A Tale of Two Tech Giants: Tesla vs. Meta Platforms in 2025

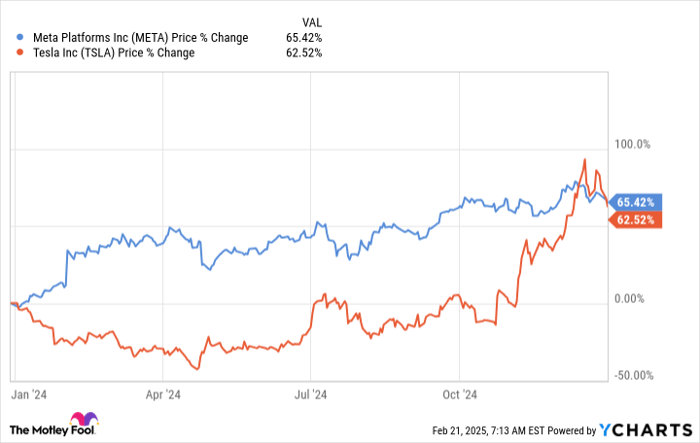

The S&P 500 (SNPINDEX: ^GSPC) achieved an impressive 23% return last year, exceeding its average gains since its inception in 1957. This remarkable growth was driven largely by substantial contributions from key players like Tesla (NASDAQ: TSLA) and Meta Platforms (NASDAQ: META), both of which saw stock prices rise over 60%:

META data by YCharts

Tesla and Meta are fundamentally different businesses. Tesla focuses on electric vehicle (EV) manufacturing, while Meta is the leading social media company behind platforms like Facebook and Instagram. Both companies are betting on artificial intelligence (AI) to spur future growth.

The question remains: Which stock will prove to be the smarter investment in 2025? Let’s explore.

Image source: Tesla.

Tesla’s Current Situation

Despite a stellar performance last year, Tesla’s stock has fallen 26% from its peak in December. While many believe in Tesla’s long-term potential, recent declines in passenger EV sales raise concerns.

Just two years ago, CEO Elon Musk touted a production growth target of 50% annually. However, the company reported 1.79 million vehicle sales in 2024, a 1% decrease from the previous year. This marked Tesla’s first annual sales decline since the launch of its Model S in 2011, signaling trouble for production increases if demand fades.

Early reports for 2025 indicate that a recovery may be challenging. Tesla experienced sales drops of over 50% year-over-year in Europe this January, including a staggering 75% decrease in Spain and a 63% drop in France. Australia faced a 33% decline as well, illustrating widespread challenges.

Given that passenger EVs account for 78% of Tesla’s revenue, these trends present significant short-term challenges. However, some investors are more optimistic about future products like the AI-powered Full Self-Driving (FSD) software, the Cybercab robotaxi, and the Optimus humanoid robot. These innovations could potentially lead to exponential growth for the company.

According to Cathie Wood’s Ark Investment Management, the Cybercab could become a major revenue source for Tesla by 2029, potentially valuing the company at $8.2 trillion, which would be eight times its current valuation. Musk has suggested that Optimus may have even greater earnings potential, estimating future revenues of $10 trillion.

Meta Platforms’ Growth Strategy

Meta currently boasts over 3.3 billion daily users across its social networking platforms. As this number nears half of the global population, the challenge of user growth becomes more pronounced, prompting Meta to shift focus toward increasing user engagement. Longer online sessions lead to more advertisements and higher revenue.

AI plays a crucial role in Meta’s strategy. They’ve incorporated AI into their algorithms on Facebook and Instagram, allowing them to tailor content to user preferences and boost engagement. During various investor briefings last year, CEO Mark Zuckerberg noted that this shift was effectively increasing users’ time spent on their platforms.

Additionally, Meta’s AI chatbot has grown to 700 million monthly active users by the end of 2024, a 50% increase in just three months. This chatbot, powered by their open-source Llama models, aids in user interaction and enhances engagement. The Llama models have been downloaded over 600 million times, enabling continuous improvement through community contributions, which positions Meta to compete with industry leaders like OpenAI. Zuckerberg anticipates that the upcoming Llama 4 model will set a new standard in AI technology.

In terms of financial performance, Meta reported an all-time high of $164.5 billion in total revenue for 2024, marking a 22% increase from the previous year and reflecting momentum spurred in part by its activities in the AI sector.

Final Thoughts

Tesla’s aggressive price cuts to drive demand unfortunately didn’t help; its earnings per share fell by 53% year-over-year. Despite a 62% stock increase in 2024, Tesla shares now appear highly expensive, boasting a price-to-earnings (P/E) ratio of 173.3.

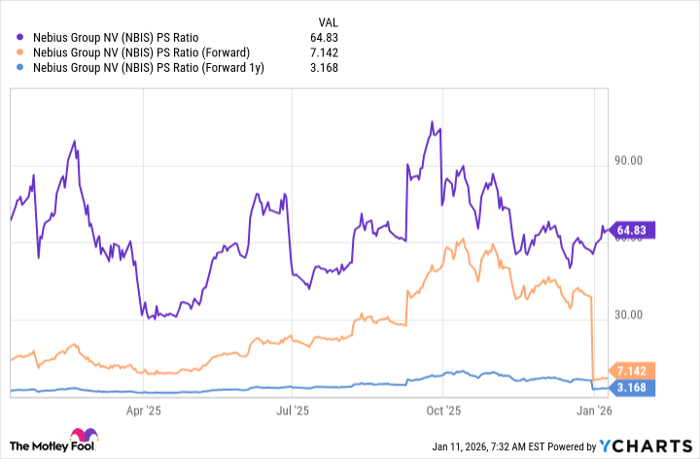

In comparison, the Nasdaq-100 trades at a much lower P/E of 33.7. Meta, with a P/E ratio of just 29.1, offers a considerably cheaper alternative in the tech market:

TSLA PE Ratio data by YCharts

This decision hinges on valuation. Justifying Tesla’s high price is difficult, particularly with doubts about its current sales. As the company leans heavily on passenger EVs for revenue for at least the next year, signs indicate that growth may be hard to achieve.

Conversely, Meta is experiencing growth in both sales and profits while also being competitively priced compared to its tech peers. Based on these factors, it appears to have a stronger opportunity for growth in 2025 than Tesla.

A Potential Second Chance for Future Investors

If you’ve ever felt like you missed out on investing in successful stocks, now may be your moment.

Occasionally, our expert analysts identify a “Double Down” stock recommendation for firms they believe are on the brink of substantial growth. For those who feel they’ve already missed their chance, the current climate may be ideal for new investments. Consider these past winners:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $348,579!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $46,554!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $540,990!*

Currently, we’re issuing “Double Down” alerts for three exceptional companies, and opportunities like this may not arise again soon.

Learn more »

*Stock Advisor returns as of February 24, 2025

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Anthony Di Pizio has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Meta Platforms and Tesla. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.