Amidst the fervor for artificial intelligence (AI), the stock market has witnessed a resurgence since its lows in the autumn of 2022. Some of Wall Street’s major players have surged in value, soaring to as high as $1,000 per share in the current trading landscape.

With such soaring values, investors are on the lookout for potential stock splits. Stock splits, a favored move among investors, offer a more accessible way to accumulate shares in a company. However, understanding the implications of a split is crucial before diving in.

So, let’s delve into what a stock split entails, and equally important, what it does not. Subsequently, we’ll explore three prime candidates in the AI sector that may be eyeing a stock split in the near future.

The Dynamics of Stock Splits

Stock splits serve to reduce a company’s share price by increasing the number of outstanding shares proportionately. For instance, consider stock XYZ trading at $100 per share. A 5:1 split would transform each $100 share into five $20 shares.

Companies opt for stock splits for various reasons, often driven by the appeal of lower share prices to investors. It can break down the psychological barrier that some investors face when shares hit a certain price threshold. Moreover, announcing a split can draw attention to a company’s stock, aiding in enhancing liquidity. The ease of managing equity for employees with stock-based compensation and facilitating stock-based compensation programs are added advantages. It’s similar to dividing a single dollar bill into 100 pennies – the tangible aspect adds convenience.

However, what stock splits do not alter is the intrinsic value of the business. Remember, the increase in shares offsets the lower price per share. Essentially, splitting a pie into smaller slices doesn’t change the total size of the pie.

So, which companies in the AI realm are perched on the brink of a stock split after their dazzling market performances?

The Prime Candidates

1. Super Micro Computer

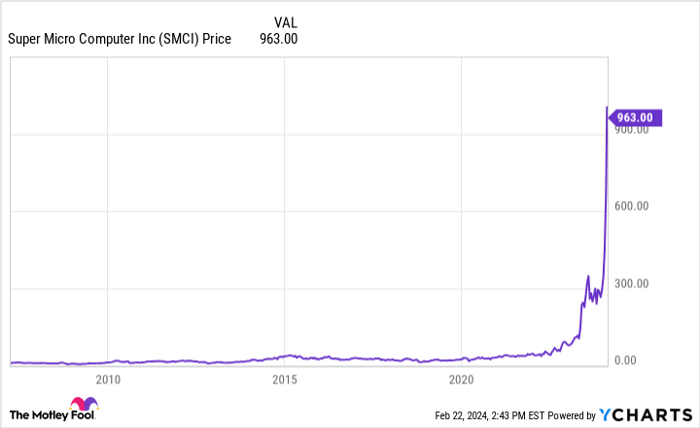

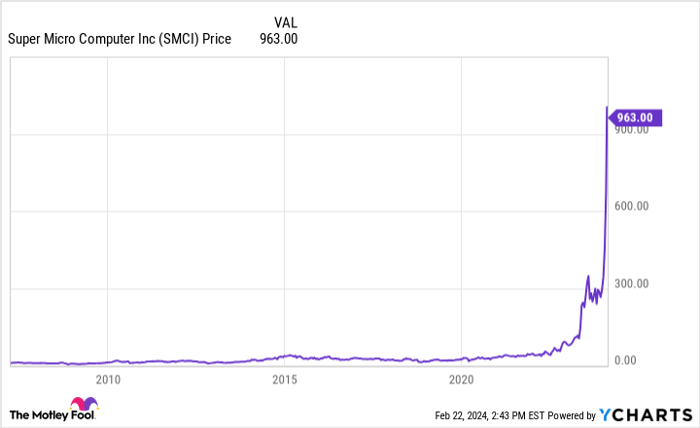

Super Micro Computer, renowned for its modular server solutions, has seen a meteoric rise in business activity lately. With AI-focused companies flocking to SMCI for its cutting-edge computing systems, the company witnessed over a 100% year-over-year revenue surge in the second quarter of fiscal year 2024, with projections of up to 219% growth in the upcoming quarter.

Originating with motherboards in the early 1990s, Supermicro transitioned to computers and servers as technology evolved. Since its IPO in 2007, the company’s stock has never undergone a split. However, with recent remarkable performance propelling shares close to $1,000, marking nearly a 3,000% surge over the past three years, a stock split seems increasingly sensible.

SMCI data by YCharts.

The prospect of a stock split at SMCI holds appeal for employees holding stock-based compensation and individual investors deterred by the high share price. Easing the division of their wealth and enhancing share accessibility, a split at this juncture aligns with market expectations.

