Understanding Growth Investing

Growth investing, a popular strategy among investors, focuses on companies expected to exceed in earnings and revenue growth. This trajectory often translates into superior stock performance.

However, these growth stocks can also be more volatile due to unforeseen events that might disrupt their positive outlook.

The Rising Stars: DECK, FIX, and LRN

For investors seeking robust growth opportunities, Deckers Outdoor (DECK), Comfort Systems USA (FIX), and Stride (LRN) offer promising prospects. Apart from anticipated growth, all three boast a favorable Zacks Rank, showing positive trends in earnings estimates.

Let’s delve deeper into each of these promising entities.

Deckers Outdoor

Deckers Outdoor, holding a Zacks Rank #1 (Buy), is a renowned creator, manufacturer, and custodian of innovative footwear and accessories designed for outdoor and lifestyle enthusiasts.

For its current fiscal year (FY24), the company’s Zacks Consensus EPS estimate of $26.86 has surged by 24% in the past year, indicating a projected 39% year-over-year earnings growth.

Image Source: Zacks Investment Research

Anticipated growth continues, with its UGG and HOKA brands expected to be key drivers. Projections for FY25 include an 11% increase in earnings and a 10% rise in revenue.

Image Source: Zacks Investment Research

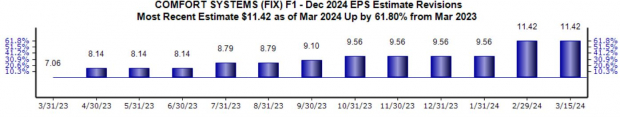

Comfort Systems USA

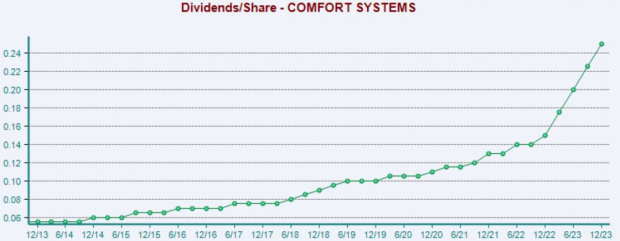

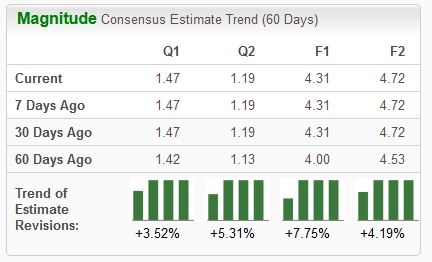

Comfort Systems USA, with a Zacks Rank #1 (Strong Buy), offers comprehensive heating, ventilation, and air conditioning services. Earnings estimate revisions for its current fiscal year have soared by 62% in the past year, predicting a 30% year-over-year growth. The company has also seen robust revenue growth in consecutive quarters.

Investors could also benefit from FIX shares, which yield 0.3% annually with a sustainable payout ratio of 11%. FIX has maintained a strong 20% five-year annualized dividend growth rate.

Stride

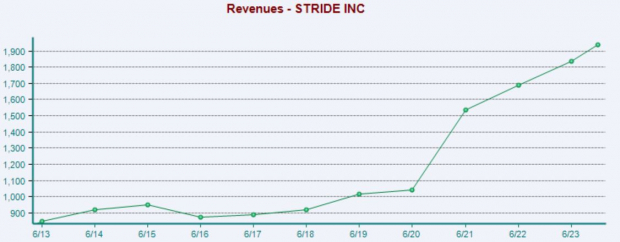

Stride, an education services provider specializing in virtual and blended learning, has garnered a Zacks Rank #1 (Strong Buy) due to analysts increasing their expectations. Current projections for FY24 hint at a 45% earnings rise with a 10% sales improvement, while FY25 estimates suggest a further 10% earnings growth on a 6% revenue increase. The company has experienced robust post-COVID demand upsurge for virtual learning services.

Visualizing the company’s sales on an annual basis:

The Takeaway

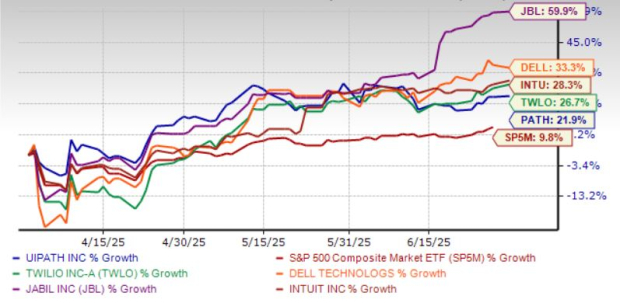

With the market’s stellar performance over the past year, growth-focused investors have reaped impressive rewards.

For those considering a foray into growth investments, Deckers Outdoor (DECK), Comfort Systems USA (FIX), and Stride (LRN) offer compelling opportunities.

These three stocks not only exhibit promising growth trajectories but also hold a favorable Zacks Rank, reflective of analysts’ positive sentiment.

Infrastructure Stock Boom on the Horizon

An imminent initiative to revamp the deteriorating U.S. infrastructure is on the horizon. With bipartisan support and immense funding, this undertaking is expected to create substantial opportunities for investors to build fortunes.

Will you seize the chance to invest in the right stocks early, maximizing their growth potential?

Zacks has unveiled a Special Report to guide you in this venture, available for free today. Discover five companies poised to benefit significantly from the monumental infrastructure overhaul encompassing roads, bridges, buildings, transportation, and energy transformation on an unprecedented scale.

Download FREE: How To Profit From Trillions On Spending For Infrastructure >>

Deckers Outdoor Corporation (DECK) : Free Stock Analysis Report

Comfort Systems USA, Inc. (FIX) : Free Stock Analysis Report

Stride, Inc. (LRN) : Free Stock Analysis Report