Amid the swarm of REITs (Real Estate Investment Trusts) lining the Zacks Rank #1 (Strong Buy) list, a handful have caught the eye with their exceptional affordability.

Priced under $20 per share, these REITs boast annual dividend yields exceeding 10%, a tantalizing prospect for prospective investors.

MFA Financial

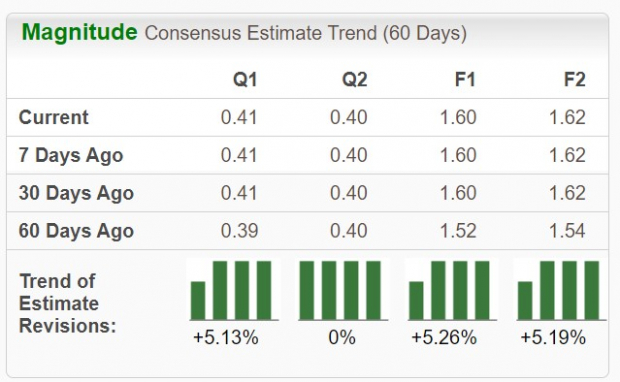

Currently trading at $12, the MFA stock from MFA Financial offers an enticing 10.96% annual dividend. What sets MFA apart is its meager 7.8X forward earnings multiple, centering its operations around mortgage-backed securities.

Considering its projected stable earnings this year and a 1% uptick expected in fiscal 2025 to $1.62 per share, MFA appears to present a compelling bargain. To add to the allure, estimates for FY24 and FY25 have shown a 5% rise in the last 60 days.

Image Source: Zacks Investment Research

NexPoint Real Estate

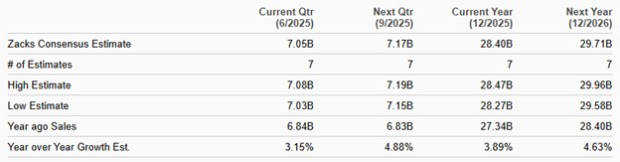

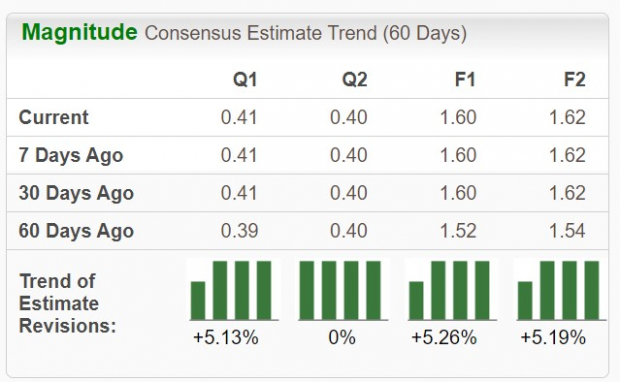

Impressive earnings estimate adjustments have bolstered NexPoint Real Estate NREF, a company involved in originating, structuring, and investing in various real estate loans and financings.

Priced at $15 per share, NREF boasts a modest 12.5X forward earnings multiple, with EPS anticipated to dip by -34% in FY24 but rebound dramatically by 72% in FY25 to $2.08. Furthermore, estimates for FY24 EPS have surged by 18% in the past two months, while FY25 EPS estimates have seen a 2% increase.

Image Source: Zacks Investment Research

Moreover, NexPoint’s impressive dividend yield of 13.2% not only surpasses the Zacks REIT and Equity Trust Industry average of 11.42% but also dwarfs the S&P 500’s paltry 1.24% average.

Image Source: Zacks Investment Research

Two Harbors Investments

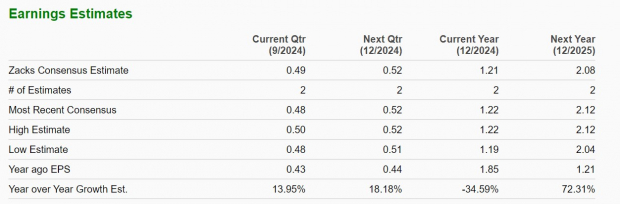

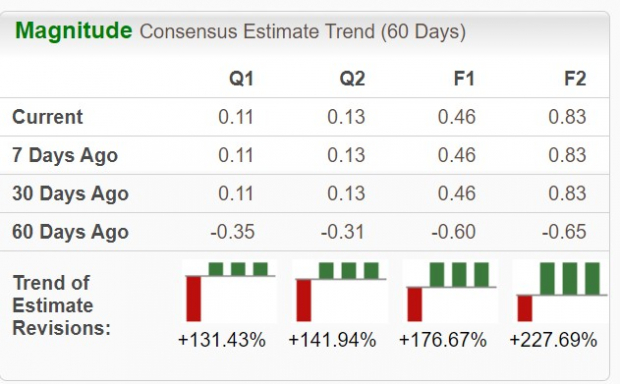

With a not-so-pocket-friendly forward P/E ratio of 30.1X, Two Harbors Investments TWO, specializing in residential mortgage-backed securities, has witnessed a meteoric rise in earnings estimates.

Priced at $13, Two Harbors is now expected to deliver a surprise profit of $0.46 per share in FY24, a stark contrast to the predicted adjusted loss of -$0.60 per share just 60 days ago.

Notably, estimates for FY25 EPS have skyrocketed to $0.83 from an anticipated loss of -$0.65 per share just two months back. Coupled with a generous 13.12% annual dividend yield, Two Harbors’ promising outlook is certainly captivating for investors.

Image Source: Zacks Investment Research

Bottom Line

The Federal Reserve’s rate cut is poised to enhance the operating environment for numerous financial sector companies, while the favorable trend of positive earnings estimate revisions bodes well for these domestic REITs. This indicates a potential upside and presents an opportune moment for investors to capitalize on these appealing dividends.

5 Stocks Set to Double

Cherry-picked by a Zacks expert as the top favorite stock poised to gain over 100% by 2024, these selections have a track record of remarkable performance, with previous recommendations skyrocketing by up to 673.0%.

Flying under the Wall Street radar, these stocks offer a ground-floor opportunity to astute investors.

Discover These 5 Potential Home Runs Today >>

Access the Free Stock Analysis Report on Two Harbors Investments Corp (TWO)

Get Your Hands on the Free Stock Analysis Report on MFA Financial, Inc. (MFA)

Explore the Free Stock Analysis Report on NexPoint Real Estate Finance, Inc. (NREF)

Read this compelling article on Zacks.com by clicking here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.