Opportunities Post Strong 2023 Market Performance

Even after the market’s strong performance in 2023, oversold gems remain for savvy investors looking in the right places.

Victor Dergunov’s Insight

Seeking Alpha analyst and Investing Group leader Victor Dergunov suggests several areas will present investment opportunities in 2024. AI surfaces again as a potential stock market winner, he says. There are other sectors to watch, including materials, precious metals miners, energy, and defense. Companies operating in these sectors and others may deliver decent returns throughout the year, according to Dergunov.

Economic Conditions and Factors to Consider

Improving economic conditions may support an environment that the markets need for further gains, he adds. An accommodative Fed potentially lowering interest rates, decreasing inflation, and earnings growth will all be positives to look for in 2024. What could impact the scenario? The threat of deflation and a possible recession.

Analyzed Market Sentiments in 2024

Dergunov presents his year-ahead perspective below:

Seeking Alpha: You’re generally positive on stock market action in 2024. The reasons why? Improving earnings? Better growth prospects? A brighter economic picture?

Victor Dergunov: I’m bullish on stocks in general for several reasons. We are coming out of a brutal bear market and a significant earnings recession. We saw many high-quality stocks become highly oversold.

Stock Market Outlook

For instance, Meta (META) was under $90, Tesla (TSLA) was around $100, and Nvidia (NVDA) was about $105. These are just several examples, but we witnessed broad market oversold and undervalued conditions. We also faced a challenging macro atmosphere with high inflation, Fed tightening, and substantial uncertainties.

We have a much different and far more bullish dynamic now. Inflation is moderating, the economy shows extraordinary resilience, corporate America demonstrates remarkable efficiency, the interest rate cycle has peaked, and the Fed will likely start lowering interest rates in Q1. The Fed could also halt QT in 2024 and introduce QE programs to stimulate growth (additionally) as we move forward. Therefore, the Fed can continue supporting the economy and the stock market in 2024 and future years.

Growth Drivers in 2024

Moreover, robust growth drivers like the AI industry, virtual and augmented reality, the alternative energy field, and other segments should boost economic growth and improve efficiency, leading to higher corporate profitability as we advance.

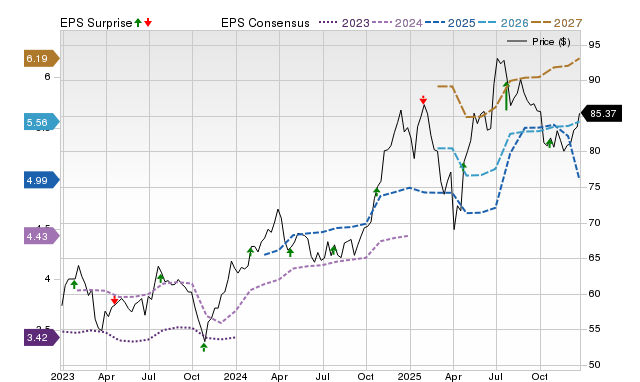

Many high-quality companies should outperform their earnings estimates, leading to multiple expansions and substantially higher stock prices in 2024.

Potential Challenges and Risks

SA: What are the challenges? The risks? What could derail positive investor momentum next year?

Of course, there are challenges, and no investment is risk free. The primary challenge may be maintaining the delicate balance in the inflation/deflation dynamic. We want inflation to continue moderating, but we must avoid inflation from dipping below 2%. The worst thing for risk assets is deflation. Thus, we want to prevent a deflationary economic scenario at all costs.

Also, we must avoid a recession. The base case scenario is still a soft landing. Therefore, we need the labor market to remain vibrant and stimulate the economy to ensure growth. Worsening economic conditions, resurging inflation, threats of deflation, deterioration in the labor market, increased Fed hawkishness, and other detrimental factors could damage sentiment, derailing positive momentum next year.

The Fed’s Impact on Markets

SA: The Fed is positioning to be more accommodating in terms of monetary policy as it enters 2024. Was the news the Fed delivered in December pretty much already factored into most investor positioning for next year? Or could the Fed still have a bigger impact on markets during the next 12 months?

VD: The Fed’s news in December wasn’t factored into many investors’ positioning for 2024. Many market participants still expect the Fed to remain hawkish for longer and view the recent optimism as a temporary event. The Fed remains the elephant in the room and could make or break the rally next year. There could be significant upside for stocks as the Fed continues pivoting toward a more accessible monetary stance in 2024. I anticipate four to six 25 Bps decreases in the benchmark next year. This dynamic will probably be very bullish for stocks.

The Revolution of AI

SA: You’ve identified AI as a recurring opportunity. Why will this niche keep delivering for investors next year?

VD: I don’t view the AI segment as a niche. Also, calling the immense AI opportunity an industry or a segment may be unfair. AI could permeate almost every layer of our economy, affecting everyday life much more than we expect now.

Few, if anyone, imagined how big the Internet would be today in 1995, and that’s where we may be with AI. We’re still in the third inning, and considering the massive market size potential, the “AI revolution” will probably be a very long game.

Aside from the direct drivers and beneficiaries of the AI industry like Nvidia, AMD (AMD), Microsoft (MSFT), Meta, and others, most companies, in general, should benefit from the AI effect.

As an example, look at what Palantir (PLTR) is doing. With the help of AI, Palantir enables companies and organizations to become more efficient. This dynamic should lead to increased growth and improved profitability for many high-quality companies in many segments and industries. The AI industry should unlock significant growth and profitability potential in the broader economy as we advance in 2024 and beyond.

Sector Performance Predictions

SA: Are there particular sectors that you see outperforming or underperforming in 2024?

VD: Many segments should do very well next year. First, we should look at the “AI segment” and the companies most likely to benefit here in the intermediate and long term. Also, we should look at solid companies likely to benefit from an expanding economy and the effects of AI.

Outside the tech sphere, we can look at high-quality material stocks. Material stocks should benefit from improving growth, more demand, higher material prices, and other beneficial elements.

Also, we can look at the gold and silver mining space. Gold and silver stocks should have an excellent year as the Fed continues pivoting toward an easier monetary stance.

Oil and energy stocks should benefit and have a bright year ahead. Oil’s price has been depressed recently, and this dynamic can change. Increasing demand due to higher economic activity and constrained supply could drive oil prices much higher. Additionally, there are geopolitical factors to consider.

While we’re discussing energy, we should discuss alternative energy. Many alternative energy/solar stocks got crushed in the recent bear market. Price action could improve considerably as growth returns to the economy and sentiment improves. Lithium mining companies also should benefit from lower rates, the improving economy, and EV demand roaring back.

Healthcare and biotechnology have been depressed, and we could see capital rotating toward this space. Also, we may see increased demand for healthcare/biotech in an election year. Earnings also should improve considerably over last year, driving stock prices higher in 2024.

The defense industry is also on the right track now, and we could see high-quality industrial stocks outperform. We should have a solid year for many high-quality companies next year. My S&P 500 target remains at 5,250 for 2024’s year-end.