2025 Market Recap and Predictions for 2026

In 2025, the April ‘Liberation Day’ led to a tariff-induced market collapse, followed by a significant rebound. Despite fears of inflation linked to tariffs, prices remained controlled, while precious metals saw their best annual performance. AI stocks experienced fluctuations, and Bitcoin faced sell-offs after favorable crypto legislation.

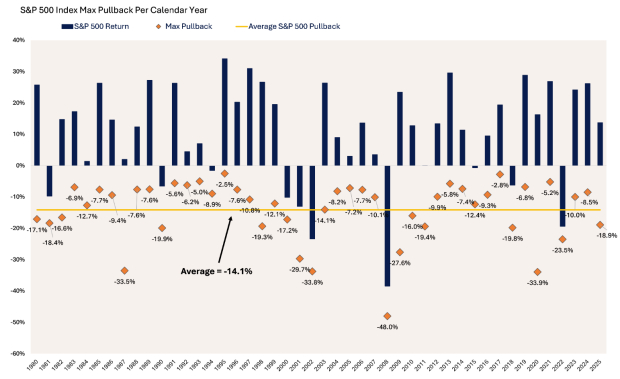

Looking ahead, key predictions for 2026 include a potential S&P 500 correction of at least 10% following an average return of 16.4% in 2025, and a subsequent gain of over 10% driven by a rare cut in interest rates. Additionally, a surge in IPOs is expected as market conditions stabilize, with companies like SpaceX and OpenAI rumored to go public. CPI inflation is projected to remain below 4%, and GDP growth could exceed 3% due to eased monetary policy and robust tax refunds.