The tech market has a long history of providing investors with significant and consistent gains. In fact, over the past decade the Nasdaq-100 Technology Sector has climbed 416%, significantly outperforming the S&P 500 (which rose 178%).

Tech companies tend to benefit from the innovative nature of the industry, with never-ending demand for upgrades to software and hardware. As a result, it’s no surprise that all five of the world’s most valuable companies are tech firms, including Microsoft, Apple, Nvidia, Alphabet (NASDAQ: GOOGL) (NASDAQ: GOOG), and Amazon.

These companies have made many millionaires over the years, and will likely continue to make more. Consequently, it could be worth dedicating a portion of your holdings to the high-growth sector and potentially benefit from tech’s development for years.

Here are two top tech stocks that could make you a millionaire.

1. Advanced Micro Devices

Advanced Micro Devices (NASDAQ: AMD) still has a long way to go before it’s in the same league as the top tech companies. Its market cap of $246 billion is still considerably lower than market leader Nvidia’s more than $2 trillion. However, that’s exactly why AMD has the potential to make you a millionaire — it has plenty of room left to run.

The chip market is booming, with demand likely to continue rising as advances in tech increase the need for high-powered hardware. For instance, chip demand skyrocketed over the last year thanks to growing interest in artificial intelligence (AI). Nvidia scooped a majority market share in AI chips in 2023, with its dominant role in graphics processing units (GPUs) allowing it to get a head start in the sector.

However, AMD has made a hefty investment in AI, which saw it launch rival GPUs this year. And its efforts appear to be paying off. The company posted earnings for its first quarter of 2024 on April 30, where revenue rose 2% year over year and beat Wall Street estimates by $20 million. AMD benefited from an 80% spike in its AI-focused data center segment, representing increased GPU sales.

AMD’s GPU market share rose from 12% to 19% between Q4 2022 and Q4 2023. Meanwhile, Nvidia’s fell from 86% to 80% in that period. AMD is gaining in the industry and could be a lucrative long-term investment.

Shares of AMD have climbed 460% in the last five years alone, but could beat that over the next half-decade as it delves deep into AI. Meanwhile, AMD’s price-to-sales (P/S) ratio of 11 is significantly lower than Nvidia’s 37, suggesting its stock is trading at a far better value than its biggest competitor.

2. Alphabet

While AMD is a great way to add an up-and-comer to your portfolio, Alphabet’s stock is a reliable option, with one of the most powerful positions in tech. In-house brands like Android, YouTube, Chrome, and Google resulted in a vast user base of billions of consumers and businesses.

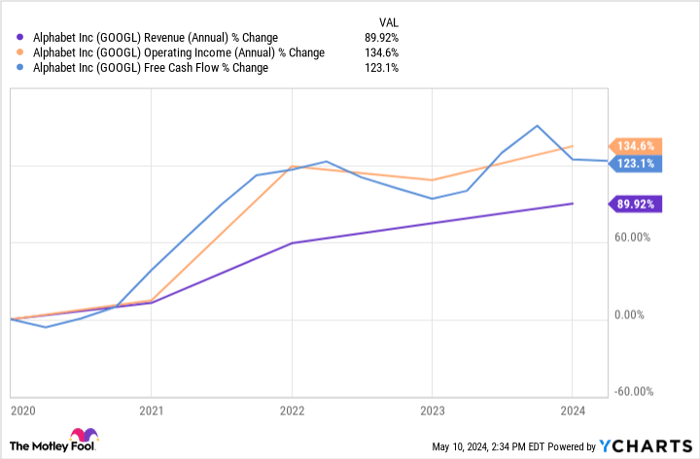

Data by YCharts

The company’s success over the years delivered promising growth, with this chart showing how its annual revenue, operating income, and free cash flow have risen high since 2020. Meanwhile, its stock climbed 143% in the same period.

Past growth isn’t always indicative of what’s to come. However, Alphabet’s future is bright. The company has used its significant user base to become a leader in digital advertising, with ad sales making up the bulk of its revenue. And now it seems that same user base is helping the company become a major player in AI.

Alphabet reported its Q1 2024 earnings on April 25, delivering a 15% year-over-year increase in net sales and outperforming estimates by nearly $2 billion. The company enjoyed solid gains in its advertising business, with Google Services revenue rising 14%. However, the most promising growth area was its Google Cloud segment, which posted a revenue rise of 28% year over year.

Alphabet gradually expanded its AI cloud services on Google Cloud over the last year, adding new tools and launching an AI model called Gemini. Meanwhile, the company announced plans in April to spend $3 billion on building data centers in Indiana and Virginia to further fuel Google Cloud.

Alphabet is a healthy business with a potent position in tech. Now is an excellent time to invest, with the company still at a relatively early stage in its AI venture.

Moreover, Alphabet’s P/S of 7 is lower than those of many of its rivals in AI, making its stock a no-brainer right now and one that could make you a millionaire with the right investment.

Should you invest $1,000 in Advanced Micro Devices right now?

Before you buy stock in Advanced Micro Devices, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Advanced Micro Devices wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $550,688!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of May 13, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Dani Cook has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Amazon, Apple, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.