Since time immemorial, the pursuit of a perpetual motion machine has captivated the human imagination. An apparatus that could run indefinitely, once set in motion, representing an endless cascade of output. This vision, obscured by the inevitable march of entropy toward equilibrium, has become synonymous with futility. Even the great da Vinci himself ridiculed the aspirants of such a contraption.

The concept of a dividend income portfolio is akin to the longing for a perpetual motion machine. Although this correlation could not be more misguided, it stems from a fundamental misunderstanding of the dynamics at play. The notion perpetuated by many investors is to commence with an initial capital investment, anticipating a predictable, steadfast income stream from the companies or funds in which they have vested their faith. Many investors keep adding capital over time – a cherished ritual reflecting their optimism and trust in the prospective returns.

Unlike a contained system, a dividend portfolio operates in an interconnected ecosystem where each company’s profitability hinges on external interactions. Post earning profits, a company may opt to reinvest for growth, dispense generous dividends, or execute a combination of both. Dividend-averse companies reinvest all earnings to fuel further expansion, signifying management’s conviction in leveraging earnings for long-term strategies. While I acknowledge the merit in management’s discretion, my immediate financial commitments take precedence over their vision. The upshot is clear – every company in which I invest must compensate me for my ownership, sans exceptions.

Today, let’s delve into two compelling opportunities that promise recurring passive income without further labor, but merely requiring ownership through shareholding. It’s a seamless, symbiotic relationship where the management team diligently earns and grows, and you, the shareholder, benefit.

Pick #1: PTY – Yield 10.6%

PIMCO Corporate & Income Opportunity Fund (PTY), a standout amongst Closed-End Fund (CEF) manager PIMCO’s offerings, exudes a distinct allure, if somewhat marred by trading at an 18% premium to Net Asset Value (NAV). Conventional wisdom might recoil at the premium, yet history unequivocally ratifies PTY’s exceptional performance.

PTY’s total return based on NAV is a testament to its resilience, notably eclipsing the S&P 500, affording it a premium that is thoroughly deserved.

The bond market recently weathered one of its most turbulent phases, accentuated by the Federal Reserve’s tightening cycle, exerting considerable downward pressure on all debt investments. PTY, primarily invested in fixed-rate debt, bore the brunt of substantial NAV erosion amidst this challenging landscape.

PTY, an actively managed fund, leverages its management’s acumen, deploying a diverse investment strategy encompassing a gamut of US and non-US assets, amplifying its appeal. The fund’s judicious use of leverage, currently at 23%, underpins its investment philosophy, complemented by calibrated interest rate swaps, fostering income generation and hedging interest expenses.

Attempting to replicate PTY’s portfolio and subsequent stellar performance verges on folly, solidified by its consistent outperformance during tumultuous periods, such as the recent headwinds from escalating interest rates. The Federal Reserve’s impending pivot, signifying a potential tailwind, underscores PTY’s astute positioning to navigate this shifting landscape seamlessly, a trust that I unconditionally bestow upon PIMCO.

Pick #2: Realty Income – Yield 5.2%

Realty Income Corporation (O), with a yield marginally surpassing 5%, aligns with the lower spectrum of yield in our Model Portfolio. However, O’s sterling record, punctuated by consistent dividend growth and a formidable track record, solidifies its stature. The treasure trove of monthly dividends, encapsulating 26 years of continuous quarterly dividend raises and 640 monthly payouts, epitomizes Realty Income’s unwavering commitment to its shareholders.

Realty Income’s peerless dedication to dividend growth, underscored by five dividend hikes in the current year, elevates it as a beacon of reliability amidst a sea of investment options, emphasizing the intrinsic value of a qualitatively superior investment. O’s dividend income trajectory since 1996 remains a timeless barometer of its steadfast commitment to redefining shareholder value, underscoring the overarching ethos ingrained within the fabric of Realty Income’s culture.

The Rein of O: A Dominating Force in the Triple-Net Sector

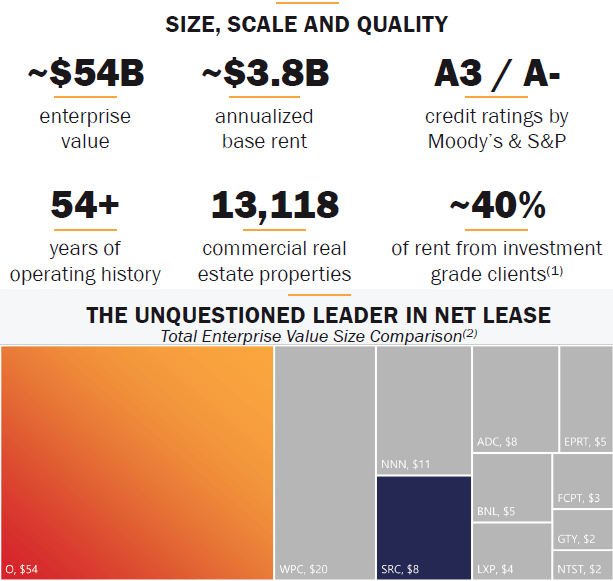

For investors seeking steady income in any economic climate, the organic growth proven by O is a significant boon. With continued income growth and a potential acceleration in pace, O is establishing itself as the undisputed leader in the triple-net sector. This dominance is set to be further solidified as the acquisition with SRC closes, making O alone account for approximately 50% of the Enterprise Value of the entire triple-net REIT sector.

The greater scale, higher credit rating, and cheaper cost of capital have allowed O to build a moat, providing a substantial competitive advantage. O’s scale enables pursuit of much larger transactions, including entire portfolio transactions, without sacrificing the benefits of diversification.

Moreover, O has leveraged its size and superior balance sheet to benefit from the expertise of others. Recent deals with BREIT and Digital Realty Trust (DLR) have demonstrated O’s ability to tap into opportunities beyond the reach of smaller triple-nets, thanks to its size, scale, and low cost of capital. With O emerging as the evident leader in the triple-net REIT landscape, any debate over the best triple-net REIT appears conclusively settled in O’s favor. The prospect of O acquiring another REIT is perhaps the most compelling reason to consider investing in a different triple-net REIT at this juncture.

As O solidifies its position in the net-lease REIT segment, shareholders stand to benefit from a monthly dividend that continues to grow with frequent raises. Considering the likelihood of the Federal Reserve changing course, an O yield of over 5% may not last long.

The Power of Passive Income

Pairing PTY and O eradicates the most common failure point in an investor’s plan – their own decision-making. The dilemma of timing the sale of shares to generate a profit or cash flow can lead retirees to underperform the market due to emotional, rather than fact-based, decision-making. This tendency to trim portfolios based on short-term needs diminishes their ability to recover from losses, leading to an opportunity cost that compounds over time.

Retirement planning should not involve the precarious game of trying to time share sales. Instead, PTY and O present the opportunity for ownership with minimal intervention. They offer truly passive income through uninterrupted dividends. Achieving financial freedom means transcending financial worries and having income that far exceeds expenses, thereby unlocking the potential to explore new opportunities and utilize newfound leisure time.

This is the essence of the Income Method – the beauty of income investing.