Assessing Investment Opportunities: Crocs, Academy Sports, and Universal Display Eye 2025

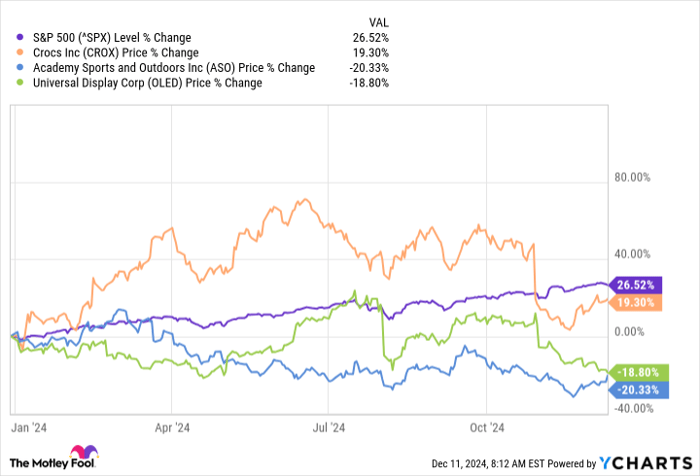

As we approach the end of 2024, the S&P 500 has seen a remarkable rise of nearly 27%. To put this gain into perspective, a $10,000 investment growing at 27% annually could surpass $100,000 in just ten years. This year has proven lucrative for investors seeking typical stock market returns.

However, not all companies have benefited from this upswing. Shoe manufacturer Crocs (NASDAQ: CROX), sporting goods retailer Academy Sports and Outdoors (NASDAQ: ASO), and display technology firm Universal Display (NASDAQ: OLED) are all lagging behind the S&P 500’s performance, with two of the three experiencing actual losses this year.

^SPX data by YCharts.

Despite their underwhelming performance in 2024, I anticipate a better showing for Crocs, Academy Sports, and Universal Display in 2025. Here’s why.

1. The Potential of Crocs

Crocs currently trades at a low price of approximately eight times its earnings, while many other stocks linger above 20 times. Whether this stock is undervalued relates to its profit stability and effective cash management. An investment could falter should profits decline or spending be mismanaged. Fortunately, the outlook for Crocs remains optimistic.

The company owns the HeyDude brand, yet 80% of its revenue still comes from its flagship Crocs line, which is anticipated to grow by 8% this year thanks to stable profit margins allowing for solid operating income.

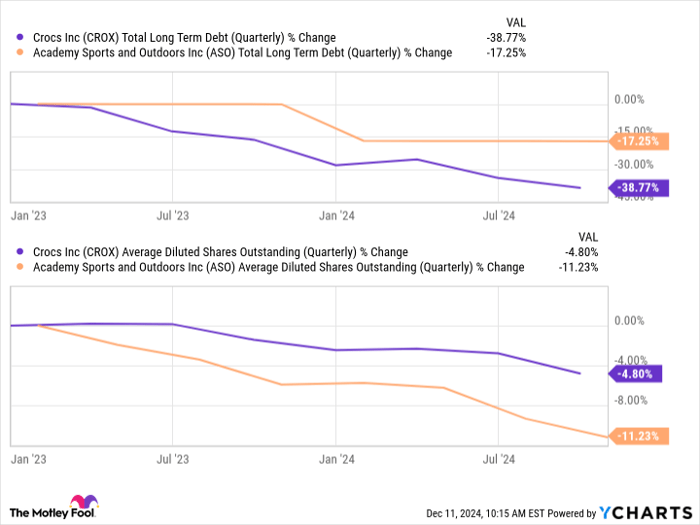

Crocs accrued significant debt when acquiring HeyDude, but has already repaid over $1 billion in the last two years. Now that its debt is being controlled, the company is beginning to repurchase shares at favorable prices.

While the HeyDude brand faces challenges, projected revenue drops of 15% this year, I believe the core Crocs brand’s strength alone can drive significant performance. If management revamps HeyDude successfully, the results could surpass expectations.

2. Academy Sports Shows Promise

Like Crocs, Academy Sports also trades around eight times earnings, reflecting similar valuation. While Crocs could see profit retention, Academy’s potential for growth enhances its long-term appeal.

Academy Sports sets itself apart by emphasizing localized merchandise rather than aiming for a broader market. This strategy proved successful, with average store sales reaching $22 million in 2023, outperforming competitors. Additionally, its net profit margin climbed from under 2% five years ago to above 7% now.

Currently operating about 300 stores, Academy Sports plans to grow to over 800 locations in the long run, with up to 25 new stores expected to open in 2025, representing nearly 8% expansion. This anticipated growth should coincide with increasing profitability.

Both Crocs and Academy Sports focus on enhancing profitability and managing debt effectively. Their significant stock buyback initiatives indicate a commitment to delivering value. While predicting precise timing can be challenging, this fundamental strategy increases the likelihood of long-term success for both stocks.

CROX Total Long Term Debt (Quarterly) data by YCharts.

3. Universal Display’s Competitive Edge

Universal Display is a leader in organic light-emitting diode (OLED) technology, holding over 6,000 patents. This established presence provides a strong competitive advantage, positioning the company for future growth.

As electronic device manufacturers increasingly seek efficiency in their products, OLED technology continues to gain traction due to its energy-saving attributes. Universal Display’s high-margin operations, with a net profit margin of 37%, capitalize on licensing and material sales.

Investments in research and development are critical for maintaining a competitive edge, with current efforts focused on phosphorescent OLED (PHOLED) technology. Universal Display has made substantial advancements, already achieving PHOLED red and green, but faces challenges in developing PHOLED blue.

Management forecasts that PHOLED blue could enhance display efficiency by 25%, making it an attractive upgrade for device manufacturers. Although the rollout has faced delays, expectations are high for 2025 to witness significant progress.

Looking Ahead to 2025

My confidence in Crocs, Academy Sports, and Universal Display stems from their strong business fundamentals and perceived undervaluation. Each company has the potential to perform well in 2025, and I expect limited downside risk.

Historically, stocks can remain undervalued despite solid company performance. Thus, it’s possible that these stocks may again underperform next year, even if their businesses thrive. Nonetheless, I remain optimistic about their prospects over the next five years.

Should You Invest $1,000 in Crocs Now?

Before investing in Crocs, consider this:

The Motley Fool Stock Advisor analyst team recently selected what they believe are the 10 best stocks for investors to buy right now—and Crocs was not among them. The chosen stocks could generate substantial returns in the coming years.

Consider, for instance, when Nvidia appeared on this list on April 15, 2005. If you had invested $1,000 at that time, you would have $822,755 today!

Stock Advisor provides investors with a clear roadmap for success, including portfolio-building guidance, regular analyst updates, and two new stock picks each month. Since its inception in 2002, Stock Advisor has achieved returns that have overwhelmingly outperformed the S&P 500.

See the 10 stocks »

*Stock Advisor returns as of December 9, 2024

Jon Quast holds positions in Academy Sports And Outdoors and Crocs. The Motley Fool recommends Academy Sports And Outdoors, Crocs, and Universal Display and maintains a disclosure policy.

The views and opinions expressed herein are solely those of the author and do not necessarily reflect those of Nasdaq, Inc.