Industry Landscape Amid Changing Times

The landscape of the Retail – Pharmacies and Drug Stores industry has been reshaped by a three-year-long health crisis, altering its trajectory significantly. Despite challenges such as supply chain disruptions and labor shortages, the sector has seen a surge in demand due to the increasing popularity of remote patient care and digital health services. Companies like CVS Health and Walgreens Boots Alliance have capitalized on these shifts, enhancing patient access to vital medications through strategic investments. However, industry giants are facing downward trends, grappling with inflation, labor shortages, and reduced demand for pandemic-related health services post-crisis.

Troubles for Herbalife Ltd and the Rise of New Competitors

Amid these industry headwinds, stocks like Herbalife Ltd have suffered negative impacts, reflecting broader sector struggles. Moreover, the entry of new competitors, most notably Amazon, has intensified the competitive landscape. Amazon’s foray into the retail drugstore arena has posed a significant challenge to existing players, creating a fight for survival among industry incumbents.

Evolution of the Retail – Pharmacies and Drug Stores Industry

The Zacks Retail – Pharmacies and Drug Stores industry encompasses a wide array of prescription and over-the-counter medication providers, catering to the health needs of patients and caregivers. Over the years, these companies have diversified their offerings, including wellness products and groceries, expanding beyond traditional pharmaceutical services. The industry has witnessed non-healthcare players like Amazon entering the market, accentuating its growth potential.

Future Trends to Watch Out For

A Difficult Pharmacy Reimbursement Landscape

Drug retailers are facing challenges with the reimbursement of generic drugs amidst an economic downturn. Rising medicine prices and non-reimbursable pharmacy expenses are squeezing profit margins, leading to a shift towards cost-effective generic alternatives. Companies like CVS Health are revamping their pricing strategies to navigate this complex terrain.

Amazon’s Disruptive Market Entry

Amazon Pharmacy’s omnichannel approach has disrupted the industry, garnering a significant market share since its establishment. With services like drone deliveries and AI-powered prescription filling, Amazon has raised the competitive bar, compelling traditional players to up their game to stay relevant.

Rapid Digital Adoption

The digital pharmacy market is witnessing exponential growth, driven by the pandemic’s impact on consumer behavior. Mail-order and online pharmacies are gaining traction, offering customers convenient access to healthcare services. As digital platforms become increasingly popular, companies are focusing on enhancing their digital presence and customer experiences.

Challenges and Opportunities Ahead

The Zacks Industry Rank points to subdued near-term prospects for the Retail – Pharmacies and Drug Stores industry. Ranked at #234, the sector falls among the bottom 7% of Zacks industries, reflecting existing challenges. While the industry faces hurdles, there are opportunities for stocks with strong earnings potential to outperform the market. Evaluating shareholder returns and valuations will be crucial in navigating the sector’s complexities.

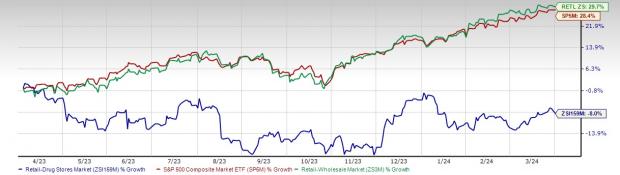

The Retail-Wholesale Sector: A Tale of Two Stocks and a Warning

The past year has witnessed a dramatic dance in the financial markets with stocks in the Retail-Wholesale sector boasting a robust growth of 29.7%, juxtaposed against a sharp downturn for the medical industry with an 8% slump. In the midst of this turbulence, the S&P 500 Composite managed to climb by a formidable 28.4%, a testament to the erratic nature of market dynamics.

The Valuation Landscape

Zooming into the microcosm of the medical industry, the forward 12-month price-to-earnings (P/E) ratio reveals compelling insights. Currently standing at 8.50X, the medical industry’s valuation starkly contrasts with the S&P 500’s 21.38X and the sector’s 22.86X. Over the past five years, the sector has oscillated between a high of 11.88X, a low of 7.18X, and a median of 8.98X, as indicated by historical trends.

Stock Focus: CVS Health

In the spotlight is CVS Health, a company on a mission to revolutionize healthcare delivery by investing in innovative technologies like enterprise data platforms and digital products. With a Zacks Rank #3, CVS Health boasts a promising long-term earnings growth rate of 9.1%. The company’s commitment to enhancing digital engagement and augmenting capabilities positions it well to drive awareness around seasonal flu vaccinations and connect patients with essential health services through CVS locations.

Stock Focus: Walgreens Boots Alliance

Walgreens Boots Alliance is another player in the retail-pharmacy arena, spearheading healthcare delivery transformation through a hybrid of physical stores and digital channels. Boasting a Zacks Rank #3, the company showcases a long-term earnings growth rate of 5%. Its innovative approach, including the deployment of micro-fulfillment centers and virtual pharmacies, underscores a commitment to bolstering patient access and driving optimal outcomes.

A Cautionary Tale: Herbalife

Contrasting the success stories of CVS Health and Walgreens Boots Alliance, stands Herbalife, a health and wellness company grappling with a downward sales spiral. Pitted against a challenging economic backdrop, the company forecasts a substantial 18.5% revenue decline in 2024 from the previous year, coupled with a negative long-term earnings growth rate of -4%. Sporting a Zacks Rank #5 (Strong Sell), Herbalife finds itself amid turbulent waters.

As the market continues to ebb and flow, investors must tread cautiously, weighing the highs and lows within the Retail-Wholesale sector to navigate the unpredictable terrain. Each stock tells a unique story – from soaring successes to cautionary declines. Amid this dichotomy, prudent decision-making based on sound financial analysis and market trends will be paramount.