Real estate investment trusts, known as REITs (VNQ), have experienced significant gains recently, prompting investors to seek advice on the best course of action. However, it would be erroneous to assume that the recent surge in REITs signifies an inopportune time for investment, as their overall trajectory still leaves them down by over 25% since the start of 2022. What’s more, various REITs are down up to 50% despite the rally, shedding light on the historically low valuations that persist across the sector.

Distinguishing Investment Potential Amidst Sector Averages

It’s crucial to discern that despite the recent surge, REITs remain attractively priced. In fact, the prevailing consensus around anticipated interest rate cuts indicates that the recent rally may simply be a prelude to further upward movement. Major financial institutions like Morgan Stanley (MS), Goldman Sachs (GS), and Bank of America (BAC) are predicting significant rate cuts by mid-2024, suggesting that REITs are still heavily discounted and could offer substantial upside potential.

Indeed, the prospect of acquiring REITs at their nadir is a rare feat. Considering the persistent undervaluation, current prices are likely to be perceived as significantly cheap in the hindsight of five years. However, the emphasis should not be on indiscriminate acquisition; rather, it is imperative to identify the most promising opportunities emerging from the recent rally.

Discovering Untapped Potential: RioCan Real Estate Investment Trust

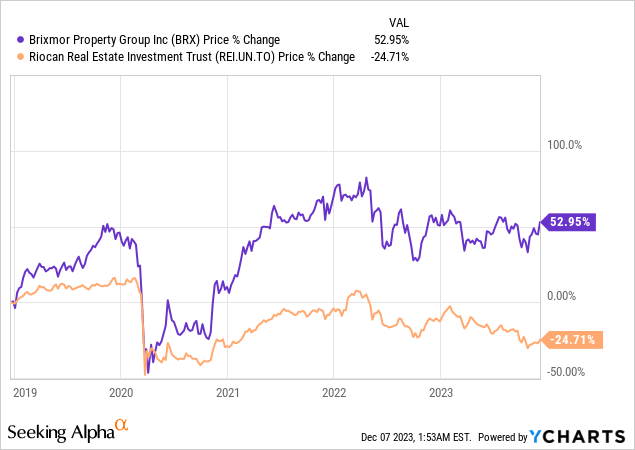

Among the standout REITs that have evaded the recent surge is RioCan Real Estate Investment Trust. Notably, RioCan has notably underperformed its industry counterparts, such as Brixmor Property Group, even throughout the duration of the pandemic. This underperformance is glaring considering that RioCan’s properties have experienced substantial appreciation in value while its share price has plummeted by 25% over the past five years.

Furthermore, RioCan is currently trading at a significantly lower valuation compared to its peers, with price-to-adjusted funds from operations (P/AFFO) and price-to-net asset value (P/NAV) ratios signaling a substantial discount relative to similar entities such as Brixmor.

This substantial discount is partly attributed to the market’s lukewarm treatment of Canadian strip center REITs compared to their American counterparts, despite the defensive cash flow and predictable growth prospects that such properties offer. This discrepancy is evident not only in RioCan’s performance but also in the performance of other Canadian peer entities such as SmartCentres REIT (SRU.UN:CA; OTCPK:CWYUF).

It’s essential to acknowledge that while RioCan may exhibit a slightly higher leverage compared to its American peers, its ownership of properties in highly urban centers with robust long-term growth potential compensates for this weakness. These properties, primarily situated in cities like Toronto, benefit from formidable barriers to entry, limited land availability, stringent zoning regulations, and higher replacement costs compared to market values. Consequently, embarking on new development projects in such areas is an unlikely proposition.

Pursuing Prudent Investment: Selective Purchases in the REIT Sector

Considering the aforementioned factors, it is evident that the recent rally has differentiated opportunities within the REIT sector, with certain entities remaining undervalued despite the overall uptrend. This underscores the importance of discerning between better and lesser opportunities. Accordingly, we are strategically accumulating shares in two specific REITs that have not participated in the recent rally, rendering them even more attractively priced relative to their peers.

It’s worth noting our recent divestment of our position in Brixmor Property Group, which yielded a total return of 155.9%. Despite the strong performance of service-oriented strip centers similar to those owned by Brixmor, we concluded that their escalation had reached its peak. These properties, benefiting from defensive cash flow and predictable growth prospects amidst declining rents due to high inflation, are poised for steady cash flow growth. However, our decision was driven by the observation that better prospects lay elsewhere.

Therefore, in the aftermath of the recent rally, guidance and discernment are paramount, as certain REITs continue to present compelling opportunities. It’s imperative to navigate this landscape with prudent and selective investment, leveraging the shortcomings of the recent rally to identify undervalued assets with untapped potential.

