Bank of America: Navigating Choppy Waters with Finesse

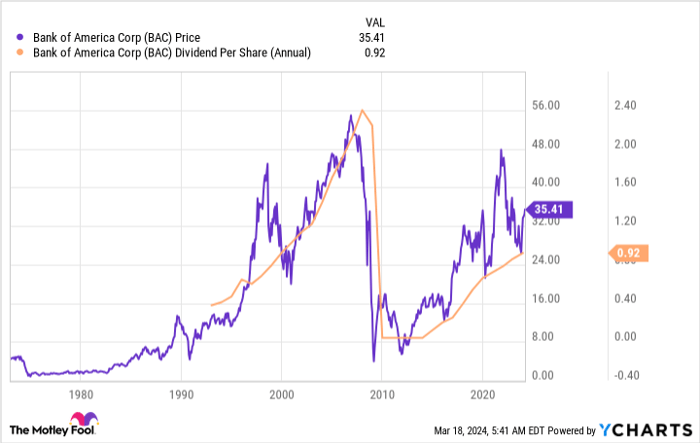

For the risk-averse dividend seeker, Bank of America’s history might whisper cautionary tales of past dividend cuts during the tumult of the Great Recession. Yet, the winds have shifted, and BofA stands steely at the helm of a more risk-averse ship today. Strengthened by regulatory reforms and internal restructuring, Bank of America has weathered the storm, reassuring investors of its commitment to consistency amidst tumultuous market seas.

Once battered, now a colossus among financial institutions, Bank of America’s sturdy vessel sailed proudly through the bank runs of early 2023. Its diversified portfolio, spanning traditional banking, investment banking, global banking, and wealth management, offers astute investors a veritable treasure trove of opportunities. And as the dividend continues its steady ascent, the stock beckons to those seeking long-term growth anchored in the U.S. financial market.

Realty Income: The Unwavering Tortoise of High Yields

As interest rates buffet the real estate realm, Realty Income stands as a steadfast tortoise amidst tempestuous winds. The REIT sector’s struggle against rising capital costs has cast a shadow on realty stocks, driving Realty Income’s yield to 10-year highs. A haven for conservative investors, Realty Income boasts a 29-year dividend increase streak, showcasing its mettle in the face of adversity.

While Bank of America sets sail with growth potential on the horizon, Realty Income trundles along with its 5.9% yield, a beacon of stability for income-hungry portfolios. With an investment-grade rating and a reputation for making deals its peers only dream of, Realty Income’s robust presence in the industry stands unchallenged. Despite the headwinds, the realty giant shows no signs of slowing its growth trajectory.

The Beauty of Building a Fortune from Meager Beginnings

With a mere $500 at hand, one might scoff at the notion of investing. But within the folds of Bank of America and Realty Income lies the potential to kickstart a journey of wealth accumulation. Bank of America’s battle scars from the recession are nothing more than a testament to its resilience, as its dividend steadily climbs to new heights. Meanwhile, Realty Income beckons with its stable yield and unwavering dividend history, a siren call to all seeking dependable returns.

Considering an investment in Bank of America?

Before setting sail with BofA, ponder this:

The Motley Fool Stock Advisor analysts have unearthed what they deem the 10 best stocks for investors today… and Bank of America didn’t make the cut. These chosen stocks carry the promise of substantial returns in the years ahead.

Stock Advisor provides a roadmap to success, offering insights on portfolio construction, analyst updates, and two fresh stock picks monthly. Since 2002, Stock Advisor has outpaced the S&P 500 returns threefold*

Explore the top 10 stocks

*Returns as of March 21, 2024

Bank of America sponsors The Ascent, a Motley Fool company. Reuben Gregg Brewer holds positions in Realty Income. The Motley Fool holds and recommends positions in Bank of America and Realty Income. The Motley Fool upholds a strict disclosure policy.

The insights and opinions articulated herein reflect the perspective of the author and not necessarily those of Nasdaq, Inc.