Block Stock: A Tale of Triumph and Turmoil

Block‘s (NYSE: SQ) stock performance in 2020 created a flurry, catapulting share prices from $38 to a staggering $240 within the pandemic-induced chaos. It was a year of plump portfolios and radiant smiles, but alas, the fall came swiftly at the close of 2021. In a mere six months, the stock tumbled, shedding over 80% of its value like autumn leaves in a brisk wind.

Amidst this tumultuous journey, a glimmer of opportunity emerges, beckoning investors near and far. Why, you may ask? Well, dear reader, there are two compelling reasons to seize the day in the realm of Block stock. Let’s embark on this elucidating voyage together.

1. The Rarity of Cheap Growth

By the very nature of growth stocks, they often don a hefty price tag. Companies painting the town red with double-digit revenue growth rates over an extended period tend to bear valuations to match their dazzling performance. Yet, in the throngs of mayhem and uncertainty, a rare jewel gleams – the chance to snag growth stocks at a discounted price.

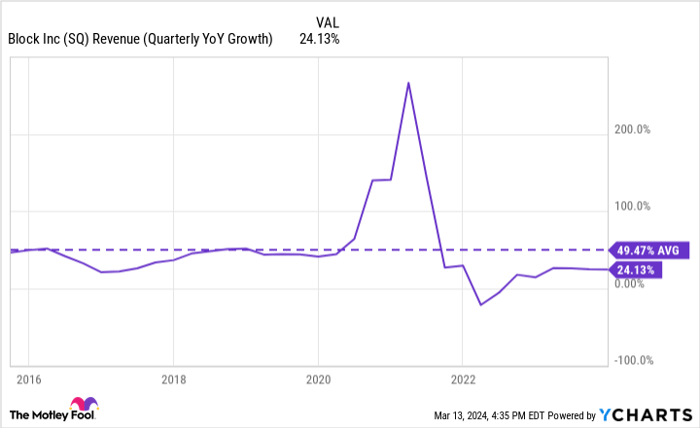

Block, at its core, stands as a payments powerhouse, with its Square payment platform serving as a stalwart for myriad businesses daily. But there’s more to this story than meets the eye. With treasures like Tidal and Cash App tucked under its belt, Block sails the tech-savvy seas, showcasing an annual revenue growth dance averaging nearly 50%.

Although recent quarters have witnessed a mild slowdown in growth rates, the heart of Block still beats with vigor. Despite such resilience, why do shares bear a modest price tag? Trading at merely 2.4 times sales, Block stock flaunts a cheaper valuation than its IPO days in 2015. While fainter growth pulses may play a part, the main culprit seems to be the struggle to stay in the black.

2. The Sunset on Bargain Valuation

Where swift growth abides, the market often endures losses, rendering a patient nod to promising prospects. But when growth’s pace mellows, impatience lurks in the market’s shadows, ready to pounce.

Since its IPO odyssey began in 2015, Block has tiptoed around the break-even line in the realm of earnings per share. The tides turned in 2020 and 2021 as profits danced into view, propelling the stock to new heights. Alas, as growth’s momentum ebbed, profits vanished into thin air – a double whammy for eager investors.

The script changed last fall when Block’s prodigal son, Jack Dorsey, reclaimed the CEO mantle, vowing a return to profitability. Lo and behold, his promises bore fruit, with Block donning its first quarterly profit laurel in nearly two years.

Block’s rekindled profitability hasn’t gone unnoticed. Since Dorsey’s encore, Block’s share price, along with its valuation metrics, have ignited, doubling in a market frenzy. Yet, this fervor does not signify the end of Block’s bargain status.

Peering into the crystal ball of expectations, Block’s forward-looking valuation – a mere 1.9 times sales – gleams like a hidden gem. Rarely do profitable firms boasting 20% to 25% sales growth wear such an accessible price tag. Perhaps, in the years to unfold, today’s stock price may cherish Block at less than a single sales unit.

This is no risk-free gamble, mind you. Dorsey’s profitability magic this last quarter was a nail-biter. Whether this enchantment can play out in the acts to follow remains an unfolding saga. A mere blink of an eye ago, Block witnessed a dreaded negative quarterly sales growth rate, cast amidst its grandest growth tale. It is these very tales of caution that hold the stock’s price at bargain altar.

The prime moment to embrace Block’s offerings dawned several chapters ago, prelude to the swell of transformation we now witness. However, the silver lining remains; the next best moment is here and now. Should Dorsey continue his profitability charade for a few more acts, a treasure trove awaits investors on the crest of the wave.

Could investing $1,000 in Block today unveil a newfound fortune?

Before plunging into Block’s realm, ponder this: the wise seers at Motley Fool Stock Advisor have unearthed what they deem the 10 finest stocks for the astute investor, and alas, Block danced outside the spotlight. This exclusive decagon of delights foresees bountiful returns in the chapters ahead.

Stock Advisor crafts a roadmap to prosperity for investors, offering insights on portfolio alchemy, periodic analyst dispatches, and a duo of fresh stock revelations each lunar cycle. Since 2002, the Stock Advisor coterie has outpaced the heralded S&P 500 threefold*

Explore the 10 stocks now

*Stock Advisor returns as of March 11, 2024

Ryan Vanzo holds no stake in the stocks referenced. The Motley Fool champions and advocates for Block. The Motley Fool stands by a transparency pledge.

The insights and assessments conveyed herein reflect the author’s thoughts and not necessarily those of Nasdaq, Inc.