The Rising Construction Sector: 3 Standout Building Products Stocks on Zacks Rank #1 Strong Buy List

Exciting Opportunities in the Construction Industry

The construction sector has been simmering with potential, boasting impressive performances and notable prospects for investors. Among the myriad of opportunities, three standout building products stocks have earned a coveted spot on the Zacks Rank #1 (Strong Buy) list this week, providing a glimpse of the sector’s allure. These companies are none other than Gibraltar Industries, Granite Construction, and Lennox International, each heralding a unique narrative of growth and resilience.

Gibraltar Industries: Weathering the Storm

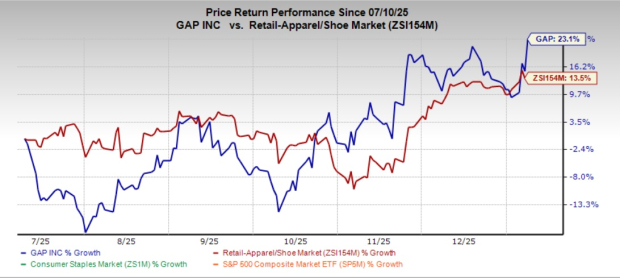

Gibraltar Industries, acclaimed for its provision of ventilation, expanded metal, and other innovative solutions, has seen its stock surge by a staggering 54% over the past year. The company’s impressive bottom-line expansion has been a major driving force behind this remarkable performance. As Gibraltar prepares to close fiscal 2023, analysts are forecasting a 21% earnings uptick, with expectations of a further 12% expansion in FY24, reaching $4.63 per share. Moreover, with modestly higher earnings estimate revisions for both fiscal years and a forward earnings multiple of 17.1X, Gibraltar’s stock is evidently trading at a reasonable valuation, solidifying its appeal to investors.

Image Source: Zacks Investment Research

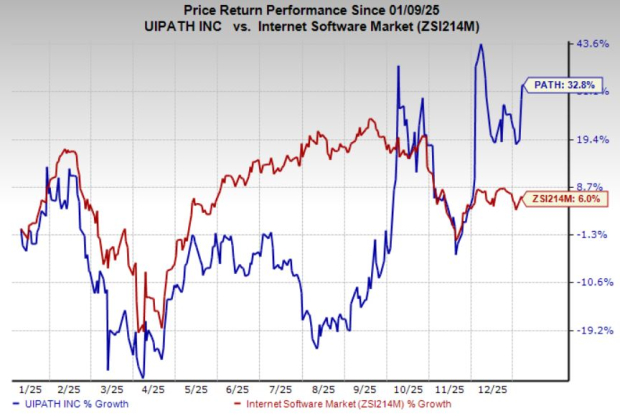

Granite Construction: Raising the Bar in Infrastructure

Granite Construction, a formidable force in the infrastructure contracting and construction materials production arena, has also been making waves. With annual earnings projected to soar by 35% in FY23 to $3.12 per share and an additional 37% expansion expected in FY24 to $4.29 per share, Granite’s stock has gained a respectable 20% over the past year. Furthermore, trading at just 10.9X forward earnings, Granite’s stock offers an enticing proposition for investors eyeing strong growth potential in the building products industry.

Image Source: Zacks Investment Research

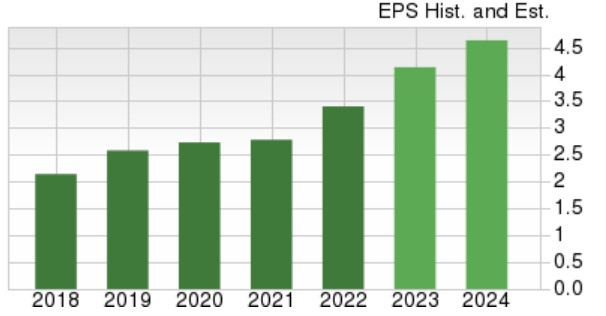

Lennox International: A Cool Proposition for Investors

Finally, Lennox International, a global leader in the heating, air conditioning, and refrigeration markets, has witnessed a remarkable surge of 70% in its stock over the past year. With a forecast of 26% EPS growth in FY23 and expectations of another 11% earnings growth in FY24 to a whopping $19.83 per share, Lennox International’s steady top and bottom line growth is simply too compelling to ignore. Moreover, with total sales projected to rise by 4% in FY23 and an additional 6% in FY24 to $5.20 billion, the stock is attractively priced at 21.7X forward earnings, presenting a favorable opportunity for investors.