2. ASML

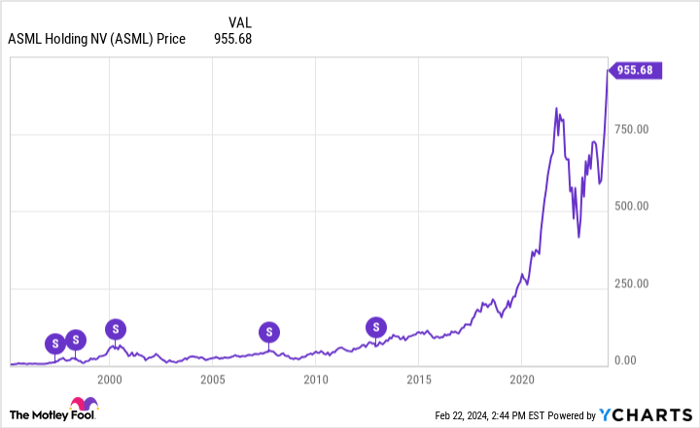

ASML, a prominent photolithography equipment manufacturer, has enjoyed substantial growth over recent years. Pioneering equipment utilizing ultraviolet light to imprint intricate circuitry onto silicon wafers, ASML remains the sole producer of specialized extreme ultraviolet light machines crucial for cutting-edge semiconductors, including those powering the latest AI models.

While ASML has experienced stock splits in the past, the company’s last split predates 2015. With analysts projecting an average annual earnings growth of 20% over the next few years, and the likelihood of shares breaching the $1,000 mark looming, a stock split in the near future seems plausible.

ASML data by YCharts.

Given the steady growth in business performance and market value, ASML stands as a strong contender for a stock split to enhance share accessibility and trading liquidity.

3. Meta Platforms

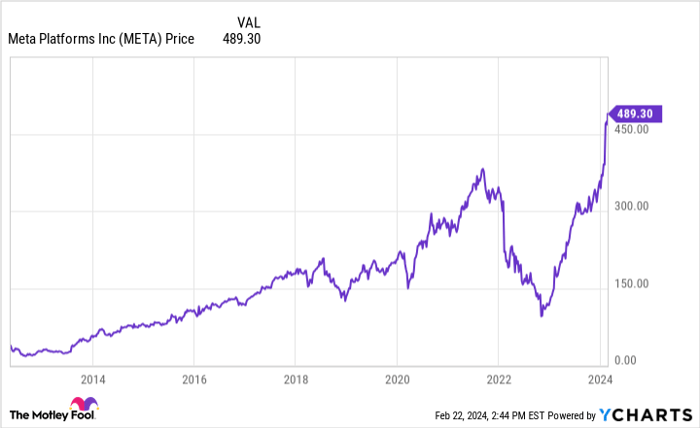

Meta Platforms, the social media giant and AI innovator, emerged as an unexpected stock-split candidate following a transformative year. Overcoming challenges posed by privacy changes on iOS devices and criticisms for aggressive spending, the company’s stock, which once hovered around $90, now nears $500.

Boasting a flourishing core business focused on expanding its social media user base and advertising endeavors, Meta Platforms has seen consistent growth. With the company yet to split its stock since its 2012 IPO, the surge in share prices to all-time highs fuels speculation of an impending stock split.

META data by YCharts.

Predicted annual earnings growth averaging 20% over the coming years enhances the case for a Meta Platforms stock split. This move would align with market expectations and bolster accessibility to individual investors amid soaring share prices.

Before diving into Super Micro Computer stocks, contemplate this:

The Motley Fool Stock Advisor team recently disclosed their top picks for investors, and Super Micro Computer didn’t make the cut. The listed stocks hold the potential for significant returns in the foreseeable future.

The Stock Advisor service provides investors with comprehensive strategic guidance, including portfolio construction tips, analyst updates, and bi-monthly stock selections. Since 2002, the service has outperformed the S&P 500 index by a significant margin.

Explore the 10 recommended stocks here

*Stock Advisor returns as of February 20, 2024

Randi Zuckerberg, former Facebook director of market development and spokesperson, and sister to Meta Platforms CEO Mark Zuckerberg, serves on The Motley Fool’s board of directors. Justin Pope holds no positions in the mentioned stocks. The Motley Fool holds and recommends ASML and Meta Platforms, and recommends Super Micro Computer, with full disclosure.

The expressions and viewpoints articulated herein represent the author’s stance and do not necessarily align with those of Nasdaq, Inc.