Unlocking Potential in AI Stocks

If you’re even remotely familiar with the technology sector in the past year, the AI frenzy must have painted a vivid picture. While AI’s surge into the mainstream is recent, the technology has been around for decades. We’re just scratching the surface of its possibilities, offering investors a golden ticket to the budding industry. For those eyeing AI-related stocks, here are three companies worth considering.

Microsoft: An AI Powerhouse

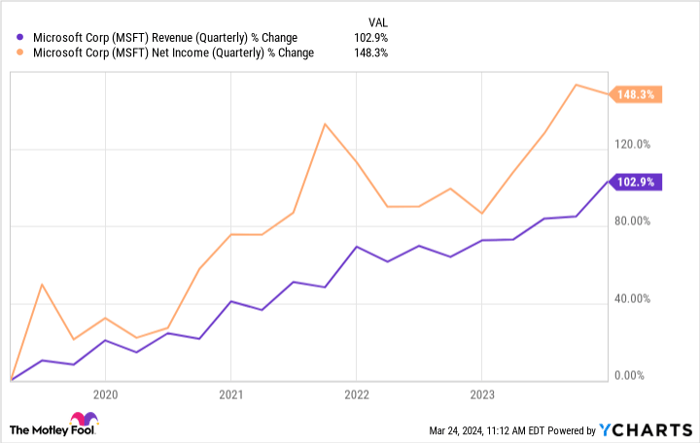

OpenAI’s ChatGPT skyrocketed AI into prominence, hitting 100 million monthly active users within two months of its November 2022 release. This success was a jackpot for Microsoft (NASDAQ: MSFT). Their collaboration with OpenAI, fueled by a hefty $1 billion investment in 2019, places Microsoft at the vanguard of AI-driven computing. Leveraging Azure’s supercomputing capabilities and OpenAI’s language models, Microsoft’s product suite stands out among its tech peers. The synergy promises a bright future, as evidenced by its impressive financial performance over the last five years.

Taiwan Semiconductor Manufacturing Company: The AI Enabler

While not an obvious AI player, Taiwan Semiconductor Manufacturing Company (NYSE: TSM) (TSMC) plays a pivotal role in the AI value chain. As the backbone of data centers, TSMC manufactures semiconductors crucial for GPU-driven AI systems. TSMC’s CEO forecasts a 50% compound annual sales growth in AI semiconductors, positioning them as a significant revenue source within TSMC’s financial future. The company’s irreplaceable role in the AI landscape highlights its strategic importance.

Amazon: AI at its Core

Amazon (NASDAQ: AMZN) has long harnessed AI to enhance its e-commerce operations. Analyzing user data, Amazon’s AI systems offer personalized shopping experiences, boosting sales and customer satisfaction. Beyond e-commerce, its cloud service AWS stands out globally, continually integrating AI and ML tools for building customized AI applications. Backed by solid free cash flow, Amazon’s hefty investments in AI unveil a promising future, cementing its position as a leader across multiple industries.

Investors keen on long-term prospects will find Amazon’s evolving AI capabilities a compelling reason to stay vested.

Curious investors may want to explore the top picks from Motley Fool Stock Advisor. Do you know what they are? Peek into the 10 stocks recommended for potential growth.

*Stock Advisor returns as of March 25, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Stefon Walters holds positions in Microsoft. The Motley Fool has positions in and recommends Amazon, Microsoft, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool maintains a disclosure policy.

Author’s views are personal and not a representation of Nasdaq, Inc. opinions or perspectives.