Written by Sam Kovacs

An Unfortunate Plunge

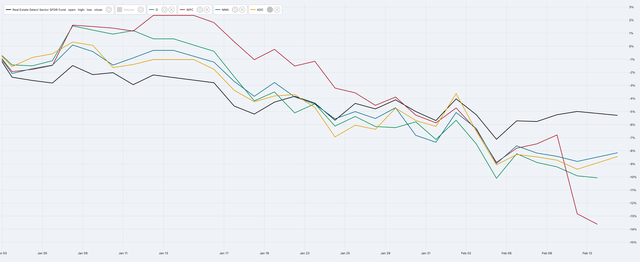

As the year 2024 unveils its course, REITs have seemingly fallen out of favor after a triumphant rise in November and December.

Particularly, the realm of Triple Net Lease REITs has been hit hardest by this nosedive.

While the SPDR Select Real Estate Fund (XLRE) shows a 5% year-to-date descent, the larger triple net REITs have endured a greater plummet, with declines ranging from 8-14% in entities such as Realty Income, WP Carey, Agree Realty, and National Retail Properties.

One of our members asked:

Just seems all the Triple Nets have done the worst, Whether it be ADC, NNN, O. It’s interest rate related, but why the triple nets more than the others ?

And that is a brilliant question, and the basis of this article.

We’ll break down why it is that triple net lease REITs are falling more than the rest, why this spells opportunity, and highlight those which we believe are the top buys.

The Root Causes of the Plunge

Reason 1: Sensitivity to Higher Interest Rates

To start with, the first cause is associated with the sensitivity of these REITs to interest rate adjustments.

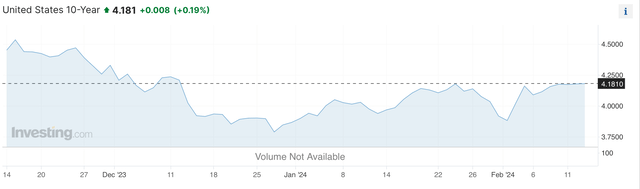

The 10-year U.S. Treasury yield has surged from 3.78% on December 27th to 4.18% today, showcasing a significant leap.

It is well known that REITs are negatively correlated to rates. Why?

- Cost of capital: higher rates mean that the cost of debt that REITs pay goes up, which crunches profits as rents are usually not tied to interest rates.

- Income yield comparisons: Investors often compare the yield from REITs to the yield of fixed-income securities. As interest rates rise, the yields on bonds increase, making them more attractive relative to REITs if the REITs do not increase their dividends at the same pace. Given that the yield on the 10Y has nearly doubled in the past two years, it is clear to everyone that dividends have not doubled for the vast majority of REITs.

- Property Prices: As rates go up, the yield required (the cap rate) for property investors on buildings goes up to justify the higher cost of capital. Given that rents don’t increase in lockstep, property values go down.

This should be clear to everyone. But it applies to all REITs right? So why does it apply more to triple net REITs than others?

The “three nets” in a triple net lease refer to the three types of costs associated with property ownership and operation that the tenant agrees to pay, in addition to their base rent. These are:

-

Property Taxes: The tenant is responsible for paying the property taxes for the leased space. This ensures that the landlord is not liable for the tax obligations associated with the property.

-

Building Insurance: The tenant must also pay for the insurance on the leased property. This coverage typically includes property damage and liability insurance, protecting the tenant and landlord against various risks and damages.

-

Maintenance Costs: Maintenance and repair costs for the property’s common areas and the structural components are also the tenant’s responsibility. This includes routine upkeep and major repairs, ensuring the property remains in good condition throughout the lease term.

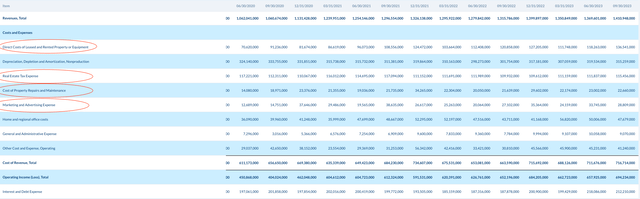

It is therefore a given that if you take out these costs, then the place that interest rates take in the cost structure is higher for a triple net like Realty Income than it is for Simon Property Group.

