took a positive turn with the Nasdaq Composite soaring by 43%. The hype around technology and artificial intelligence (AI) fueled this striking recovery. With an 8% increase in 2024, it appears a sense of stability might be on the horizon after years of ups and downs.

Embracing a long-term approach to investing is crucial, as evident from the swift rise in many stocks in 2023 that still persists. Now is the perfect time to reinforce your portfolio by delving into companies with the potential for consistent growth for years to come. Here are two hypergrowth stocks set to shine in 2024 and beyond.

Embracing Nvidia’s Rise

The landscape of tech stocks has blossomed over the past year, riding on the wave of AI advancement. With the industry hitting almost $200 billion in 2023 and estimated to grow at a compound annual rate of 37% until 2030, the allure of AI is undeniable.

Nvidia (NASDAQ: NVDA) has carved out a niche in the AI chip market, securing an estimated 90% market share in AI graphics processing units (GPUs) necessary for AI model training and operation. Riding this wave, Nvidia’s stock soared by 294% in the last year, alongside a meteoric rise in earnings.

In the past 12 months, Nvidia’s quarterly revenue surged by 207%, with a whopping 536% leap in operating income. The company’s free cash flow skyrocketed by 430% to surpass $27 billion. When compared to rivals like Advanced Micro Devices and Intel, Nvidia’s financial prowess shines brightly.

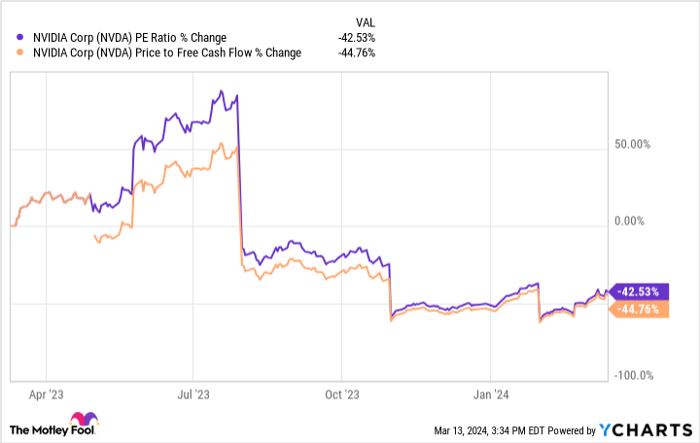

Even with new GPU releases from competitors, Nvidia’s strategic foothold in AI positions it ahead, leveraging its ample cash reserves for further technology investments and market dominance. The charts suggest Nvidia’s stock is currently trading at an opportune value, making it a compelling pick for investors eyeing long-term growth.

The Commanding Presence of Amazon

Amazon (NASDAQ: AMZN) stands tall as a tech giant, boasting a market cap of $1.8 trillion and ranking as the world’s fifth most valuable company. Over nearly three decades, the online retailer has expanded its reach across various sectors, from e-commerce dominance to cloud computing, and beyond.

While Amazon faced challenges in 2022 from inflation spikes hindering consumer spending, the company staged an impressive comeback in 2023, validating its stock as a solid long-term investment.

In fiscal 2023, Amazon witnessed a 12% year-over-year revenue spike, with operating income more than tripling to hit $37 billion. Astute cost-cutting measures revived its retail segments’ profitability. Additionally, Amazon’s dominant position in cloud computing through Amazon Web Services positions it strongly in the AI arena.

The future looks bright for Amazon, as earnings estimates project nearly $7 per share by fiscal 2026. Coupled with a forward price-to-earnings ratio of 42, this forecast hints at a substantial stock price increase in the coming years. Amazon’s stronghold in e-commerce and cloud services makes it a prime stock to consider at present.

Is investing $1,000 in Nvidia right for you?

Before diving into Nvidia stock, ponder this: The Motley Fool Stock Advisor analysts have earmarked what they believe are the top 10 stocks for investors in the current market climate, and Nvidia didn’t make the list. These 10 chosen stocks hold the promise of significant returns in the years ahead.

Stock Advisor offers an accessible roadmap for investors, providing portfolio-building guidance, regular analyst updates, and two fresh stock picks monthly. The service’s track record of outperforming the S&P 500 since 2002 underscores its credibility.*

Explore these 10 stocks

*Stock Advisor returns as of March 11, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Dani Cook holds no position in the mentioned stocks. The Motley Fool holds and advocates for Advanced Micro Devices, Amazon, and Nvidia. The Motley Fool endorses Intel and the following options: long January 2023 $57.50 calls on Intel, long January 2025 $45 calls on Intel, and short May 2024 $47 calls on Intel. The Motley Fool upholds a disclosure policy.

The expressed views and opinions are those of the author and not necessarily those of Nasdaq, Inc.