Having strong cash flows is a sign of financial security, giving companies the ability to pay off debts, pursue expansion opportunities, and provide dividend payments. Such companies are also better positioned to withstand economic downturns, offering a significant advantage for investors in the long term.

For investors seeking stable cash flows, there are three companies – Broadcom AVGO, Microsoft MSFT, and Visa V – that stand out as prolific generators of cash. Let’s delve deeper into each of them.

Broadcom

Broadcom is a leading global supplier, designer, and developer of a wide array of semiconductor devices.

It is noteworthy that analysts have turned bullish on Broadcom’s current fiscal year, with the $47.87 Zacks Consensus EPS Estimate increasing by 11% over the last year, sporting a 13% year-over-year growth.

Image Source: Zacks Investment Research

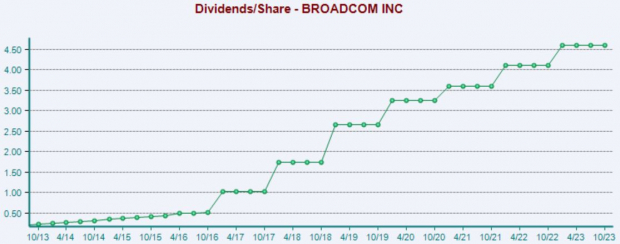

The company has exhibited a robust commitment to rewarding shareholders, showcasing an impressive 13.7% five-year annualized dividend growth rate. AVGO shares currently yield a solid 1.9% annually, surpassing the Zacks Computer and Technology sector average of 0.7%.

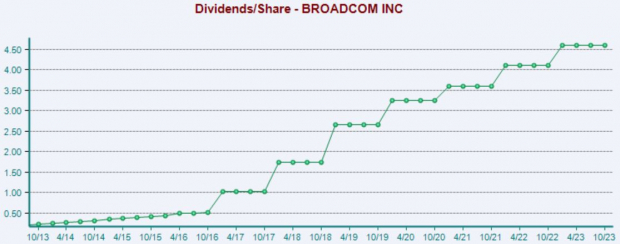

Moreover, Broadcom’s substantial cash generation, with approximately $16.3 billion in free cash flow throughout its FY22 – a 22% increase year-over-year – has safeguarded its dividends, making it an attractive proposition for investors.

Image Source: Zacks Investment Research

Microsoft

Similar to Broadcom, analysts have also become bullish on Microsoft’s current fiscal year, with the $11.14 Zacks Consensus EPS Estimate increasing by 6% over the last year, indicating a robust 14% year-over-year growth.

MSFT shares currently offer a respectable annual yield of 0.8%, slightly above the corresponding Zacks sector average, and the tech giant has demonstrated a strong commitment to shareholders, boasting a 10% five-year annualized dividend growth rate.

Image Source: Zacks Investment Research

Microsoft’s formidable cash-generating capabilities, evident from the substantial $59.5 billion in free cash flow in FY23, and the trailing twelve-month figure of an equally impressive $63.3 billion, have solidified its dividend payouts.

Visa

Financial powerhouse Visa is renowned for its cash-generating prowess. The company recorded approximately $17.9 billion in free cash flow throughout its FY22, a 23% improvement from FY21. Over the last twelve months, the company has generated an impressive $19.7 billion.

Image Source: Zacks Investment Research

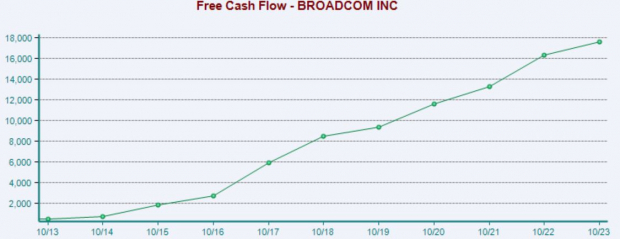

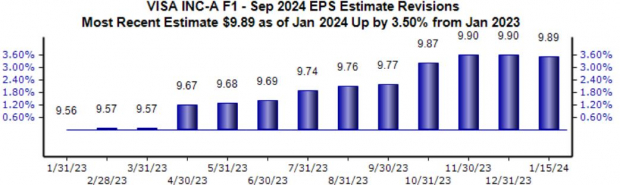

Equally to the above companies, Visa has experienced positive earnings estimate revisions for its ongoing fiscal year, with the $9.89 Zacks Consensus EPS Estimate rising by 3.5% over the last year, indicating a 12.7% year-over-year growth.

Image Source: Zacks Investment Research

Investors should keep an eye out for the company’s upcoming quarterly release expected on January 25th, with the $2.33 Zacks Consensus EPS Estimate suggesting a 7% year-over-year growth. The consensus revenue estimate stands at $8.5 billion, 7% higher than the figure from the previous year.

Bottom Line

Companies demonstrating robust cash-generating capabilities make excellent investment prospects, as they have the financial resources to drive expansion, distribute dividends, and efficiently tackle debt. As articulated above, these companies are well-prepared to navigate economic downturns, undoubtedly a positive factor for investors.

If you are in pursuit of cash-generating companies, all three aforementioned – Broadcom AVGO, Microsoft MSFT, and Visa V – are ideal candidates.

Just Released: Zacks Top 10 Stocks for 2024

Hurry – you can still get in early on our 10 top tickers for 2024. Hand-picked by Zacks Director of Research, Sheraz Mian, this portfolio has been stunningly and consistently successful. From inception in 2012 through November, 2023, the Zacks Top 10 Stocks gained +974.1%, nearly TRIPLING the S&P 500’s +340.1%. Sheraz has combed through 4,400 companies covered by the Zacks Rank and handpicked the best 10 to buy and hold in 2024. You can still be among the first to see these just-released stocks with enormous potential.

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Visa Inc. (V) : Free Stock Analysis Report

Broadcom Inc. (AVGO) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.