You can see this by comparing the ratio of the cost of interest to all these costs.

1x to 2x for Realty income vs 1.0x to 1.3x for SPG.

SPG is the prime example as it does not operate any form of net-leases. The financial statements extract above clearly shows items that you’ll never see on Realty Income’s income statement: tax expenses, maintenance, direct costs of the real estate.

Because of this, if rates go up, there’s more downside for Realty Income.

If rates go down, there’s more upside for Realty Income.

Of course since stock prices reflect future expectation, the mere expectation of rates going down later, or less, can be enough to send prices down if they had previously increased in anticipation of these declines.

This is Keynes “second level thinking”. In the stock market, first-level thinking is buying a stock because you think the company is good. Second-level thinking is buying a stock because you think other investors will realize it’s good and start buying it too, making its price go up.

Keynes suggested that successful investing requires this second-level thinking. You have to think about what others believe and how they’ll act, not just what you believe. It’s like playing chess and thinking several moves ahead, considering not just what you want to do but also what your opponent might do in response.

So this is the first reason explaining why

Reason 2: Longer Lease Terms Weight Heavily

A secondary factor contributing to the downfall of triple nets is the extensive durations of their leases.

This implies that fixed rents (or rents with set escalators) are negotiated for a long period of time.

The Impact and Complexities of Triple Net REITs in Fluctuating Markets

The Influence of WALT on Triple Net REITs

Traditionally, triple nets have positioned their long-term lease structures as a testament to their stability compared to other industries within REITs. A cursory review of the investor presentations of the four triple nets reveals a consistent emphasis on this attribute as a key selling point.

Interestingly, the correlation between the Weighted Average Lease Term (WALT) and the stock performance is not absolute. Although WPC boasts the largest WALT, it has suffered the most significant loss year to date. However, it would be a mistake to extrapolate this as the sole determinant of stock performance.

One explanation for this deviation is the inability to adjust rents during the lease term to accommodate increasing capital costs. Consequently, triple nets are more susceptible to interest rate fluctuations, akin to the impact on treasuries.

The 10-Year UST data shows a 0.4% increase in yield from December 27th to the present day, whereas the 1-year treasury experienced a 0.2% increase, and the 1-month saw an increase of less than 0.1%. This underscores the heightened sensitivity of REITs, particularly triple nets, to interest rate movements.

The Variability of Revenue Streams in Different REITs

Triple nets, such as Chatham Lodging Trust (CLDT), which operates in the hospitality industry, witness revenue fluctuations tied directly to room bookings. This leads to revenue variability and explains why CLDT had to suspend its dividend in 2020, only reinstating it after a couple of years. The revenue stream for CLDT is not guaranteed beyond the duration of client hotel stays.

This revenue variance is depicted in the DFT chart by the absence of vertical bars representing dividend payments. The colored ranges illustrate the diminishing value for dividend investors.

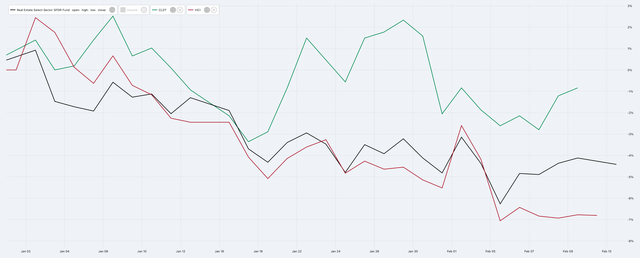

On the other end of the spectrum is VICI Properties (VICI) with an impressive WALT of 41 years. Correspondingly, VICI’s performance has lagged behind the sector index, whereas CLDT has outperformed it year to date.

Mitigating Macro Influences in REIT Performance Analysis

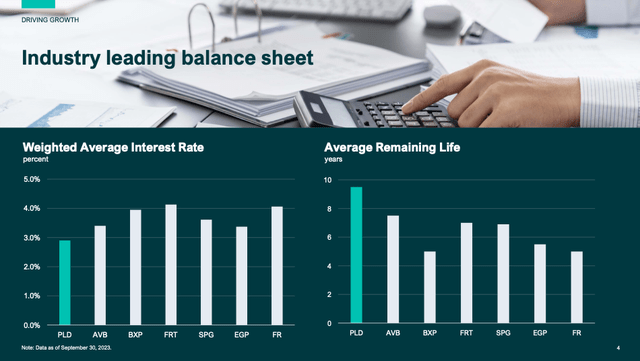

The convention of triple-net REITs exhibiting heightened interest rate sensitivity has instigated a closer examination of other REITs. Prologis (PLD) recently showcased the WALT of several REITs in its investor presentation, highlighting the contrasting performance dynamics.

