Key Points

-

Amazon is seeing strong operating leverage in its e-commerce business, while AWS growth is starting to accelerate.

-

Philip Morris International is a strong growth Stock in a defensive industry.

-

Both stocks are attractively valued.

- 10 stocks we like better than Amazon ›

Investors have been encouraged to double down on stocks they own that are down, but it can also be a smart move to add to stocks you own, even when you already have gains in them. This is an often overlooked strategy, but one that can be effective.

Let’s look at two growth stocks you can double up on right now.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. see the stocks »

Image source: Amazon.

Amazon

Amazon‘s (NASDAQ: AMZN) Stock isn’t too far from its highs, but it also hasn’t moved a whole lot over the past five years, up less than 40%. However, now may be a good time to add to positions in the Stock heading into 2026.

The company is already seeing strong operating leverage in its e-commerce business, as demonstrated by its North American segment’s adjusted operating income climbing 28% last quarter on just an 11% increase in sales. This stems from its embrace of robots and artificial intelligence (AI).

While Amazon is widely known to have the world’s largest e-commerce and cloud computing businesses, it is also the biggest operator and manufacturer of industrial robots. It just doesn’t get the credit it deserves in this area, since it makes the robots for its own use. However, it’s making big advancements in this area and deploys more than 1 million robots in its fulfillment centers, all coordinated by its DeepFleet AI model.

Amazon has also become one of the leading digital marketing companies in the world through its sponsored ad program. The company is using AI in this business to help merchants create better campaigns and improve targeting. As a result, this was one of its fastest-growing businesses in Q3, with revenue for this high-gross-margin service climbing 24%.

Meanwhile, its cloud computing unit, AWS, could be its biggest catalyst next year. The segment has been growing quickly and is starting to see revenue accelerate. With capacity constrained and demand for AI services growing, the company is investing heavily in capex to build out its AI data center footprint, which should drive strong revenue growth next year.

With Amazon’s Stock trading at a forward price-to-earnings (P/E) ratio less than 30 times 2026 analyst estimates, the Stock is attractively valued both historically and versus retail peers like Walmart and Costco Wholesale, making it a great Stock to double up on.

Philip Morris International

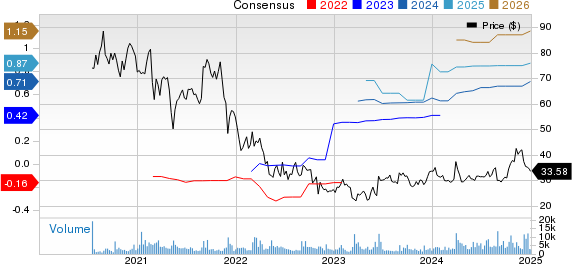

Philip Morris International (NYSE: PM) Stock has had a strong year, up around 35%, but it’s off its highs and has been stuck in neutral since the summer. Meanwhile, the company is a unique growth Stock in a defensive industry, which makes it a strong candidate to double up on.

Philip Morris benefits from not selling cigarettes in the rapidly declining U.S. market. International markets are seeing volumes hold up much better, while the company continues to see strong pricing power across the globe. However, it is the company’s smokeless portfolio that is powering its growth.

Its popular nicotine pouch brand, Zyn, is leading the way. Shipments in its main U.S. market soared 37% last quarter, while retail sales volumes (offtake) jumped by 39%. The product is finally no longer capacity-constrained, and Philip Morris is beginning to invest more in promotions to help drive growth. Meanwhile, global shipments outside its original Nordic markets more than doubled.

The company’s heated tobacco offering, Iqos, is also seeing strong growth in international markets. Volumes grew 15.5% in Q3, led by growth in Japan and Europe and increasing strength in new markets.

Meanwhile, the company has a big opportunity after buying back its rights to sell the product in the U.S. It’s currently waiting for approval from the FDA for its new Iluma delivery system before a full launch in the U.S. The best thing about Philip Morris’ Zyn and Iqos growth is that both products have much better unit economics than its traditional cigarettes, helping drive gross margin and profits.

Philip Morris Stock is also attractively valued, trading at around a forward P/E ratio of under 19.5, based on the analyst consensus for 2026, and a price/earnings-to-growth (PEG) ratio of 0.85. Stocks with positive PEG ratios below 1 are generally considered undervalued.

Its valuation and growth prospects make the Stock a top option to double up on.

Should you buy Stock in Amazon right now?

Before you buy Stock in Amazon, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Amazon wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004… if you invested $1,000 at the time of our recommendation, you’d have $505,641!* Or when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $1,143,283!*

Now, it’s worth noting Stock Advisor’s total average return is 974% — a market-crushing outperformance compared to 193% for the S&P 500. Don’t miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

see the 10 stocks »

*Stock Advisor returns as of January 2, 2026.

Geoffrey Seiler has positions in Amazon and Philip Morris International. The Motley Fool has positions in and recommends Amazon, Costco Wholesale, and Walmart. The Motley Fool recommends Philip Morris International. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.