Market Insights: Semiconductor Stocks to Watch Amid Tariff Changes

President Donald Trump’s tariffs on various countries, notably China, caused significant turmoil on Wall Street, particularly impacting semiconductor stocks. Recently announced exemptions on tariffs for chips and other advanced technologies have led to a market uptick, enabling a recovery for numerous semiconductor companies that had been on a downward trend.

Given the current market condition, it is an opportune moment to consider investments in robust semiconductor firms like ASML Holding N.V. and NVIDIA Corporation. Both companies are trading at a discount following recent declines but stand in a favorable position to capitalize on the market’s anticipated rebound.

While these tariff reliefs are not permanent, fluctuations may occur if trade relations remain tense. Nevertheless, both ASML and NVIDIA possess significant competitive advantages—often referred to as a “wide moat”—that insulate them from market volatility. Let’s explore this in detail.

ASML and NVIDIA: Companies with Wide Moats

ASML, based in the Netherlands, is a pioneer in manufacturing extreme ultraviolet (EUV) lithography systems vital for producing powerful artificial intelligence (AI) chips. Due to the high cost of this specialized equipment, ASML does not need to sell large quantities to achieve robust revenue. In fact, the company sold only 44 EUV systems last year, which accounted for 38% of its total net system sales, reaching 21.8 billion euros. Major chip manufacturers such as Intel Corporation and Taiwan Semiconductor Manufacturing Company Limited are significant customers.

Although there is a risk of market share loss due to China’s efforts to develop similar systems, the complexity and time-consuming nature of EUV technology mitigate this risk. Thus, ASML’s monopoly position seems secure, enabling sustained long-term growth for its investors.

Conversely, NVIDIA, led by CEO Jensen Huang, commands over 80% of the discrete graphics processing units (GPUs) market. This dominance not only offers a competitive edge but also propels long-term growth. The company’s CUDA software platform is gaining traction among developers worldwide, while demand for Blackwell chips is surging due to their enhanced energy efficiency and faster AI processing capabilities.

Positive Indicators for ASML Stock

The surge in AI application growth has led to increased demand for the advanced memory chips that require ASML’s EUV technology for production. New orders for ASML’s lithography machines rose in the fourth quarter of 2024, with expectations of a substantial increase in bookings for the first quarter of 2025.

Consequently, ASML is positioned for a strong first quarter, forecasting revenues between 7.5 billion euros and 8 billion euros—representing a significant 46% year-over-year increase. Expected earnings are projected at 5.75 euros per share, marking an impressive 85% year-over-year jump.

NVIDIA’s Promising Future

The ongoing escalation in spending for AI data centers is set to benefit NVIDIA significantly. To support the rising demand for AI workloads, major cloud computing players are expanding their GPU purchases, leveraging NVIDIA’s advanced computing capabilities.

Three leading cloud companies are projected to invest $250 billion in AI data center infrastructure, with OpenAI and Softbank aiming to spend $500 billion on projects like Stargate. As a result, NVIDIA anticipates that AI data center spending could reach $1 trillion by 2028, indicating robust potential for stock appreciation.

Now is the Time to Buy ASML and NVIDIA

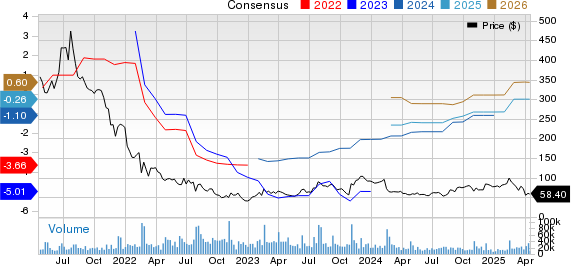

ASML’s market leadership in lithography equipment and the rising demand for its products make its stock an attractive investment. Currently, ASML shares have decreased by 3% year-to-date, though they gained 0.6% on Monday following the tariff exemptions.

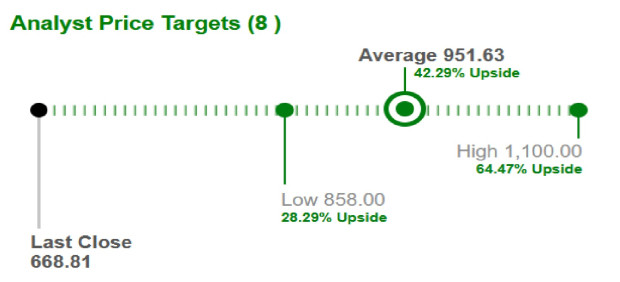

With an expected earnings growth rate of 23.1% for this year, analysts have raised ASML’s average short-term price target from $668.81 to $953.61—an increase of 42.3%.

Image Source: Zacks Investment Research

NVIDIA’s dominance in the GPU sector, alongside the increasing investment in AI infrastructure, positions its stock for upward momentum. Despite a 17.8% decline this year, NVIDIA anticipates earnings growth of 47.5% for the current year.

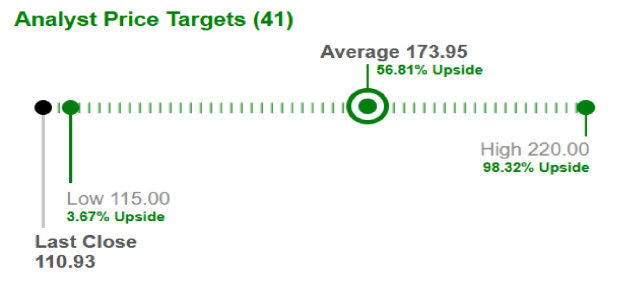

Additionally, analysts have raised NVIDIA’s average short-term price target from $110.93 to $173.95, reflecting a considerable 56.8% increase.

Image Source: Zacks Investment Research

Both ASML and NVIDIA hold a Zacks Rank #2 (Buy), indicating favorable prospects. The complete list of Zacks Rank #1 (Strong Buy) stocks can be viewed here.

Discover the 7 Best Stocks for the Next 30 Days

Experts have recently identified 7 elite stocks from a current pool of 220 Zacks Rank #1 Strong Buys. These stocks are predicted to yield “Most Likely for Early Price Pops.”

Since 1988, the comprehensive list has outperformed the market with an average gain of 23.9% per year, doubling the market average. It is advisable to closely monitor these top picks.

see them now >>

Stay updated with Zacks Investment Research’s latest recommendations. Download the free report 7 Best Stocks for the Next 30 Days.

For free stock analysis reports, explore the following:

Intel Corporation (INTC): Free Stock Analysis report

NVIDIA Corporation (NVDA): Free Stock Analysis report

ASML Holding N.V. (ASML): Free Stock Analysis report

Taiwan Semiconductor Manufacturing Company Ltd. (TSM): Free Stock Analysis report

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.