Co-authored by Treading Softly.

A highly popular game in Canada that people like to play but is no longer in print, is the game called Stock Ticker. This board game has become an annual tradition

with my family, playing it on Christmas Eve, Christmas Day, and, at times, even on Boxing Day. The entire point of the game is to walk away with the most money. There are six different investments that you can invest in, and via dice roll, which can rise, fall, or pay dividends. You start with $5000, and at the end of the game, see how much money you have to determine the winner. This year, at the end of the game, after only playing for 6 hours over two different days, I turned my $5000 into over $55,000 worth of value. It would be nice if this were truly possible all the time so that after six hours of work, you could generate a $50,000 return on a $5000 investment.

Among the listed available investments were gold, silver, oil, and grain. I was quick to point out to my family – being the buzzkill that I am – that these are all commodities and wouldn’t have the ability to pay a cash dividend directly.

When it comes to the market, that’s where you can benefit from having something called a closed-end fund, or CEF. These are funds that exist to help generate more income from asset classes that may not pay a lot or allow you to leverage the benefit of a skilled portfolio manager. This gives you the ability to step away from the board game and step into the market and earn great income.

Today, I want to look at two funds that I think are worth holding in every retiree’s portfolio.

Let’s dive in!

An In-Depth Look at John Hancock Financial Opportunities Fund

John Hancock Financial Opportunities Fund (BTO), yielding a substantial 8.4%, is a CEF that invests in banks.

The failure of Silicon Valley Bank (OTCPK:SIVBQ), followed closely by the FDIC shutting down Signature Bank (OTCPK:SBNY), set off fears of another Great Financial Crisis in early 2023.

In a Market Outlook available to subscribers, I outlined why I did not believe the banking crisis in March 2023 was comparable to those we saw during the GFC. In a public article, we discussed BTO in particular, noting that BTO did not have exposure to the banks that failed:

“Banks sold off heavily on Friday, March 10th, and BTO was down 5.6% (plus another 2% because it was ex-div). As I outlined to our subscribers, I do not see that what happened at SI and SIVB as a systematic risk throughout the banking sector. On average, banks are very strong and are in a far superior financial position than they were during the GFC.

The reality is that when you are dealing with “averages,” there will be some holdings that are below average. Even when a sector is strong, there will always be some outliers that will fail. We are encouraged that BTO avoided two banks that turned out to be much weaker than average. While others are dumping all the good banks, we are happy to increase our exposure to the sector through BTO.”

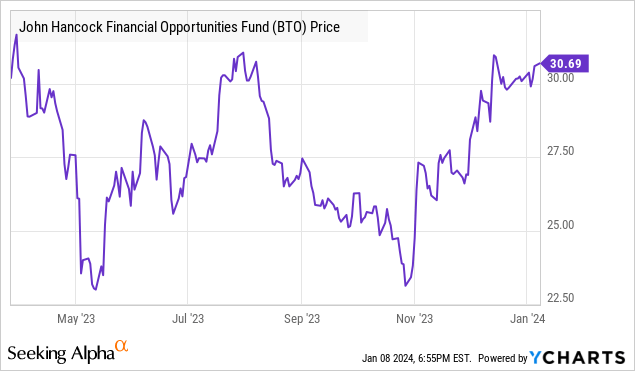

The market disagreed with our assessment; banks sold off heavily, and BTO sold off along with them. BTO bottomed out around $23 in May and then dipped back to similar lows in October. A couple of quarters of earnings later, it is increasingly obvious that banks have stabilized. The end of the Fed’s hiking cycle has served as a catalyst for the prices of bank stocks.

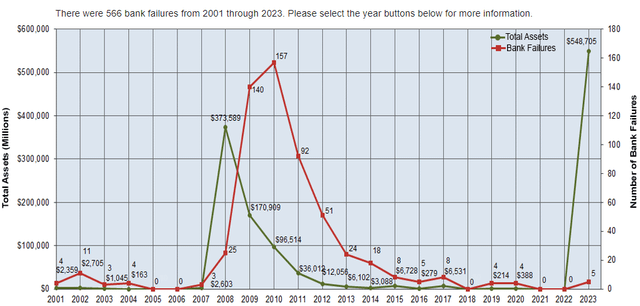

As we look at bank failures in 2023, we can see that in terms of the number of bank failures, it isn’t particularly high. With five banks failing in 2023, the number of banks that failed was average relative to 2015 through 2019. What was significant was the size of the assets involved, and that is primarily due to Silicon Valley Bank, which was the second largest bank failure in history behind Washington Mutual. Source.

