The Oracle and Adobe Showdown

Recent quarterly results from tech giants Adobe and Oracle have ignited investor speculations on what lies ahead for the earnings season. While Oracle’s robust performance signaled positive market sentiments, Adobe’s lackluster guidance raised concerns about its AI competitiveness. This clash sets the stage for anticipation as other companies gear up to unveil their Q1 reports.

Marching Through the Market Performance

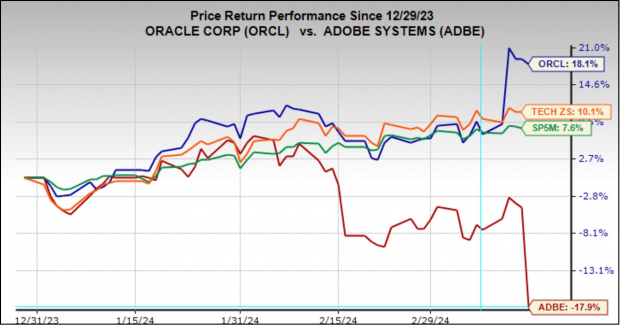

An intriguing visual aid showcases the year-to-date performance of Adobe and Oracle against the broader Tech sector and market indexes. The diverging trajectories of Oracle and Adobe post their quarterly releases add a layer of complexity to the current market dynamics, hinting at potential shifts in investor confidence and sectoral strength.

The Macro Backdrop: A Resilient Economy

Amidst macroeconomic uncertainties and inflationary pressures, the US economy has demonstrated resilience. As the Fed prepares to recalibrate its policy stance, the extreme risks looming over corporate earnings have dissipated. This favorable macro environment sets the context for the upcoming Q1 earnings reveals.

Analyst Projections and Sectoral Insights

Anticipations suggest a modest uptick in Q1 earnings and revenue growth compared to the previous quarter. Sector-specific analyses hint at nuanced trends, with sectors like Tech primed for significant earnings growth. Tech’s revival from a post-COVID slump and its pivotal role as a major contributor to the overall market earnings landscape underscore its impact on shaping the market narrative.

Charting the Course: Tech Sector’s Triumph

The Tech sector’s resurgence, evident in its expected robust earnings growth, carries substantial weight in driving positive momentum across the market. Excluding Tech’s contribution, the aggregate earnings picture could have shown a different narrative. The sector’s stalwart performance and all-time high quarterly earnings signify a potential shift towards sustained growth and sectoral dominance.

Navigating the Earnings Landscape

Peering into the broader earnings vista, projections paint a moderately optimistic picture for overall S&P 500 earnings and revenue growth. The intricate interplay of sectoral performances and market dynamics underscores the multifaceted nature of the earnings landscape, hinting at a tapestry of opportunities and challenges.

For a detailed analysis of the evolving earnings narrative and insights into future projections, delve into our comprehensive weekly Earnings Trends report for an in-depth exploration.