Your Guide to Top Stock Picks for 2024

Investing in stocks has shown strong potential for growth this year, especially when it comes to my top picks. If you had placed $10,000 evenly across my chosen stocks back in December 2023, your investment would be worth $14,281 by December 5, 2024. In contrast, an S&P 500 index fund would only yield $12,890, illustrating a 48% advantage for my selections.

The Market Landscape

This remarkable performance should inspire confidence. Although many portfolios struggled when the S&P 500 plunged 18% in 2022—with 51% of U.S. equity managers trailing the market—current data shows that 57% of large-cap equity managers have not kept pace with the index as we approach year-end in a bullish 2024. This suggests that outperforming the S&P can become more challenging when the market thrives.

Let’s examine how my top 10 stocks for 2024 are performing, leaving you with insights on potential future purchases.

Revealing the Stock Lineup

My 2024 selections include Airbnb (NASDAQ: ABNB), Amazon (NASDAQ: AMZN), Costco Wholesale (NASDAQ: COST), Global-e Online (NASDAQ: GLBE), Lemonade (NYSE: LMND), Lululemon Athletica (NASDAQ: LULU), MercadoLibre (NASDAQ: MELI), Nu Holdings (NYSE: NU), SoFi Technologies (NASDAQ: SOFI), and Visa (NYSE: V).

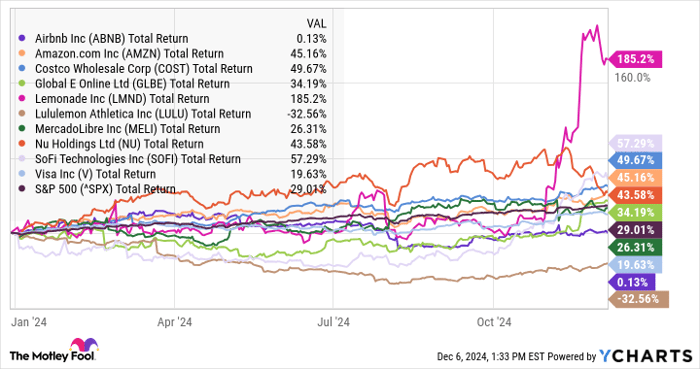

Here is how these stocks have stood against the S&P 500 as of December 5:

Data by YCharts.

Nine of my ten selections have seen gains, with Lululemon facing challenges. Let’s break down their performances and outlook heading into 2025.

Stock Reviews

Airbnb: Flat Growth

After a sharp 59% rise in 2023, Airbnb’s growth has leveled off this year, though profit margins have improved. Trading at 22 times its trailing-12-month free cash flow, it could appeal to value investors.

Amazon: 45% Increase

Amazon is thriving, with powerful AI tools positively impacting its cloud business, Amazon Web Services (AWS), the largest of its kind globally. Its dominance in U.S. e-commerce keeps it a preferred investment.

Costco: 50% Growth

Costco remains a favorite for steady growth across varying economic climates, achieving record highs lately. With a long-term investment strategy, now could be a great time to consider adding to your holdings.

Global-e Online: 34% Increase

Global-e is carving a niche in e-commerce with its cross-border solutions for retailers and serving major brands like Disney and LVMH. As profitability approaches, it stands poised for continued expansion.

Lemonade: An Impressive 185% Surge

Lemonade stands out with remarkable growth this year. After facing setbacks, the insurance provider is now leveraging AI effectively, presenting an enticing investment opportunity.

Lululemon: 33% Decline

Despite being a fan favorite, Lululemon has stumbled this year due to some product launch issues. However, it now trades at a discount compared to the broader market. Investors might view this dip as a chance to buy into a top activewear brand.

MercadoLibre: 26% Growth

Even facing competition and economic challenges, MercadoLibre is thriving with high profitability and growth prospects in Latin America, making it a robust investment option.

Nu: 44% Increase

Brazil’s digital bank Nu is rapidly expanding, reaching a notable 110 million customers and entering fresh markets, which should bolster its future growth.

SoFi: 57% Growth

SoFi is making strides as it gains market share and reaches sustainable profitability. Its complete financial service platform positions it well for future expansion.

Visa: 20% Increase

Visa remains a reliable performer, historically profiting in a growing economy. This year it has slightly lagged behind the market due to tech stock momentum but still represents a solid investment choice.

Building a Diversified Portfolio

While ten stocks offer substantial potential, a truly diversified portfolio should include a wider range of investments. Balancing growth stocks with additional equities or ETFs will help navigate differing market conditions effectively.

Remember that stock performance varies yearly. Focus on quality stocks and a long-term holding strategy to build wealth over time, rather than fixating on short-term fluctuations.

Is Now a Good Time to Invest in the S&P 500 Index?

Before deciding to invest in the S&P 500 Index, consider this:

The Motley Fool Stock Advisor team has highlighted their top 10 stocks for current purchase consideration, and the S&P 500 Index is not among them. These identified stocks are expected to deliver significant returns in upcoming years.

Take, for instance, Nvidia, which made it onto this list on April 15, 2005. An investment of $1,000 back then would be worth $872,947 today!

Stock Advisor has provided investors with a straightforward blueprint for success, including portfolio-building guidance and ongoing updates. Since 2002, the service has more than quadrupled the returns of the S&P 500.*

Discover the 10 stocks »

*Stock Advisor returns as of December 2, 2024

Former Whole Foods CEO John Mackey is on The Motley Fool’s board. Analyst Jennifer Saibil holds shares in several companies listed. The Motley Fool recommends multiple stocks mentioned here, including Airbnb, Amazon, and Costco.

The views and opinions expressed herein are solely those of the author and do not necessarily reflect those of Nasdaq, Inc.