January delivery figures are out and the performance of various players in the electric vehicle (EV) industry in China portrays a mixed picture. BYD Company Limited BYDDY managed to shine, albeit amidst a month-over-month (MoM) dip. It’s a trend not uncommon for January, given the impending Chinese Lunar Year on February 10th, disrupting both production and demand, as February is expected to echo January’s subdued sales.

Nio Inc. NIO reported an 18.2% year-over-year (YoY) increase in deliveries, with 10,055 EVs hitting the roads. However, juxtaposing this against the prior year doesn’t paint an accurate picture, considering that last year, the Chinese New Year fell on January 22nd. Therefore, viewing the 44% MoM drop in sales as a sign of weakness overlooks Nio’s massive sales push in December 2023.

Li Auto Inc. LI delivered 31,165 EVs in January, marking an impressive 105.83% YoY escalation but suffering a 38.11% MoM decline. Li Auto, which aspires to become China’s best-selling premium EV brand and achieve an annual delivery milestone of 800,000 vehicles, is set to unveil over 330 of its supercharging stations during the Chinese New Year, further fortifying its charging infrastructure. Unlike Tesla, Li Auto’s SUVs come equipped with a fuel tank for battery charging, marking a distinction in its approach to EVs.

XPeng Inc. XPEV delivered 8,250 vehicles in January, buoyed by a 58.11% YoY surge, yet confronted with a steep 58.99% MoM decrease. In late January, XPeng announced a 20-day upgrade plan for its first plant, aimed at bolstering the capacity of the Zhaoqing facility to pave the way for a new model anticipated later in the year.

As per data from the China Passenger Association, Tesla Inc. TSLA sold 71,447 made-in-China EVs. Tesla’s sales marked an 8.17% YoY ascent but concurrently slipped 24.1% on a MoM basis. In a bid to stimulate demand, Tesla initiated fresh discounts on its Model Y in China on February 1st, following price cuts on both the Model Y and Model 3 in January.

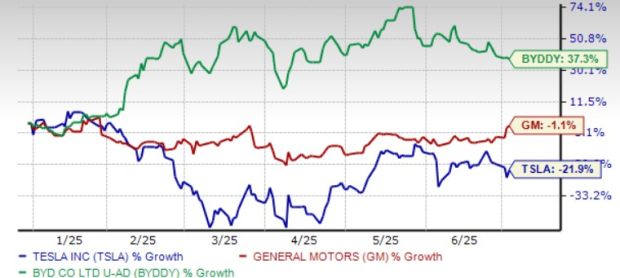

BYD, which surpassed Tesla in electric vehicle sales during the final quarter of 2023, sustained its strong performance into 2024, with sales of battery-powered EVs leaping nearly 50% in January. BYD retailed 105,304 fully electric vehicles during the month, while escalating production by 64% YoY to 114,365 EVs. However, the firm also grappled with a 40.92% MoM slump, delivering a total of 205,114 vehicles in January, reflecting a 33.4% MoM drop. Despite the month’s tepid sales, BYD anticipates its annual earnings to soar as much as 86.5%, fueled by record deliveries and cost-cutting measures. Nonetheless, its profitability continues to lag behind that of Tesla, which reported a 2023 net income of $15 billion last week, marking a 19.4% YoY surge. Notably, BYD also achieved a milestone with overseas sales swelling 247.53% YoY.

Understanding the Slow Start

While the EV market in China is off to a sluggish start in 2024, innovation remains the key driver for sustaining investor optimism. Even Tesla has cautioned of notably slower growth in the year ahead. However, the evolution of electric vehicles transcends mere sales figures, encompassing a broader spectrum of advancements. For instance, Worksport Ltd WKSP, a pickup accessories manufacturer, has begun 2024 on a robust footing, with the release of its durable, functional, and stylish ‘made-in-the-USA’ AL3 PRO hard-folding tonneau cover on its e-commerce platform, while also preparing to debut on e-commerce giants like Amazon, eBay, and Walmart. Worksport’s tonneau covers will be compatible with a wide range of popular pickups, underscoring the company’s commitment to redefining standards in clean transportation with its solar-powered tonneau cover SOLIS and portable battery system COR.

Paving the Road to the EV Future

As Yunfei Li, BYD’s general manager succinctly puts it, the race in the EV market is not solely about who sells the most EVs, but rather about collective efforts to expand the EV ecosystem. Each player, undeniably, is contributing its share to create the influential EV future.

DISCLAIMER: This content is for informational purposes only. It is not intended as investing advice.

This article is from an unpaid external contributor. It does not represent Benzinga’s reporting and has not been edited for content or accuracy.