The Internet Software & Services Landscape and Investment Outlook

The Internet-Software & Services industry shows signs of a mixed bag. Over the past year, some companies experienced a resurgence in business, while others faced a tough spot due to market corrections following the pandemic-induced digitization frenzy. Despite this, it’s challenging to see this industry underperforming over time, given its significance as the backbone of the digital economy. The industry has weathered long-term trends and remains resilient even as concerns about a slowing economy loom large. While geopolitical tensions and improving economic indicators affect most industry players, some are better equipped than others to navigate these challenges. Despite innovation-driven growth deserving a premium, the industry’s reliance on a robust economy has kept prices contained over the past year. This presents an opportune time for investors to explore potential investment opportunities, with NetEase (NTES) and Okta (OKTA) emerging as top contenders.

Fundamentals of the Industry and Industry Trends

The Internet Software & Services industry, while relatively small, primarily enables platforms, networks, solutions, and services for online businesses and facilitates customer interaction and internet-based service usage. Several critical industry trends merit attention, such as the level of technology adoption impacting growth and the increasing demand for software and services delivered through the internet. The industry has had a tumultuous few years, with recent inflation numbers raising hopes for a mild recession despite geopolitical tensions in Europe and volatility within the economy. There is also an observed preference for a subscription-based model among industry players, which brings relative stability, especially for companies with critical offerings. However, escalating infrastructure buildout costs have led to profitability challenges for players, despite revenue growth acceleration.

Industry Recognition and Performance

The Zacks Industry Rank for the Internet – Software & Services industry indicates improving prospects and positions it in the top 24% of over 250 Zacks-classified industries. The industry’s Zacks Industry Rank, an average of the Zacks Rank of all member stocks, reflects better coping mechanisms compared to many other industries. With the aggregate earnings estimate for 2023 up by 40.9% and a 54.9% increase for 2024 from a year ago, the industry’s earnings outlook for constituent companies is on a steady upward trajectory.

Industry Stock Market Performance and Valuations

While the Zacks Internet – Software & Services Industry has lagged behind the broader Zacks Computer and Technology Sector and the S&P 500 over the past year, the industry’s current valuation indicates a fair trading scenario. Despite modest stock market performance, the industry is now trading at a reasonable valuation with a forward 12-month price-to-earnings (P/E) ratio at a 23.3% discount to its median level over the past year. This makes the industry undervalued compared to the sector’s P/E, presenting an intriguing investment proposition.

Promising Investment Opportunities

NetEase, Inc. (NTES): Based in Hangzhou, NetEase is a prominent provider of various online services, including games, music, education, and smart devices in China. The company’s diverse content and service offerings make it an attractive investment prospect in the dynamic Internet Software & Services landscape. Whether fueled by business resurgence or market corrections, astute investors recognize the long-term potential of NetEase in their investment portfolios.

Investing in NetEase and Okta: An In-Depth Analysis

NETEASE (NTES): NetEase, a leading internet technology company based in China, has undergone a strategic transformation that underscores its commitment to enhance community, communication, and commerce. The company has strategically expanded its international footprint by focusing on creating gaming content that resonates with a global audience. To achieve this, NetEase has established its own studios in Japan, Europe, and North America, nurturing creative talent in these regions. Furthermore, the company’s expansion into the console gaming market has facilitated seamless gameplay across multiple devices, significantly broadening its user base.

Invigorating Growth in Gaming

NetEase recently witnessed robust growth in its gaming segment, propelled by the successful launch of new titles. With an array of upcoming games spanning diverse genres and geographies, the company is poised for continued customer additions and expansion. The company’s Youdao division experienced robust growth driven by its learning services, notably high-quality courses and the human language coach ‘Hi Echo,’ resulting in an expanded user base and increased online marketing services. Furthermore, NetEase’s cloud music business is undergoing a strategic revitalization, with a renewed focus on profitable content and the cultivation of independent talent.