At this point, it is safe to say that we were “right” that the bank failures in March were not the beginning of a systemic problem that would result in dozens of bank failures. However, in the stock market, being “right” doesn’t mean that you will be immediately rewarded.

After that article was published, BTO went down, back up, back down, and is on another rally up. It is trading at roughly the same price as it was in March.

The fact that banks weren’t going to fail was not as important to the short-term price movements as the market’s belief that banks might fail. Through the dips, we continued to identify BTO as a great buying opportunity.

As a long-term investor, I don’t attempt to trade in and out of short-term patterns. They are difficult to predict and extremely hard to stay ahead of. One benefit of being an income investor is that I don’t have to worry about timing the market. I buy shares at a yield I am happy with and allocate at least 25% of my income to reinvest. When I have a position like BTO, where I have a strong conviction that the environment isn’t as bad as the market fears, I can use a portion of my income to buy the dip. It is hard to predict exactly when the market will realize things aren’t as bad as people feared, but as an income investor, time is your friend.

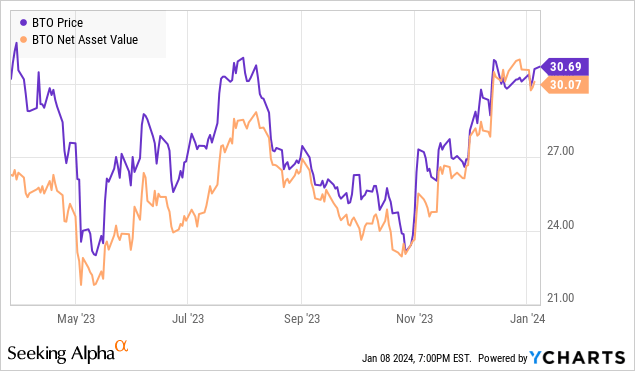

So, have you missed the buying opportunity? No. You see, in March, BTO was trading at a large premium to net asset value. Today, BTO is trading very close to NAV. The premium has closed by NAV rising.

With banks continuing to recover from the 2023 scare, BTO is positioned to continue seeing rising NAV, and the share price is likely to follow. As my

div>

The BTO and RNP Investment Outlook

Investors looking to reap significant dividends in 2024 might consider Cohen & Steers Dividend Reinvest & Income Fund, Inc. (BTO) and Cohen & Steers REIT & Preferred Income Fund (RNP) as potential avenues for leveraging income from various sectors. Both funds offer strong outlooks for the year and the potential to provide robust income for decades to come.

The Allure of BTO: A Stable Income Provider

Cohen & Steers Dividend Reinvest & Income Fund, Inc. (BTO) has a strong track record of steady income generation. This closed-end management investment company has consistently provided significant dividends. As per its investment policy, a portion of these dividends will continue to be reinvested in BTO, compounding the potential for notable returns over time.

RNP: Diversifying with REITs and Preferred Equity

Cohen & Steers REIT & Preferred Income Fund (RNP) presents investors with a unique opportunity, boasting a diversified portfolio that includes investments in both real estate investment trusts (REITs) and preferred equity, particularly in the banking and insurance sectors. This diversified approach serves to mitigate correlation risks, providing a resilient investment avenue even amidst macroeconomic uncertainties.

Despite the recent pressure from rising interest rates, REITs are anticipated to regain favor among investors as interest rates stabilize, potentially even decline. Moreover, RNP’s focus on REITs with robust balance sheets further fortifies its position in the market, offering investors a stronghold amid market fluctuations.

On the other hand, RNP’s preferred portfolio, largely comprised of banking preferred positions, has weathered challenges. As interest rates transition from acting as a headwind to providing tailwinds, RNP is poised for substantial growth, especially considering the improving sentiment towards the banking system. These developments make RNP a potentially lucrative investment for income-focused investors.

Prospects for the Year Ahead

With the potential for rising interest rates, both BTO and RNP offer promising opportunities for income generation and capital appreciation in 2024. For income-oriented investors, these funds can serve as reliable income generators, securing financial stability in retirement. Through astute portfolio management, these funds have the potential to provide a reliable income stream while navigating market uncertainties.

A Commitment to Financial Security

The current economic landscape has left many retirees pondering their financial security. The income method, as crafted by investment managers, aims to empower individuals to generate robust income from the market, assuring financial stability in retirement. This approach seeks to alleviate the burden of retirees being restrained by fixed incomes, providing a means to enjoy retirement without financial constraints.

Ultimately, the BTO and RNP investment opportunities underscore the potential for income-focused investors to fortify their financial positions, ultimately ensuring a more secure and enjoyable retirement.