Key Points

-

The stock market is currently the second priciest in history with a Shiller Price-to-Earnings (P/E) Ratio exceeding 30, signaling potential declines ahead.

-

In 2026, the Dow, S&P 500, and Nasdaq Composite are expected to decline by at least 20%, potentially entering bear market territory.

-

Meta Platforms is anticipated to become the top stock-split candidate of 2026, expected to attract more daily active users than any other social media provider with 3.54 billion in September.

-

Elon Musk’s SpaceX is projected to conduct the largest IPO in history, targeting an estimated $30 billion or more.

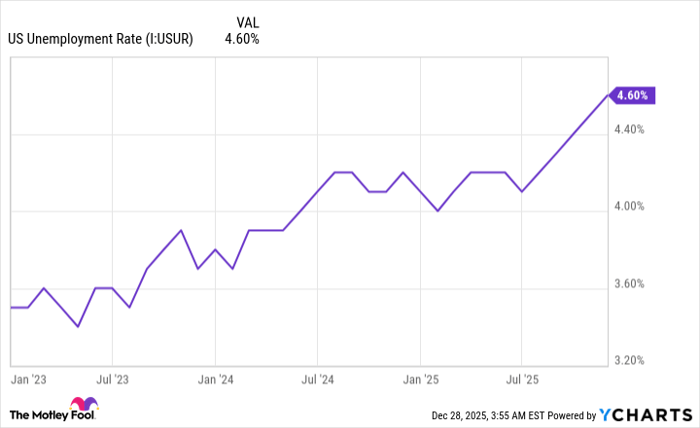

According to analysts, the stock market’s current pricing levels, the impact of the Federal Reserve’s monetary policy, and emerging challenges such as stagflation create a treacherous landscape for investors. As a result, significant volatility is projected for 2026, making defensively positioned stocks, particularly in the consumer staples sector, more appealing than their tech counterparts.