The Brightening Landscape of Semiconductor

Semiconductors, widely known as microchips, are the unsung heroes of the tech world, weaving themselves intricately into the fabric of our daily existence. Over the past few years, chip stocks have emerged as the darlings of the investing universe, and it’s not hard to see why—they have proven to be excellent wealth generators.

An In-Depth Look at Micron Technology

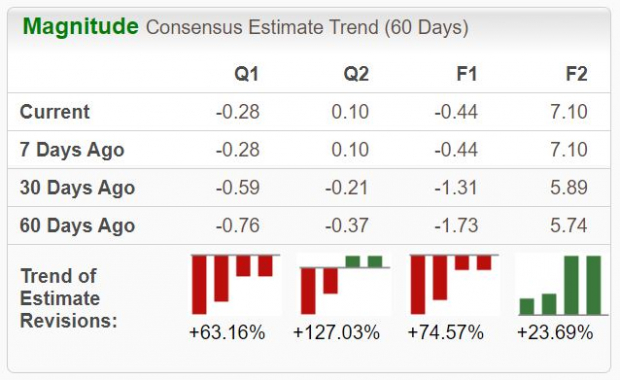

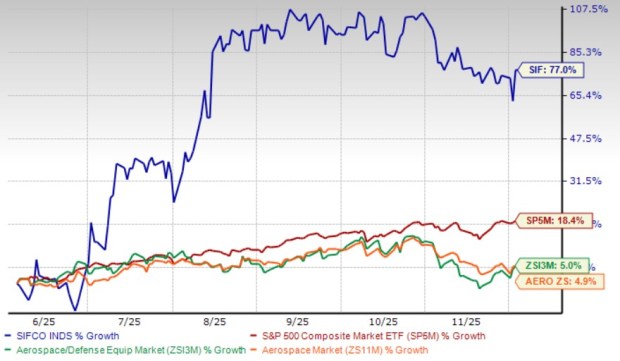

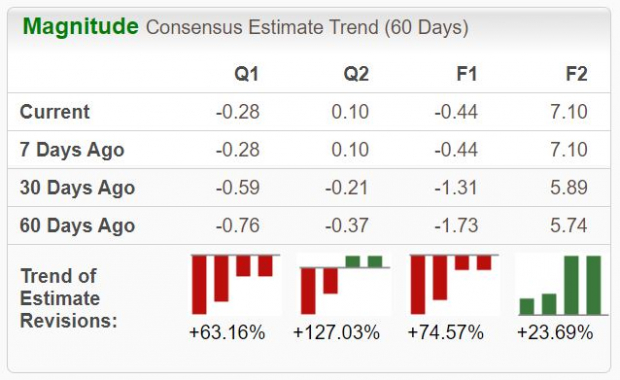

Micron Technology, a major player in high-performance memory and storage technologies, has surged to a Zacks Rank #1 (Strong Buy), with a noticeably positive shift in its near-term earnings outlook. The company’s stock holds great potential for investors seeking semiconductor exposure.

Image Source: Zacks Investment Research

Paving the way for a steady stream of passive income, MU shares presently yield 0.5% annually. Though the yield may seem modest, it serves as a cushion against potential downturns. The forecasted growth of Micron is impossible to overlook, with consensus expectations suggesting a whopping 90% earnings growth and a 43% rise in sales for the current fiscal year. Looking ahead, expectations for FY25 indicate an additional surge in earnings accompanied by a 45% increase in sales.

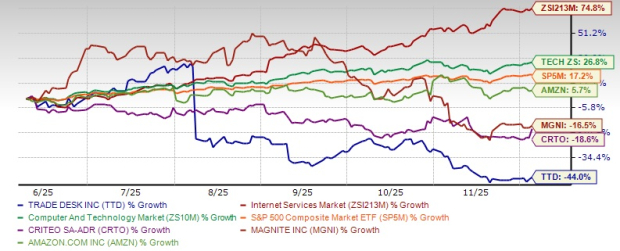

ASML: Leading the Semiconductor Landscape

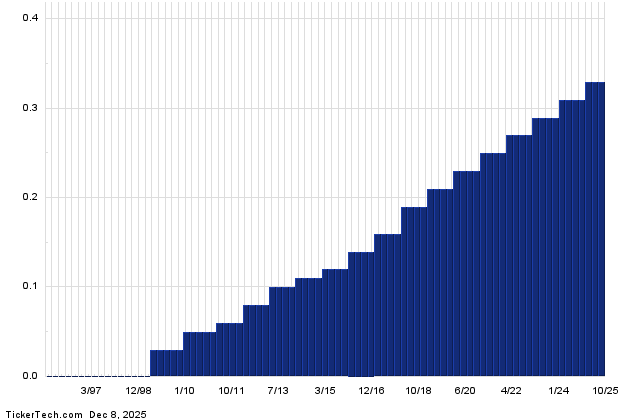

ASML, a global pioneer in advanced technology systems for the semiconductor industry, has witnessed a gradual improvement in its earnings outlook across various timeframes, earning it a spot at Zacks Rank #2 (Buy). Similar to MU, ASML shares come with the added benefit of passive income, boasting an annual dividend yield of 0.7%. Furthermore, the company has displayed its commitment to increasingly rewarding shareholders, evident in ASML’s significant 33.4% five-year annualized dividend growth rate.

Although ASML shares may seem pricey, they are relatively less expensive when viewed historically. With the current P/E ratio at 35.5X, falling lower than the five-year median of 36.1X and the 2021 highs of 55.4X, the stock carries a Value Style Score of ‘D’.

Image Source: Zacks Investment Research

Conclusion: An Exhilarating Journey

The phenomenal performance of semiconductor stocks over the past years has catapulted them to the top of investors’ wish lists. For those seeking exposure, both Micron Technology MU and ASML ASML are tailor-made choices. In addition to favorable Zacks Ranks, both stocks offer dividends, adding to their allure.

Ready to Take a Leap?

Five stocks handpicked by Zacks experts are set to gain +100% or more in 2023. Previous recommendations have skyrocketed by incredible percentages. Most of the stocks in this report are still under the radar of Wall Street, presenting a fantastic opportunity to get in on the ground floor. Click here to see these 5 potential home runs.

Micron Technology, Inc. (MU) : Free Stock Analysis Report

ASML Holding N.V. (ASML) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.