After enduring market volatility in recent years, the resurgence of growth stocks in 2023 and 2024 is a sight for sore eyes. With companies like Nvidia, Microsoft, and Apple fueling the S&P 500 index up by approximately 20% and the Nasdaq Composite index up by roughly 32% over the last year, investors are eagerly seeking attractively valued growth plays with promising long-term potential.

The Remarkable Bargain of Alphabet Stock

Parkev Tatevosian: Despite being the parent company of Google and YouTube, Alphabet offers its stock at a surprisingly low valuation given its robust and lucrative businesses. A significant portion of its revenue comes from advertising, which has seen remarkable growth. Over the last decade, Alphabet’s annual revenue has surged from $66 billion in 2014 to $307 billion in 2023 (a 365% increase), propelling its operating income from $16.5 billion to a remarkable $84.3 billion over the same period (an astounding 411% surge).

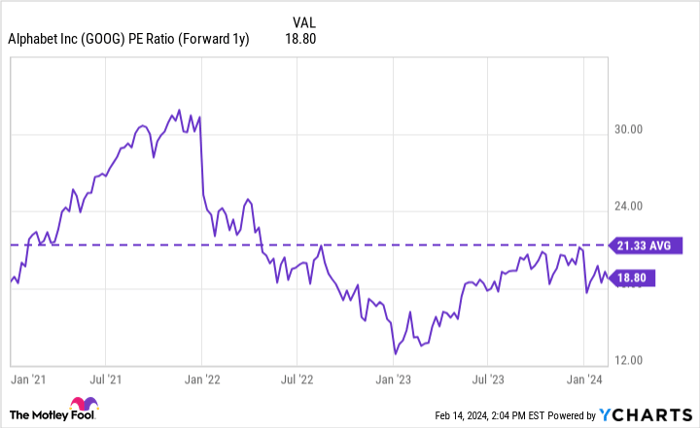

Alphabet’s unmatched ability to provide targeted ad placements through its platforms like Google Search, Gmail, and YouTube has continued to attract marketers and advertisers, resulting in sustained revenue and profit expansion. The company’s forward price-to-earnings ratio of 18.8 presents an appealing opportunity for investors, considering its historical average and the potential for further growth.

Unveiling the Potential of StoneCo Stock

Keith Noonan: StoneCo, a Brazilian financial-tech firm, nosedived due to a misguided foray into providing loans to small and medium-sized businesses (SMBs), which backfired due to insufficient data and the pandemic-induced surge in business closures. Despite a drastic 82% slump from its peak, the company has resolved its credit business issues and shifted its focus to payment-processing, delivering impressive revenue growth and a substantial increase in non-GAAP earnings per share.

With an attractive forward price-to-earnings multiple and robust growth prospects, StoneCo’s valuation belies its potential for significant profit expansion. The company’s aggressive growth forecasts and solid demand for its services indicate a compelling risk-reward profile for investors, positioning its stock as a promising bet in 2024.

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Keith Noonan has positions in StoneCo. Parkev Tatevosian, CFA has positions in Alphabet. The Motley Fool has positions in and recommends Alphabet and StoneCo. The Motley Fool has a disclosure policy.