Favorable Market Performance

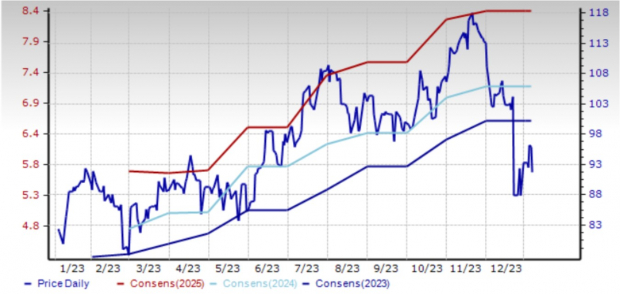

NetEase’s shares, designated as Zacks Rank #2 (Buy), have surged by 16.8% over the past year. Additionally, the Zacks Consensus Estimate for 2023 has seen a 4.3% increase, reflecting favorable market sentiment. Moreover, the 2024 earnings estimate has also risen by 2.3%, signaling a positive outlook for the company’s financial performance.

Price and Consensus: NTES

Image Source: Zacks Investment Research

OKTA, Inc. (OKTA): On the other hand, Okta, based in San Francisco, CA, specializes in providing a comprehensive suite of identity, access, and authentication solutions to a diverse clientele, including small and medium-sized businesses, educational institutions, non-profits, and government agencies in the U.S. and abroad. Notably, the company’s products are distributed through a direct sales force and channel partners.

Robust Growth Trajectory

Okta is actively charting a growth trajectory, with management projecting a 37% compound annual growth rate (CAGR) from 2021 to 2024. With an estimated total addressable market of $80 billion, Okta is strategically positioned for rapid expansion, buoyed by its innovative product portfolio encompassing Privileged Access, Identity Governance, and Access Management solutions, both for the workforce and customers.

Steadfast Revenue Outlook

The company’s resilient revenue and profit outlook for the year is underpinned by the critical importance of secure access, especially amid mounting macro pressures. Moreover, Okta’s customer cohort with an annual contract value of over $1 million has exhibited robust growth, signifying sustained capital investments by its larger clients. With 97% of its revenue generated from subscriptions and a commendable customer retention rate in the mid-90s, Okta enjoys strong revenue visibility.

Market Performance

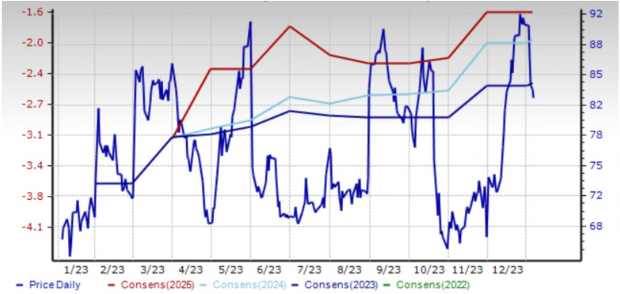

Okta’s shares, also holding a Zacks Rank #2 designation, have surged by 24.9% over the past year, reflecting the company’s robust market performance. While estimates have remained unchanged over the past 30 days, the 2024 and 2025 estimates have surged by 23.7% and 27.0%, respectively, in the last 60 days, underscoring positive market sentiment.

Price and Consensus: OKTA

Image Source: Zacks Investment Research

Are you missing out on potential stock opportunities?

We’re not kidding.

Several years ago, we shocked our members by offering them 30-day access to all our picks for only $1. No hidden obligations.

A myriad of investors have seized this opportunity, while some remained skeptical, assuming there must be a catch. Yes, there’s a rationale behind our decision. We strive to acquaint you with our portfolio services such as Surprise Trader, Stocks Under $10, and Technology Innovators, all of which have closed 162 positions with remarkable gains in 2023 alone.

NetEase, Inc. (NTES) : Free Stock Analysis Report

Okta, Inc. (OKTA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.