This presentation illustrates that REITs such as EastGroup Properties (EGP), First Industrial Realty (FR), Federal Realty (FRT), and Simon Property Group (SPG), boasting WALTs of 5-7 years, have outperformed the sector index year to date. The unanticipated market dynamics challenge the conventional assumptions of triple nets being the most responsive to interest rate changes.

Micro and Macro Factors in REIT Performance

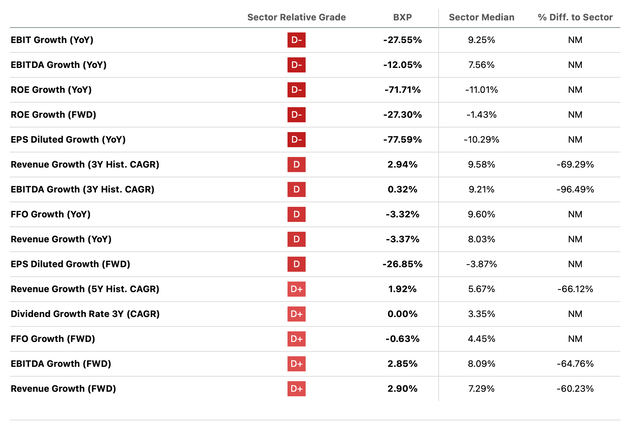

While macroeconomic pressures undoubtedly influence REIT performance, the idiosyncratic risks of individual firms often play a significant role in stock performance. Boston Properties (BXP) exemplifies this complexity, with micro-level challenges significantly impacting its outlook.

The decline in office values and decreased office rents intensify the risk for BXP due to its lower WALT. This has resulted in the company’s poor operating performance relative to the sector, warranting a high risk rating from SA’s Quant System. The challenges faced by BXP underscore the nuanced and multi-faceted nature of REIT performance.

In navigating these complexities, it’s vital to recognize that micro-level influences often overshadow the macro. As the market continues to evolve, a comprehensive understanding of both these factors is crucial for investors aiming to capitalize on the dynamic REIT landscape.

Investor Analysis: The Fed’s Game of Chance

As we watch the economy teeter on a knife’s edge, one can’t help but wonder if the Federal Reserve is playing a risky game of chance. The recent fluctuations in the market have once again sparked the age-old debate of when and how the Fed will act. Let’s dive into the dynamics at play and what they mean for investors.

Reading the Tea Leaves

The Federal Reserve’s wavering stance on rate cuts has left investors on tenterhooks. Following a rally at the close of 2023, the tides swiftly turned, leaving market participants in a state of flux. The Fed’s indecision, particularly on the prospect of a March rate cut, has been exemplified by recent statements from Jerome Powell, the Chair of the Federal Reserve.

Forecasts and Fluctuations

Powell’s recent remarks hint at the central bank’s struggle to find solid ground. While the economy continues to show robust signs, such as a strong labor market and solid growth, the shift in inflation remains a primary concern. Powell’s emphasis on a targeted 2% inflation rate seems to have become the focal point of the Fed’s decision-making process, effectively overshadowing other economic indicators.

The Inflation Conundrum

The fixation on a 2% inflation target has faced criticism from experts, with some advocating for a higher threshold to stimulate economic growth. This approach, they argue, would mitigate the risk of recession while fostering a more conducive environment for expansion. Nevertheless, the Fed appears steadfast in its commitment to the 2% benchmark, a decision that has sparked considerable debate among economists and investors alike.

The Ripple Effect

The impending PCE and CPI readings leading up to the March 19th meeting hold the key to the Fed’s next move. Should these indicators fall in line with expectations, the likelihood of a rate cut in March diminishes. However, this adjustment may set the stage for a potential rate cut in May, signaling a moment of reckoning for the central bank and investors.