Image Source: Zacks Investment Research

The Bottom Line

The growth and expansion of these key construction sector players look likely to continue in 2024, providing investors with another window of opportunity to capitalize on their promising trajectories. With their stocks trading at reasonable valuations, the current scenario presents an ideal time for investors to consider adding these compelling building products stocks to their portfolios, harnessing the potential for future gains.

Zacks Names #1 Semiconductor Stock

It’s only 1/9,000th the size of NVIDIA which skyrocketed more than +800% since we recommended it. NVIDIA is still strong, but our new top chip stock has much more room to boom. With strong earnings growth and an expanding customer base, it’s positioned to feed the rampant demand for Artificial Intelligence, Machine Learning, and Internet of Things. Global semiconductor manufacturing is projected to explode from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>

Lennox International, Inc. (LII) : Free Stock Analysis Report

Gibraltar Industries, Inc. (ROCK) : Free Stock Analysis Report

Granite Construction Incorporated (GVA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Exciting Opportunities in the Construction Industry

The construction sector has been simmering with potential, boasting impressive performances and notable prospects for investors. Among the myriad of opportunities, three standout building products stocks have earned a coveted spot on the Zacks Rank #1 (Strong Buy) list this week, providing a glimpse of the sector’s allure. These companies are none other than Gibraltar Industries, Granite Construction, and Lennox International, each heralding a unique narrative of growth and resilience.

Gibraltar Industries: Weathering the Storm

Gibraltar Industries, acclaimed for its provision of ventilation, expanded metal, and other innovative solutions, has seen its stock surge by a staggering 54% over the past year. The company’s impressive bottom-line expansion has been a major driving force behind this remarkable performance. As Gibraltar prepares to close fiscal 2023, analysts are forecasting a 21% earnings uptick, with expectations of a further 12% expansion in FY24, reaching $4.63 per share. Moreover, with modestly higher earnings estimate revisions for both fiscal years and a forward earnings multiple of 17.1X, Gibraltar’s stock is evidently trading at a reasonable valuation, solidifying its appeal to investors.

Image Source: Zacks Investment Research

Granite Construction: Raising the Bar in Infrastructure

Granite Construction, a formidable force in the infrastructure contracting and construction materials production arena, has also been making waves. With annual earnings projected to soar by 35% in FY23 to $3.12 per share and an additional 37% expansion expected in FY24 to $4.29 per share, Granite’s stock has gained a respectable 20% over the past year. Furthermore, trading at just 10.9X forward earnings, Granite’s stock offers an enticing proposition for investors eyeing strong growth potential in the building products industry.

Image Source: Zacks Investment Research

Lennox International: A Cool Proposition for Investors

Finally, Lennox International, a global leader in the heating, air conditioning, and refrigeration markets, has witnessed a remarkable surge of 70% in its stock over the past year. With a forecast of 26% EPS growth in FY23 and expectations of another 11% earnings growth in FY24 to a whopping $19.83 per share, Lennox International’s steady top and bottom line growth is simply too compelling to ignore. Moreover, with total sales projected to rise by 4% in FY23 and an additional 6% in FY24 to $5.20 billion, the stock is attractively priced at 21.7X forward earnings, presenting a favorable opportunity for investors.

Image Source: Zacks Investment Research

The Bottom Line

The growth and expansion of these key construction sector players look likely to continue in 2024, providing investors with another window of opportunity to capitalize on their promising trajectories. With their stocks trading at reasonable valuations, the current scenario presents an ideal time for investors to consider adding these compelling building products stocks to their portfolios, harnessing the potential for future gains.

Zacks Names #1 Semiconductor Stock

It’s only 1/9,000th the size of NVIDIA which skyrocketed more than +800% since we recommended it. NVIDIA is still strong, but our new top chip stock has much more room to boom. With strong earnings growth and an expanding customer base, it’s positioned to feed the rampant demand for Artificial Intelligence, Machine Learning, and Internet of Things. Global semiconductor manufacturing is projected to explode from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>Lennox International, Inc. (LII) : Free Stock Analysis Report

Gibraltar Industries, Inc. (ROCK) : Free Stock Analysis Report

Granite Construction Incorporated (GVA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.