Earning is the lifeblood of companies, fueling growth, innovation, and shareholder returns. Companies that share their wealth through dividends not only attract investors but also demonstrate a commitment to long-term sustainability. In the complex world of stock analysis, the Price-to-Earnings (P/E) ratio emerges as a critical tool in evaluating a company’s valuation.

The P/E ratio, derived by comparing a stock’s price with its earnings per share, offers insights into how the market views a company’s worth. For income-seeking investors, a lower P/E ratio is like finding a hidden gem at a thrift store – a potential opportunity to purchase high-value stocks at discount prices. In this light, examining the P/E ratios of Dividend Aristocrats provides a window into promising investment prospects.

One can gauge the value of a company based on its projected earnings for the next four quarters through the forward P/E ratio, a more proactive metric than the trailing twelve months P/E. Investors and analysts often gravitate towards stocks with lower P/E ratios, hinting at possible undervaluation and growth potential.

Let’s explore three dividend aristocrats with enticingly low P/E ratios.

Archer Daniels Midland (ADM)

Archer Daniels Midland’s (ADM) FY’23 report disappointed stakeholders due to delayed disclosures and diminished segment profits. Amidst accounting controversies, ADM faces uncertainty. Despite recent stock price fluctuations, ADM presents a promising prospect with a rock-bottom forward P/E ratio of 10.32, the lowest among Dividend Aristocrats. Income-focused investors eyeing steady returns might find ADM’s 3.12% dividend yield appealing.

3M Company (MMM)

3M, renowned for its industrial prowess, witnessed setbacks in 2023, impacting its share price and financials. However, with a forward P/E of 10.50 and a history of dividend increments affirming shareholder commitment, 3M bounces back as a resilient investment opportunity. Offering a hearty 5.75% dividend yield, 3M beckons income seekers with promising growth prospects.

Franklin Resources (BEN)

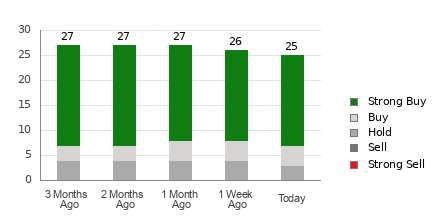

Franklin Resources (BEN), a global investment management titan, maintains a strong foothold in the market. Despite a forward P/E of 10.79 and moderate sell recommendations due to looming legal issues, BEN excites investors with a generous 4.50% dividend yield. With recovery potential and enhanced dividends, BEN stands as an alluring investment avenue for astute income seekers.

Final Thoughts

While low P/E ratios signal potential opportunities, prudent investors exercise caution before diving in headfirst. The stock market, akin to a bustling marketplace, swirls with unpredictability, necessitating a holistic evaluation beyond singular metrics like P/E ratios. For smart investing decisions, thorough research and diligence remain paramount.

On the date of publication, Rick Orford did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.