Navigating Uncertain Waters

As the market brims with anticipation, the stage is set for a delicate dance between the Fed and investors. The impending adjustments in bond and REIT pricing, contingent on the March meeting’s signals about a potential May cut, stand to illustrate the market’s sentiment amidst the economic turbulence. The question remains: will the Fed rise to the occasion or risk the consequences of a hesitant approach?

The narrative of risk and reward has never rung more true. The Fed’s high-stakes game, characterized by wavering confidence and a rigid inflation target, ultimately places the onus on investors to navigate these uncertain waters with wisdom and vigilance. As we eagerly await the outcome of the March meeting, the specter of a looming rate cut in May serves as a stark reminder of the volatility that lurks within the delicate balance of the financial markets.

The Rise of Triple Net Lease REITs Amid Changing Market Sentiments

The Federal Reserve’s stance on inflation cuts has been nothing short of a rollercoaster ride, complete with loops, twists, and sudden drops. Investors were repeatedly told it was transitory, only for the Fed to reverse course and abandon the description.

As rates are widely expected to decrease, REITs, especially Triple Net Lease REITs, are poised to be significant beneficiaries of this market shift.

Despite short-term pessimism in the market, astute investors perceive a golden opportunity to capitalize on the shifting landscape.

Patience will be key as market jitters may arise regarding the timing of rate cuts. However, those strategically positioned stand to reap substantial benefits once the dust settles.

Top Picks in the Triple Net Lease REIT Arena

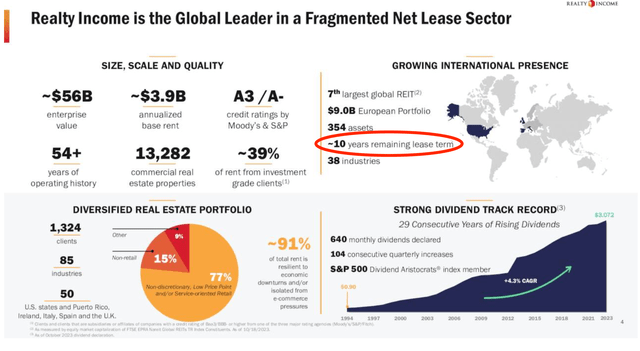

Realty Income (O) stands out as the flagship player in the triple-net REIT domain, boasting the largest market share in the US and significant access to lucrative deals at cheaper capital costs.

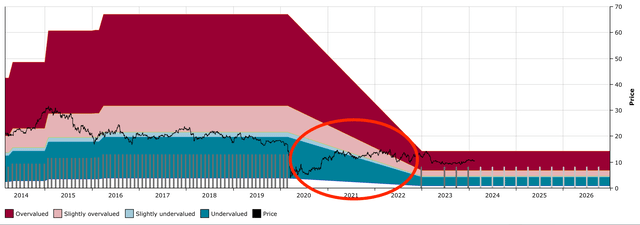

Historical trends reveal that O typically yields around 4.6% over the past decade. Deviations from this norm indicate potential overvaluation when the yield is below 4% and undervaluation when it exceeds 5.5%.

With 93% of fixed debt and investment spreads moving in parallel with rates, O appears insulated from significant earnings headwinds even as rates fluctuate.

This implies that despite stock price fluctuations in response to rates, the fundamental business model of O remains relatively unaffected, positioned to rebound as rates decline.

VICI Properties (VICI) presents an enticing prospect with its specialization in gaming and entertainment properties, offering a unique barrier to entry and extensive industry knowledge.

Furthermore, VICI’s impressive dividend growth, clocking in at a 7.6% CAGR since 2018, coupled with a current 5.6% yield, underscores its potential for future dividend growth.

Lastly, Agree Realty (ADC) emerges as a compelling choice, featuring a robust portfolio predominantly comprised of consumer staples tenants and a superior track record of dividend growth.

With a current 5.1% yield surpassing its 10-year median yield of 4.1%, ADC is well-positioned to trend upwards as rates decrease, potentially reaching $73 and even $80 in an optimistic market scenario.

In Conclusion – Capitalizing on Market Psychology

Stock price movements are often influenced by a myriad of fickle factors, making it imperative for adept investors to comprehend market psychology and policy-making rationale to identify lucrative opportunities.

Navigating through the market noise and seizing the right opportunities is a surefire way for investors to be handsomely rewarded in this transforming landscape of real estate investment.