Navigating the tumultuous waters of investment is akin to a tightrope walk, balancing risk and reward. As whispers of potential Federal Reserve policy shifts swirl amidst inflation fears and escalating oil prices, the need for grounding in stable, long-term investment options has never been more critical.

Eschewing the siren song of volatile stocks, investors are urged to steer their portfolios towards well-established, resilient companies known as blue-chip entities. These stalwarts of the industry offer a safe harbor against stock market storms, providing both seasoned and novice investors with a sense of security and predictable growth. Moreover, these companies’ solid financial foundations often translate into consistent dividend payouts, appealing to those seeking reliable income streams.

The Allure of Blue-Chip Stocks

What sets blue-chip companies apart is their established market presence, strong brand recognition, loyal customer bases, and widespread market reach. These attributes not only shore up their competitive edge but also pave the way for continued investor confidence and growth opportunities.

By delving into the Blue-Chip Retail sector, three standout stocks beckon investors with their resolute performance and unwavering stability — Walmart Inc. (WMT), The Home Depot, Inc. (HD), and Costco Wholesale Corporation (COST). These titans of industry have weathered market upheavals, rewarding shareholders with robust returns and demonstrating their ability to withstand volatile market conditions.

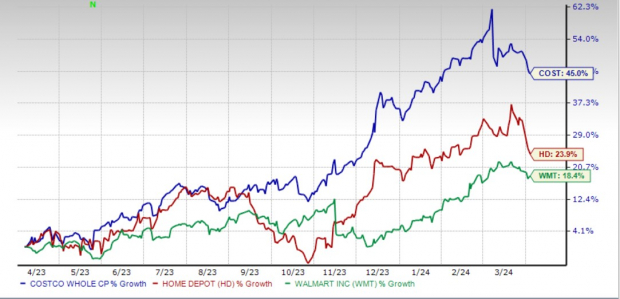

Steady Performers in the Retail Arena

Past-Year Price Performance

Image Source: Zacks Investment Research

Prominent Picks

Walmart: Reveling in its status as an omnichannel retail powerhouse, Walmart continues to fortify its market dominance through strategic e-commerce endeavors. A relentless focus on enhancing product offerings, delivery mechanisms, and payment systems underscores Walmart’s commitment to innovation and customer satisfaction.

With a market cap of $479.5 billion as of April 4, 2024, Walmart, a Zacks Rank #3 (Hold) stock, boasts a trailing four-quarter earnings surprise averaging 7.3%. Amidst projections of sales and earnings growth for the current financial year, Walmart maintains a solid dividend yield of 1.4%, reflecting its stability and investor-friendly approach.

Home Depot: Hailing from Atlanta, GA, Home Depot commands a dominant position in the home improvement retail landscape. Its unwavering focus on expanding across Professional and Do-It-Yourself segments, coupled with digital innovations, has been a cornerstone of its success. A robust online strategy and technological infrastructure have propelled Home Depot’s digital sales growth, signaling a bright future for the company.

With a market cap of $354.5 billion, Home Depot, a Zacks Rank #3 stock, shows a trailing four-quarter earnings surprise averaging 2%. The company’s consistent dividend payouts and growth reflect its commitment to shareholders and sound financial management.

Costco: Weathering market uncertainties with grace, Costco stands tall as a consumer defensive stock, underpinned by strategic investments and customer-centric initiatives. Its unparalleled membership model and pricing strategies set it apart in the retail arena, enabling Costco to carve a niche for itself amidst competition.

Costco, boasting a market cap of $312.6 billion and holding a Zacks Rank #3, maintains a trailing four-quarter earnings surprise averaging 2.6%. With a focus on sales and EPS growth for the current financial year, Costco’s consistent dividend payouts and solid financials position it as a reliable choice for investors seeking stability.

Embrace the Future with ChatGPT Stocks

Cutting-edge insights lead Zacks Senior Stock Strategist, Kevin Cook, to unveil 5 hand-picked stocks with exponential growth potential in the Artificial Intelligence sector. As the AI industry hurtles towards a $15.7 Trillion economic impact by 2030, astute investors have the opportunity to ride the wave of future automation and innovation.

Don’t miss out on this transformative journey; download the Free ChatGPT Stock Report now to explore a realm where automation transcends boundaries, enabling individuals to achieve the extraordinary.

Download Free ChatGPT Stock Report Right Now >>

Explore the realm of Zacks Investment Research for comprehensive financial insights.

The author’s viewpoints expressed here do not necessarily align with those of Nasdaq, Inc.