As an investment analyst, I’m always on the lookout for exciting new opportunities in the ever-expanding world of REITs.

But sometimes, sticking with tried-and-true picks is the wisest move, especially when the existing investments continue to shine. Today is one of those times. We have diligently selected the REITs in our portfolio, and to warrant a new investment, it must surpass the attractiveness of our current holdings or bring a compelling new aspect to diversify and optimize our portfolio’s risk-to-reward profile.

Hence, let’s delve into two of our favorite REITs for accumulation today:

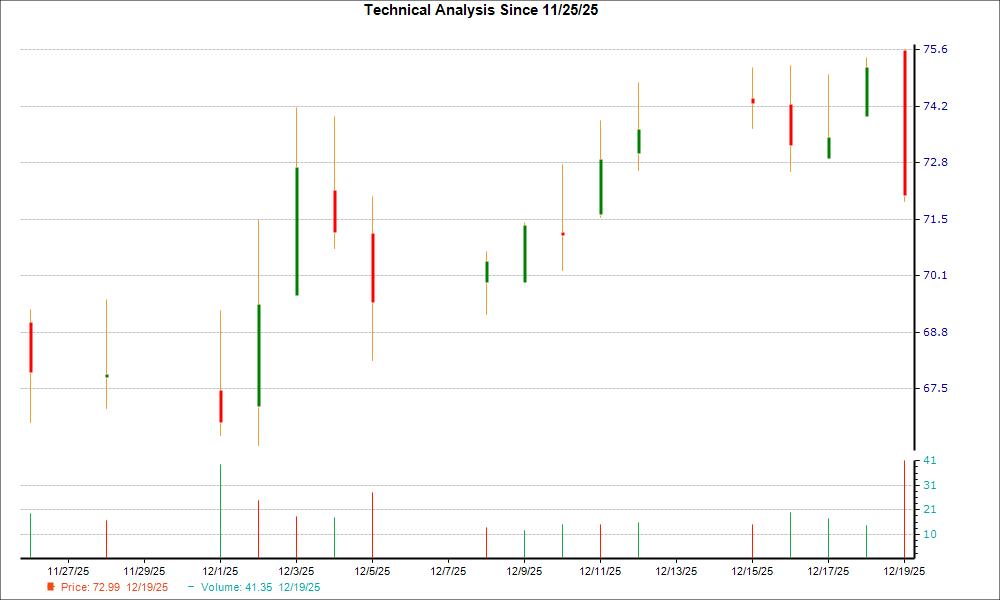

NNN REIT (NNN)

Our analyst, R. Paul Drake, described NNN as “almost perfect” for valid reasons. Key attributes highlighted previously include an investment-grade BBB+ credit rating, substantial lack of secured debt, negligible near-term debt maturities, and a sustained very high occupancy of 99.4%. Notably, it boasts 33 years of increased dividends and has proven to generate above-average returns with below-average risk and superior income for over three decades. The impressive attributes go on and on.

I would add to its robust traits a focus on properties with low rents, a discount to replacement cost, and high land value per asset to mitigate risks in rare vacancies. Moreover, the REIT’s emphasis on high-growth states and defensive concepts provides a solid foundation for its long-term stability.

Remarkably, NNN is now priced at a historically low valuation of 13.4x FFO and offers a high 5.3% dividend yield with a low 69% payout ratio. Anticipating roughly 4-5% FFO per share growth annually, we anticipate double-digit total returns when considering today’s high dividend yield. Furthermore, the potential for significant upside exists as its valuation is expected to expand as interest rates decline back to historic levels. These factors could result in an expected annual total return of 15-20%.

Given the REIT’s resilient performance during the pandemic, we believe that NNN offers an exceptional risk-to-reward profile for conservative investors.

EPR Properties (EPR)

EPR Properties (EPR), a net lease REIT like NNN, has its own merits. It specializes in experiential

The Silver Lining: EPR Properties Resilience in the Face of Setbacks

EPR Properties, a real estate investment trust (REIT) with properties in movie theaters, ski resorts, and golf complexes, has weathered the storm despite facing challenges, offering investors an opportunity to buy heavily discounted shares.

A Favorable Resolution to the Regal Bankruptcy

Following the resolution of the Regal bankruptcy, EPR Properties emerged with a favorable outcome. Rent was raised on the majority of the theaters that continue to operate, which strengthens the company’s portfolio and validates the resilience of high-quality theaters in the current market. The restructuring of the tenant’s finances has significantly reduced risks and set a reassuring precedent in the event of another tenant’s potential bankruptcy in the future. This news serves as a confidence booster for investors in EPR Properties.

Continued Resilience and Validation

In addition to the positive outcome of the Regal bankruptcy, reports of record-breaking performances by Barbie and Oppenheimer, AMC’s first quarterly profits since 2019, and successful capital raising showcase continued resilience and validation within the industry.

Compelling Investment Opportunity

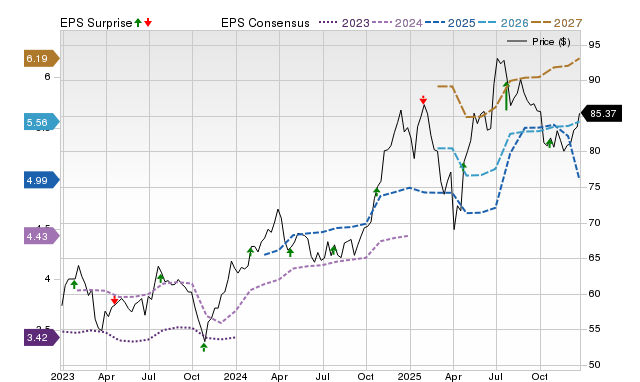

| EPR Properties | |

| Value | 9.3x FFO |

| Growth | 9% FFO per share growth in 2023 |

| Income | 7% dividend yield |

| Upside | 50% upside to 14x FFO multiple |

Despite the positive developments, EPR Properties’ share price has not fully recovered, presenting an appealing proposition for investors. The combination of value, growth, income, and potential upside in today’s market offers a compelling investment opportunity.

As the company continues to prove market sentiments wrong, diversifies its property portfolio, and anticipates the return of interest rates to lower levels, EPR Properties stands to unlock significant upside by repricing higher. With strong growth prospects and a history of outstanding performance in the market, the current discounted price offers a favorable entry point for investors.

Resilience and Growth Prospects

EPR Properties’ strong growth prospects are underpinned by its properties’ average annual rent escalation of nearly 2% and the ability to acquire properties at cap rates exceeding 8%, resulting in a favorable spread over its cost of capital. Despite facing a temporary setback during the Covid crisis, the company has historically outperformed the broader market and is now positioned for a resurgence.

Closing Note – Embracing the “Landlord Approach”

In the world of investing, the most rewarding strategies are often unexciting and require patience and discipline. EPR Properties’ resilience and potential for future growth epitomize the “landlord approach to REIT investing” – a simple and patient strategy that may lead to significant long-term rewards.