Unlocking The Hidden Potential of RioCan Real Estate Investment Trust

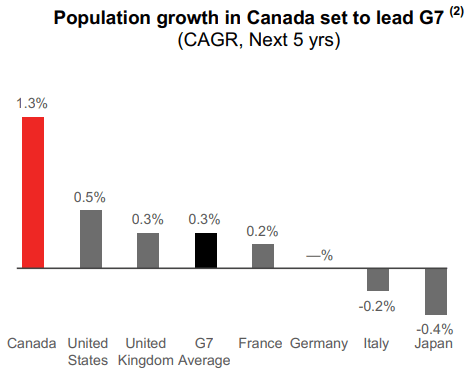

RioCan Real Estate Investment Trust has its finger on the pulse of a high-growth market. Located within a 5-kilometer radius of its assets, the average population is 260,000 people and it is growing rapidly. This favorable demographic trend reflects the robust growth experienced by Canada, marking it as the fastest-growing G7 country. The markets where RioCan’s properties are situated are witnessing an even more accelerated pace of growth.

Capitalizing on the rapid population growth and limited new supply, RioCan boasts an impressive occupancy rate of over 98%. In comparison, its American counterpart, Brixmor, lags behind at 93.9%. The leasing spreads on new leases stand at over 20%, with renewals fetching a respectable 10% spread. The demand for its properties has driven the average rent on new deals to $27.02 per square foot, well above the portfolio’s average net rent of $21.39. This differential signifies a significant mark-to-market opportunity, promising substantial cash flow growth as leases slowly expire.

Despite being slightly more leveraged than its American peers, RioCan maintains a solid BBB investment grade rating due to its promising growth prospects. The company’s low 60% payout ratio enables organic reinvestment in its growth initiatives. Notably, RioCan is actively engaged in constructing condominiums and selling them at substantial gains to reduce debt, as indicated by their recent conference call:

“I’ll emphasize that the 2,605 condominium and townhouse units we currently have under construction are expected to generate combined sales revenue of over $800 million between now and 2026. These proceeds are earmarked for effective uses, including the repayment of debt.”

The investment story for RioCan is straightforward. The company offers a nearly 6% dividend yield paid monthly, retains 40% of its cash flow to fuel growth, develops assets to create value and reduce leverage, and benefits from a portfolio with robust long-term organic growth prospects. Trading at a 30% discount and with an upside potential of 40-50%, RioCan’s recent underperformance presents a strong risk-to-reward opportunity, leading to an increased stake in the company.

Exploring the Potential of Camden Property Trust (CPT)

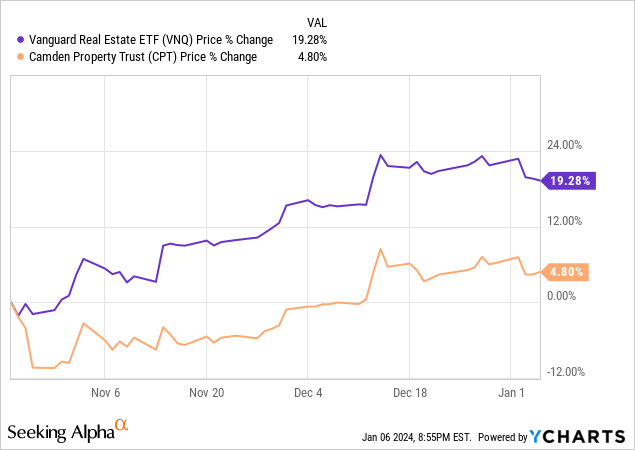

Camden Property Trust, a prominent apartment REIT, has been an observer rather than a participant in the recent market rally, thereby enhancing its relative valuation. The market’s apprehension about the impact of new supply on Camden’s rent growth is a likely reason for its underperformance.

The concerns about new supply affecting the sunbelt markets, where Camden operates, seem to have overshadowed several key aspects that could signal an undervalued opportunity:

- Temporary Issue: Despite the transient nature of the current headwinds, the market’s short-term focus has amplified its impact on sentiment. However, the oversupply phase usually precedes a subsequent period of undersupply, with apartment REITs anticipating accelerated rent growth in late 2024/early 2025.

- Class B Focus: The ownership of predominantly affordable Class B communities insulates Camden from the direct impact of new supply. These older, cheaper properties are less susceptible to direct competition, distinguishing them from Class A properties owned by other apartment REITs, which have witnessed a more significant impact on leasing performance.

- More than Priced In: Trading at a substantial discount to its net asset value, coupled with a historically low FFO multiple, Camden presents an intriguing investment opportunity. Additionally, the successful issuance of 10-year unsecured debt at a competitive interest rate reflects the company’s resilient balance sheet, further solidifying its appeal to investors.

With potential upside of approximately 50% and a current 4% dividend yield, Camden is strategically positioned to capitalize on growth opportunities. Despite transitional headwinds, the company’s commitment to reinvesting cash flow in value creation for shareholders underscores its long-term value proposition.

Final Thoughts

Amidst the recent market upswing, compelling opportunities persist, reinforcing the decision to increase investment positions. While pinpointing the absolute market bottom is rare, the ongoing potential for growth validates a proactive investment approach.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.